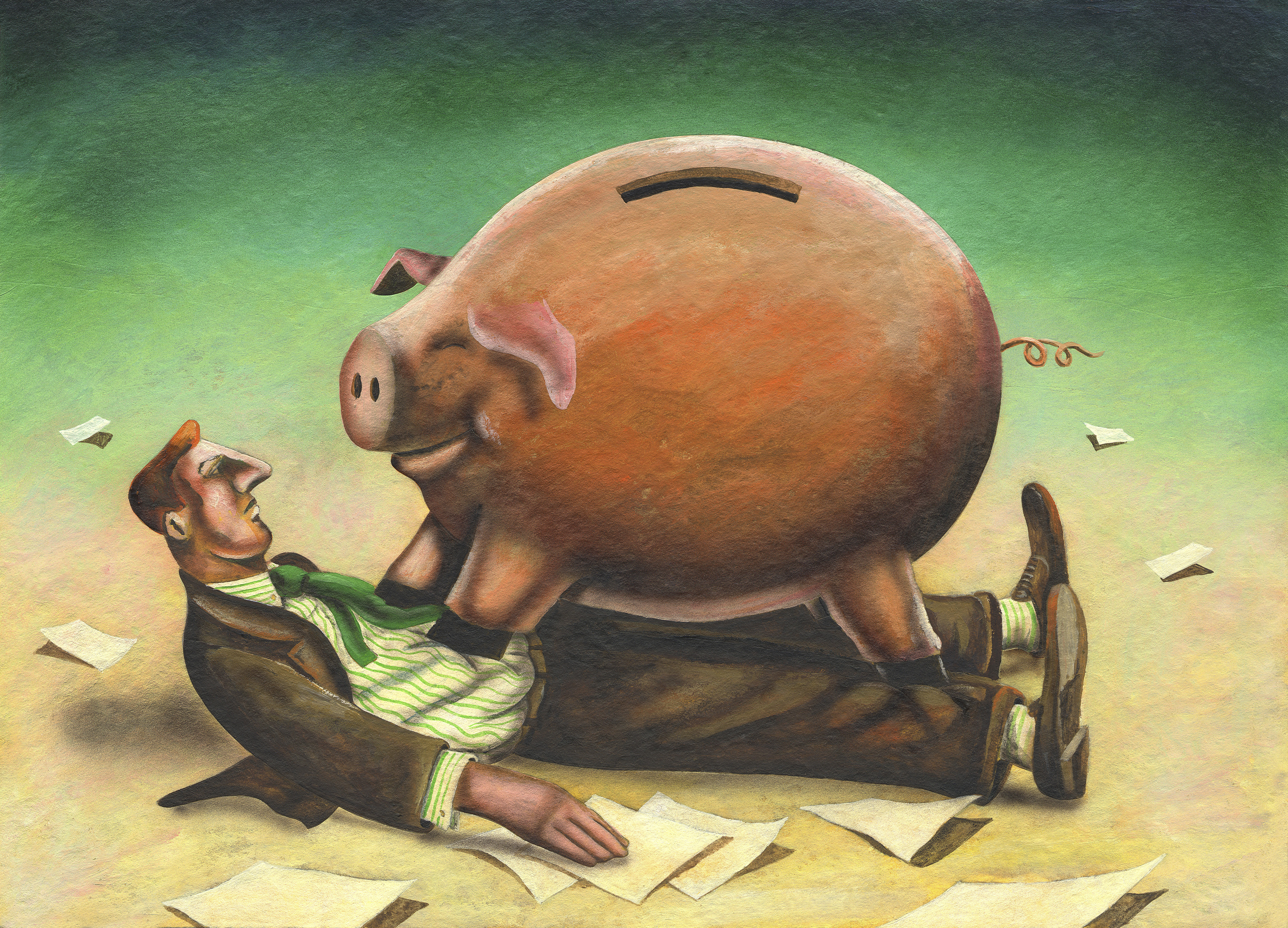

Too big to punish: Why Wall Street gets away with piddling fines

A $55 million fine sounds like a lot. But it won't change a bank's bad behavior.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One annoying tic in economics journalism is the tendency to present numbers without context.

Take this New York Times headline from Tuesday: "Deutsche Bank to Pay $55 Million to Settle Derivatives Inquiry." Seems like a huge fine, right? Fifty-five million! But when you actually think about it, this is horribly uninformative. The whole purpose of a fine is to deter unwanted behavior. But the deterrence only works if the fine actually bites; a $100 speeding ticket is way more likely to make an impression on someone who makes $30,000 a year than someone who makes $300,000.

Without context, the Times' headline amounts to "big number is big." For the record, Deutsche Bank's profit after taxes in 2014 was 1.7 billion euros, or about $1.85 billion. And $55 million is about 3 percent of $1.85 billion. The big number is not so big, it turns out.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This illustrates an ongoing problem with the financial industry both here in America and in other advanced Western nations. Ever since the 2008 economic collapse, we've been trying to figure out how to get better behavior out of the big banks. But behavior is a matter of incentives. These are massive and incredibly powerful for-profit institutions; they aren’t going to change their ways out of the goodness of their hearts. They will change when they are forced to change, and that means confronting them with something close to a truly existential threat.

So far, policy-makers have been either unable or unwilling to muster fines or penalties that even come close to meeting that threshold.

Let's stick with Deutsche Bank as our example. With any bank, you want to consider both the flow of its revenue and the stock of its assets. First, the flow: Deutsche Bank's total revenue in 2014 was $34.9 billion. In 2013, revenue was $34.8 billion and profits were $742 million — and profits would have been $1.6 billion had it not been for another round of legal disputes. In 2012, profits were $400 million, and would have been $800 million if not for more litigation and regulatory penalties.

And so it goes.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Looking at both the profits and the revenues is important, because profits are simply the gravy that the bank can pay out to shareholders. You can eliminate profits entirely, and you still haven't really threatened a company's existence, because you haven't yet cut into its ability to sustain its operating costs. So reducing profits by half every other year or so, while certainly annoying, is hardly a recipe for getting Deutsche Bank's sustained and undivided attention.

Then there's Deutsche Bank's stock of assets, which is well over $2 trillion. An institution with that scale and clout is going to be able to command enormous amounts of credit and equity to plug the holes when it goes into the red. So you can't just eliminate its profits or even cut into its revenues; you have to really cut, in a way that will threaten its ability to function even when accounting for how much revenue it will take in over a number of years.

Deutsche Bank is based in Germany, and does a lot of business in America. But the story is much the same for U.S. banks. According to a joint investigation by The Wall Street Journal, The Huffington Post, and Reuters, the six largest banks in this country from 2009 to late 2014 collectively paid $130 billion in fines, settlements, and the like stemming from the financial crisis. (Deutsche Bank paid a total of $1.9 billion.) Over the same time period, the U.S. banking industry took in just over $500 billion in profits, and its combined assets are something in the vicinity of $6.8 trillion.

Those losses amount to about 26 percent of profits, and they're even smaller compared to revenues and assets. As The Huffington Post put it, that's enough to make "occasional dents in some quarterly earnings," but not nearly enough to actually threaten the banks' ability to function. Last year the combined penalties and fines for U.S. and European banks were about $65 billion — a number the Journal breathlessly characterized as heralding a new and tougher world for the banks. And if that number were to keep heading up, maybe it would be. But as the Journal itself put it, "those 2014 penalties were likely the high-water mark as cases remaining from the financial crisis got resolved."

Given all this, it really shouldn't surprise anyone that, as Bloomberg View's Matt Levine reports, several of the big U.S. banks have no intention of changing their behavior after yet another round of fines. This time it was a $5.6 billion hit to JPMorgan, Citigroup, and others, all of which were charged with manipulating the markets that determine how much different international currencies are worth compared to one another, and what rates they should trade for. Literally the day after pleading guilty, JPMorgan sent a letter to clients making it clear that plenty of the practices that got it in trouble would keep happening.

As Levine notes, this has become a ritual: Regulators get angry about something the banks did, fine them billions for it, the banks grumble, a few people lose their jobs, but there are few enduring consequences and nothing much else changes.

Levine blames much of this on philosophic differences over what should and shouldn't count as financial crimes. Which is fair: That $55 million fine for Deutsche Bank took years to bring to completion, and was over whether the bank improperly estimated the value of one of its portfolios at the height of the financial crisis, thus hiding the scale of its losses. Deutsche Bank complained that there was no industry standard at the time for how to do such a valuation, and the Times noted these sorts of disagreements may be why regulators are reluctant to bring charges in these sorts of cases to begin with.

Finance is a devilishly complex business, and that makes defining financial crime a devilishly complex matter as well.

But at some point, you also have to ask: So what? It's the government's job to write the law, not Wall Street's. Eventually the government has to decide it's done parsing the philosophic nuances and draw a line in the sand. And then it has to defend that line with penalties that can actually shift behavior.

So far, it looks like even that is too much to ask.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day