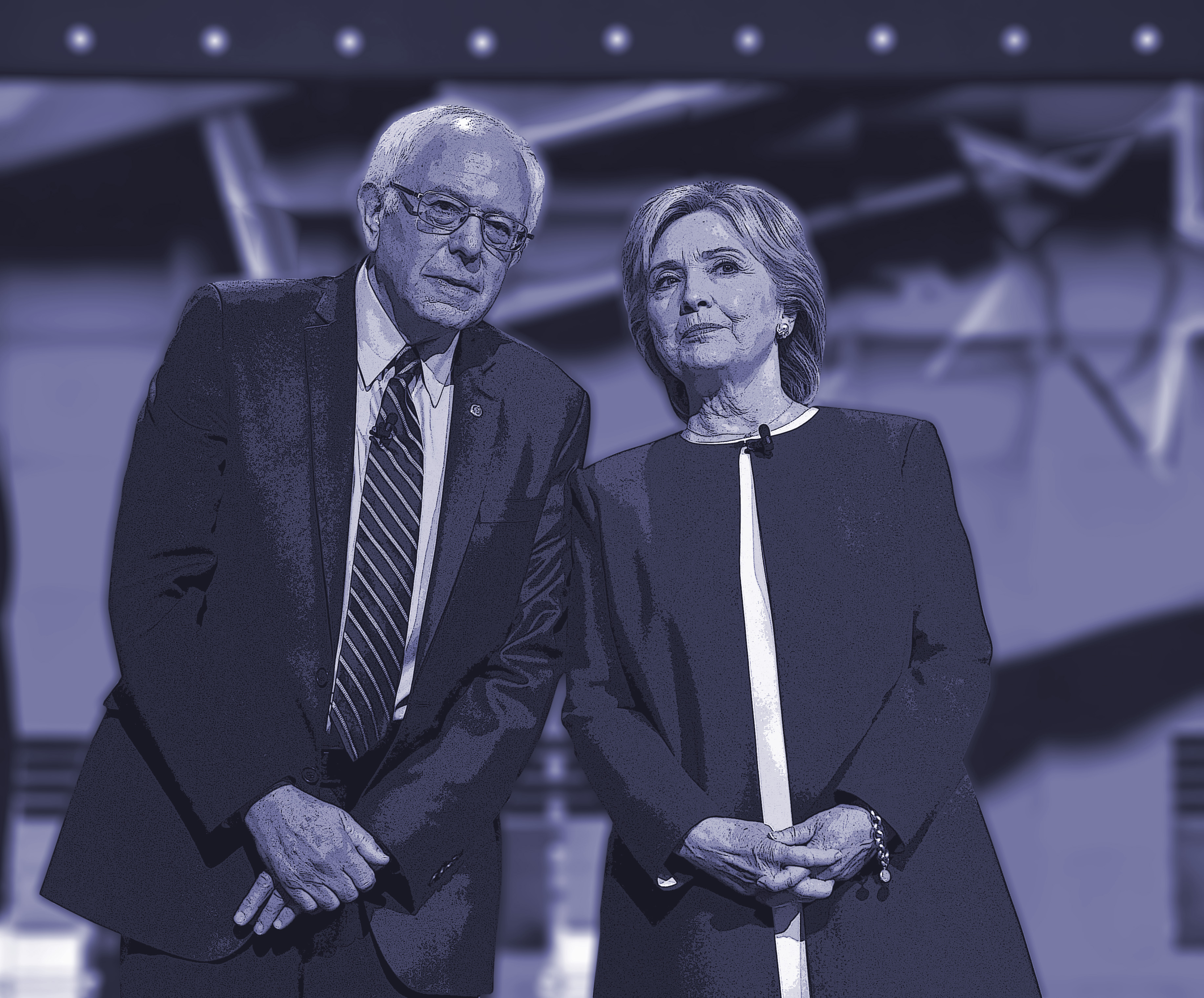

Want killer financial regulation? Just combine Bernie Sanders' plan with Hillary Clinton's.

Two great bank-smashing tastes that taste great together!

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Bernie Sanders and Hillary Clinton are having, by 2016 standards at least, an intelligent and productive debate about the proper form of financial regulation. Even more astonishing, the proposals are actually complementary rather than exclusive. It's two great bank-smashing tastes that taste great together!

Each reform perspective is a rather good encapsulation of the candidate's personality. Clinton's ideas, leveraging her command of the intelligent but timid Democratic Party policy apparatus, focus on a fine-grained understanding of the financial sector and empowering the regulatory apparatus to control it. Sanders mainly wants to bludgeon Wall Street with a cricket bat — crushing Big Finance's political power by slashing bank size and attacking their profitability with deliberately onerous regulation.

Aspects of both proposals will be needed for any comprehensive reform — strong and vigilant regulation, one major task of which is simply capping the power and profitability of finance.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Mike Konczal has a great deep dive into the weeds of each candidate's proposals. The main axis of disagreement is shadow banking. This set of institutions, like the great trusts of financial crises past, was basically designed to evade banking regulations — providing bank-like functions without having to follow annoying federal rules about not taking insane risks. Sanders proposes to break up the largest banks within a couple years and reinstitute Depression-era laws separating commercial and investment banking. Clinton wants to bring shadow banking under the aegis of the regulatory apparatus — the idea being that if it isn't, there will continue to be a risk of a "bank run" in the capital markets.

Meanwhile, Matt Yglesias has a great post rooting this debate in the history of the presidential campaign of 1912, with Woodrow Wilson and Theodore Roosevelt playing the roles of Sanders and Clinton respectively. While both perspectives have merit, there is a real difference in outlook. Just as in those days, Clinton is much more sympathetic to the general idea of high finance, while Sanders views the entire enterprise with his trademark acidic skepticism.

Obviously the details of regulation are extremely important, but it's worth thinking more generally about what the financial system is supposed to do. Finance accounts for about half of nonfarm corporate profits and over 6 percent of GDP (both more than doubled since the postwar age), and New York remains the world's leading financial center. This quite naturally generates a perspective among financial employees and hangers-on that all their incomprehensibly well-remunerated activities are a necessary part of America's economic engine. Excessive regulation, then, risks killing the golden goose.

This is nonsense.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Take Brad DeLong's account of how the financial industry was regulated during and after World War II. The war effort involved the most borrowing in American history, and afterward the government used "financial repression" — enormous regulatory force dedicated to forcing as many bonds down the throat of a prostrate banking sector as possible — to guard against inflation or a bond market death spiral. That was eased after a few years, but for roughly the next three decades, financial regulation was still extremely strict, and finance was a boring, safe economic backwater, fit for the mediocre third sons of actual businessmen.

On standard economic theory, this should harm economic growth as it interferes with the process of mobilizing risk-bearing capital. That's certainly what Sanders' and Clinton's Republican opponents would say. But nothing of the sort happened — on the contrary, the following generation saw the greatest economic boom in American history before or since. So much for the Big Finance apologists!

To return to the two Democrats' plans, I think Clinton's idea to build on Dodd-Frank (which has been an underrated success) is somewhat more grounded and realistic than Sanders'. But where Sanders is unquestionably right is in how that plan must be implemented: with a determination bordering on zealotry. As Haley Sweetland Edwards has explored in depth, any financial reform effort is met with endless legal trench warfare from the big banks.

Sanders' proposal to break Big Finance's economic and political power by brutally breaking apart banks is thus a very worthy idea. The point isn't that bigger banks are necessarily more dangerous than smaller ones — Lehman Brothers and Bear Stearns were relatively small — but that it's much easier to bring them to heel when necessary.

During the financial crisis, the FDIC liquidated hundreds of small banks. Few aside from Duncan Black even noticed.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred