Hey, Democrats: Stop freaking out about the 'gig economy'

It's just much ado about nothing

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Think about the big economic challenges facing America. The share of adults with any kind of job tumbled during the Great Recession and has barely recovered. Productivity growth — the basic driver of rising living standards — has been stagnant for a decade. Then there's the ginormous national debt, $18 trillion and counting. (Just to name a few.) But where in America's perceived panoply of economic problems does the "gig economy" rank?

Pretty high it seems, at least according to Democrats and much of the media. "Contract work is becoming the new normal," warns technology news site TechCrunch. The New York Times cites the business model of startups such as Uber and TaskRabbit as a notable reason why "most Americans remain deeply anxious about their economic prospects six years after the Great Recession ended." In a recent economic speech, Democratic presidential candidate Hillary Clinton said the "on-demand, or so-called gig economy is … also raising hard questions about work-place protections and what a good job will look like in the future."

It's understandable that traditional journalists are obsessed with the gig economy. They're all worried that's their part-time, piecemeal future, too. (ReporterRabbit!) And Democrats think the economic security issue is a sure winner for them. So they hype the gig economy — while tossing the less scary "sharing economy" nomenclature. If the private sector seems uncertain, anxious workers are maybe more likely to look to government and the Government Party for help.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So liberal wonks hope, at least.

In the new issue of the progressive journal Democracy, left-of-center venture capitalist Nick Hanauer and union official David Rolf argue that businesses should be required to offer a range of benefits — health insurance, vacation days, sick days, paid leave, pensions — to almost all workers whatever their status. "A robust set of mandatory universal benefits would put all employees and employers alike on an equal footing, while providing the economic security and certainty necessary for the middle class to thrive," they write.

But the "Shared Security System" that Hanauer and Rolf advocate for might just be a solution in search of a problem.

For starters, almost all the job growth during this recovery has been full-time work, not part-time gigs. And Moody's Analytics points out that the share of workers describing themselves as self-employed is at a 70-year low and falling. Likewise, the share of workers reporting they work multiple jobs is at a 20-year low and falling. This is an especially interesting stat since news stories about the gig economy tend to feature anecdotes about stressed and beleaguered millennials trying to cobble together a traditional 40-hour week through multiple piecemeal jobs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But, tellingy, Hanauer and Rolf don't even bother finding a real person in their piece. They create a fictitious "Zoe," a late 20-something who supplements her 29-hour workweek as a suburban Denver hotel manager (no benefits) by landscaping for TaskRabbit, spending weekend nights ferrying downtown partygoers on bar crawls with UberX, and renting out her apartment through Airbnb during tourist season. Poor Zoe, temporarily living back at home with her parents, no savings and no prospects for anything resembling a career. What's your 4 percent GDP growth target going to do about Zoe, Jeb Bush?

Yet how many Zoes actually exist in the real world? And even if there were lots and lots of them, would mandating more benefits be the right policy approach?

There is no free lunch here. Employer benefit contributions come out of worker wages. As Democratic economist Lawrence Summers wrote in a seminal but simple paper on the subject, "Mandated benefit programs can work against the interests of those who most require the benefit being offered." For instance: One common criticism of employer provided health care is that workers pay two ways, through premiums and through wages that are lower than they would be otherwise. Similarly, most economists think that both the employer and employee shares of Social Security taxes are really borne by workers.

Why double down on such an approach, especially during a time of supposed wage stagnation? Let middle-class workers keep more of what they earn and make it easier for them to save their own dough to meet the ups and downs of life — as well as build wealth. Maybe even nudge them through mechanisms such as, say, auto-enrollment into retirement plans. And if some workers simply don't make enough to save, then the rest of us should subsidize their earnings. And let the on-demand economy continue to mature and evolve and perhaps create new models for employer-employee relations.

For now, perhaps, policymakers should take a "do no harm" stance toward an emerging, innovative sector that is providing income and flexibility for many Americans.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

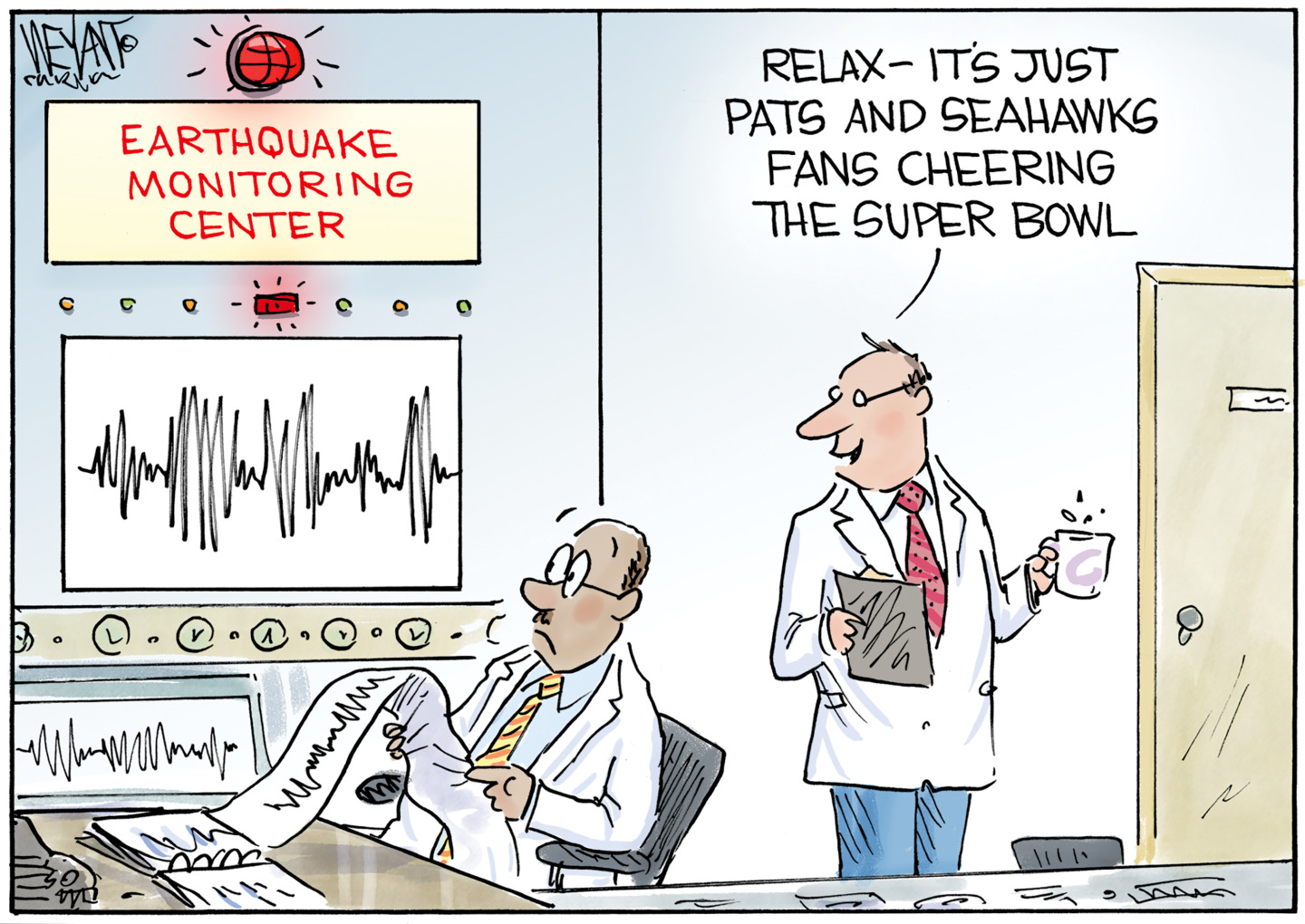

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred