What Elizabeth Warren should whisper in Janet Yellen's ear

There are few people standing up for the working poor at the Federal Reserve. Warren could be that person.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In 2013 and 2014, Sen. Elizabeth Warren (D-Mass.) apparently had more meetings with Federal Reserve Chair Janet Yellen than anyone else in Congress.

According to a story this week in The Hill, the subject of the chats — two phone calls and five meetings — was enforcement of the 2010 Dodd-Frank financial reform law, which is designed to prevent another financial crisis. Warren, a liberal populist beloved by the Democratic base, has long been a dogged champion of reining in the banks and the financial industry, and Dodd-Frank gave the Fed a slew of new duties in that area.

But of course, regulation isn't the Fed's only policy responsibility. Another one — perhaps the most important one — is monetary policy, which has big consequences for how much the economy delivers for the moneyed elite versus everyday working Americans. Yet Democrats have largely ignored it, and Republicans have ferociously pushed for the Fed to maximize the interests of the rich.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The issue is desperately in need of a populist left-wing champion. Warren should step up.

The Fed's job is to control the supply of money in the economy. Through a variety of tools, it can increase the supply to boost economic activity and job growth, or pull the supply back to tamp down inflation. There's an unavoidable trade-off here; the more the Fed does of one, the less it does of the other.

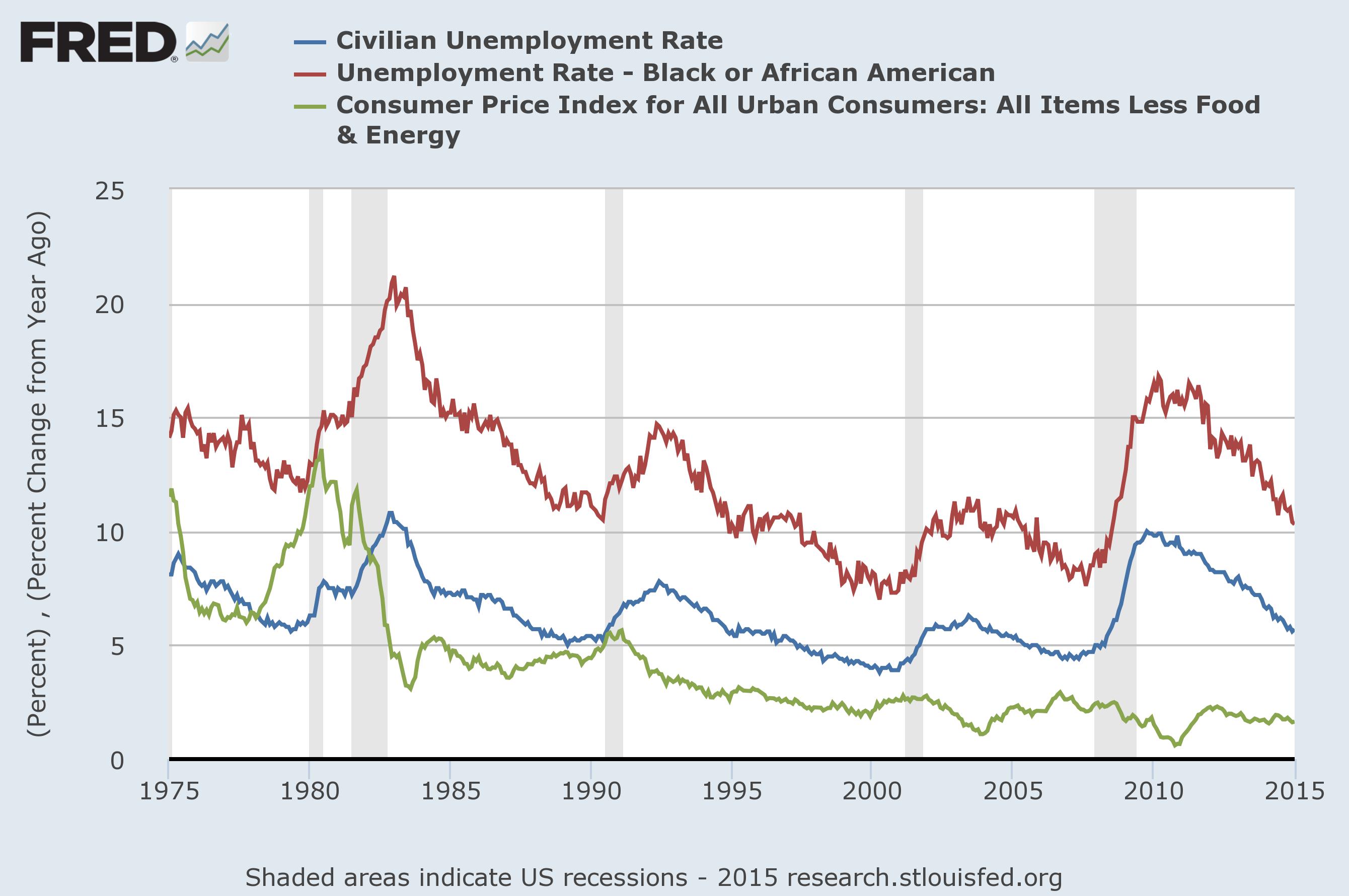

That's important, because the costs of unemployment fall first and hardest on the most vulnerable Americans. The costs of inflation, meanwhile, fall primarily on elite and upper-middle class Americans: anyone who's a creditor or holds bonds, anyone with significant savings, and anyone with a stable job they’re unlikely to lose even in a big recession.

There's also a darker point to make: business owners and the financial industry benefit directly from high unemployment, because it allows them to play workers off each other, scuttle labor activism, and keep wages low. Which increases their power and profits.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This balance between inflation and unemployment — between the interests of the elite and the interests of workers — is built into the Fed's dual mandate. And in recent decades it's done a very skewed job.

Since roughly 1980, what began as an effort to fight stagflation morphed into a Fed policy that typically sacrifices the well-being of poor and working Americans to create as attractive and pleasant an economic environment as possible for big business and financial elites. Low and stable inflation has come with wildly fluctuating unemployment, stagnant incomes, jobless recoveries, collapsing union membership, spiking inequality, and the decay of poor and working class families.

It was news yesterday when the Federal Open Market Committee (FOMC) — the Fed body that decides monetary policy — lowered its projection of the long-term unemployment rate to between 5 and 5.2 percent. That's a signal it thinks the threshold for sustainable unemployment — below which inflation will take off — is not as high as previously estimated. But economists have been arguing over where that threshold is, and even whether it exists, for years. It didn't show up even when we got down to 4 percent unemployment in the late 1990s; the last time wages all rose in tandem up and down the income ladder.

There's zero evidence of rising inflation or increasing wage pressure, and enormous numbers of Americans have yet to be brought back into the labor market after the 2008 collapse. But a full 70.5 percent of economists in a recent Wall Street Journal poll said they were worried the Fed would wait too long to raise rates, as opposed to raising them too soon and choking off the recovery.

Some members of the FOMC, like Yellen, appear to favor holding off on rate hikes. But they're under intense pressure from other members, not to mention Republicans, who regularly rail on Fed officials for any efforts to combat unemployment, claiming it risks runaway inflation.

Yet the consensus among Democrats and many liberals seems to be that monetary policy is a morally and politically neutral matter, and that the sensible, non-fever-swamp thing to do is leave the technocrats at the Fed alone to do their thing. Which is a terrible idea, because Fed officials are only human, and the world of corporate, financial, and business elites is the socioeconomic water in which they swim. They don't have regular contact with labor activists or minority groups and the like, and that's going to skew their sense of which problems in the economy are the most acute. Worse, how the members of the FOMC are selected is practically designed to favor financial industry interests.

There is no one regularly pressuring the Fed to be even more aggressive in fighting unemployment, much less to fundamentally reform the way it does business. Given Warren's long history of populist instincts, this role seems tailor-made for her. And given that she has Yellen's ear already, and has a demonstrated ability to take control of Senate senate hearings to press her priorities, Warren seems well-placed for this mission.

Furthermore, it's an issue that meshes well with Warren's penchant for digging into complex regulatory and policy topics, while still being able to clarify why they matter for everyday working Americans. Federal Reserve policy can seem horribly arcane. But what it comes down to is simply this: if the Fed moves its dial in one direction, workers get more help, at the cost of some loss of wealth and power for the upper crust. If it moves it in the other direction, the upper crust benefits, and workers pay the price in lost jobs and lost wage growth.

In recent decades, the Fed's been moving its dial in that second direction a lot. Which is the kind of thing Elizabeth Warren was placed on this Earth to combat.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred