The conservative idea that is holding back Obama — and the rest of the country

The president's economic plan is good. But it could be a lot better.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

With his State of the Union speech this week, President Obama officially pitched his new populist tax plan to the country. There was, however, a key word missing from the proposal that sheds light on the limits of the policy thinking in elite Democratic circles.

Under the plan, households with two working parents would receive a new $500 second earner tax credit. The child care tax credit would be streamlined and tripled to $3,000. And the Earned Income Tax Credit (EITC) would be expanded, as would tax incentives for education and retirement savings. Rep. Chris Van Hollen (D-Md.) and other Democrats recently proposed a similar plan that included giving every American worker a $1,000 “paycheck bonus” tax credit, along with further bonuses for savings, a tax deduction for second earners, and other ideas.

Now, the word missing from both these plans? It’s “refundability.” It’s slightly wonky, but it basically works like this: once you’ve calculated what income you actually have to pay taxes on (after deductions and exemptions), and what your tax liability is, tax credits reduce that liability directly. So if you owe $2,000 in taxes, Van Hollen’s $1,000 credit would cut that to $1,000.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But what if you owe, say, $700 in taxes? What happens to the other $300 left over from Van Hollen’s credit? If the credit is refundable, you get that $300 in a check from the government. If it’s not refundable, you get nothing.

This makes refundable tax credits a huge win for poorer Americans. As we learned from Mitt Romney’s infamous “47 percent" remark in 2012, the lower half of Americans already pay no income taxes. Conservatives tend to lament this as an unfair giveaway, but it’s actually an indication of how bad income inequality and wage stagnation have become. So many households are having such a rough time, and we’ve blown so many holes in the tax code to help them, that we’ve effectively cut the income tax bill of half the working population to zero. (Bear in mind they still pay payroll taxes, as well as state and local taxes.)

If you already owe no income taxes, a nonrefundable tax credit does you no good at all. But if it is refundable, that’s extra money in your pocket to put food on your table and gas in your car.

Now Obama’s plan does expand the EITC, which has traditionally been refundable, along with the American Opportunity Tax Credit for education, which is at least partially refundable. But according to Bloomberg, the second earner credit and the child care credit definitely won’t be. There’s no mention of refundability in the Van Hollen plan either.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This leaves a considerable hole in both proposals where the poor and the working class are concerned. Because of the lack of refundability, the bulk of the benefits will actually go to the upper middle class: people making more than half the median income, but who don’t make it into the top 10 or 15 percent of earners.

Interestingly, ObamaCare actually had the mirror-opposite effect. According to the Brookings Institution, when you account for all the ways the law alters a person’s financial situation — by offering subsidies on the exchanges, by changing employer-provided benefits, by expanding Medicaid, etc. — Obamacare will significantly improve the incomes of the bottom fifth of Americans, by 6 to 7 percent. But for Americans above that threshold, Obamacare will slightly reduce their income. For the second-to-last fifth of earners it’s about a 1 percent drop, and for the middle fifth it’s a 0.7 to 0.8 percent reduction.

It’s not a huge reduction, and that offsetting gain for the bottom is big. But if you’re wondering why ObamaCare’s popularity has never quite achieved liftoff, the fact that lots of Americans in the bottom half of the income distribution will likely be slightly worse off financially is a big part of the story.

So ObamaCare left out the middle class, and the Democrats’ new tax plans largely leave out the poor. But the underlying reason for both exclusions is probably the same: cost control. If ObamaCare had extended the subsidies on its exchanges further up the income ladder, this would’ve significantly improved the financial outlook for the second-to-last and middle fifths. But it would also have added tens of billions in spending to ObamaCare’s annual price tag, which will likely be at least $140 billion per year as it stands.

The cost of Obama’s tax plan is $235 billion over the next decade — or about $23 billion per year, which is chump change compared to the annual federal budget. Van Hollen’s plan will probably be more expensive, but in a similar range. But if you made that $1,000 worker tax credit refundable, you’d probably add at least $100 billion to the annual cost of the plan, because along with the reduction in the upper class’ tax bill, you’d basically be giving $1,000 to every American worker in the lower half of the distribution.

Those kind of spending increases are certainly manageable in the grand scheme of things — $200 billion is only roughly 1.1 percent of the country’s yearly economic output — but they aren’t small. There’d be no way to pay for them with tax hikes on the rich alone. There’s certainly hundreds of billions to be found in cutting defense spending or tax loopholes for the wealthy, but those are very difficult political lifts.

Arguably, the Democrats would be better off not paying for these sorts of increases at all. Debt is, after all, a tool, there to be used for the right goals. The Democrats should not be a afraid to argue that refashioning the economy in a more equitable and humane direction is a good reason for breaking out the national credit card.

The bigger point is that by implicitly agreeing with the GOP that deficit reduction and budget neutrality are goals of paramount importance, the Democrats are locking themselves into a situation in which they have to pick and choose which slice of the income distribution they want to help in order to keep spending down. This inevitably means leaving people behind.

Conversely, the country's classic safety net programs — Social Security and Medicare — are so expensive and so politically untouchable precisely because they don’t pick and choose. As long as you’re of retirement age, they help you, regardless of your class position. The very way those programs spend money embody the value that all us Americans are in this together.

If the ostensible goal of your political coalition is to increase the economic rewards for the broad sweep of poor, working class, and middle class Americans, that’s the direction you want to go in.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

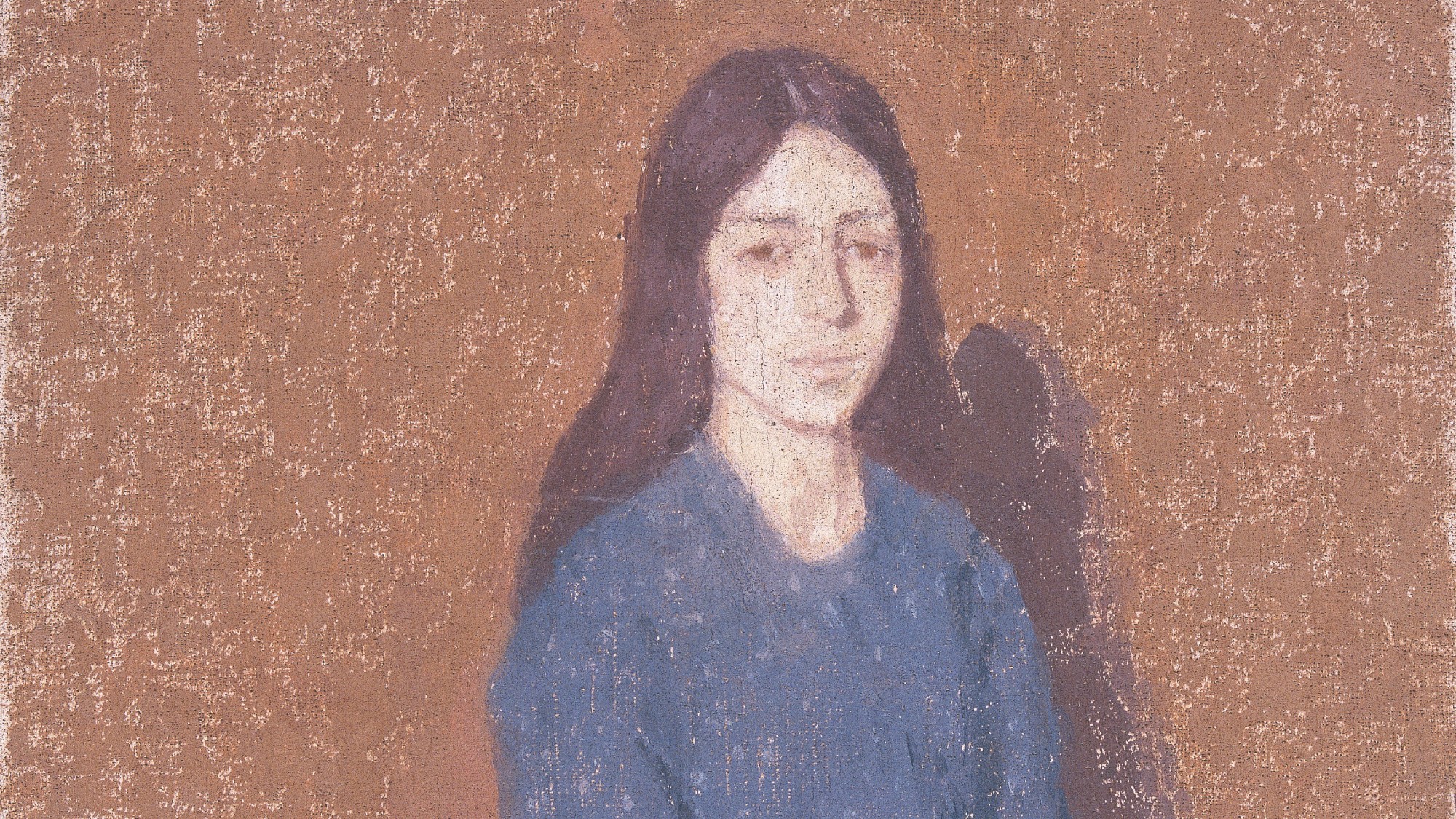

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred