Why buying gold is still a big gamble

And more of the week's top financial advice

Here are three of the week's top pieces of financial advice, gathered from around the web:

Gold: Still a gamble

Investors are once again looking to gold as "insurance against chaos," said Jason Zweig at The Wall Street Journal. The price of gold is up about 20 percent since last July. But investing in it "is still a leap in the dark." I'll admit that the yellow metal has certainly "preserved its purchasing power" over the centuries. The same amount of gold used to pay a Roman centurion's annual salary in the 1st century A.D. would cover a U.S. Army captain's annual salary today. Problem is, "most investors don't lock their money up for a couple thousand years at a time." In the short term, gold's value "fluctuates so wildly" that it can't even be guaranteed to keep up with the cost of living. Adjusted for inflation, gold remains 35 percent below its record highs in 1980.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Personal loans gain popularity

"Ahead of your next big-ticket expense, it may be time to reconsider the personal loan," said Kelli Grant at CNBC. Lenders issued $30.2 billion in personal loans to borrowers with good credit during the first three quarters of 2015, up 67 percent from the same period in 2013, according to credit bureau TransUnion. Low interest rates are the biggest selling point. APRs on a three-year, $10,000 loan start at 5.99 percent at Wells Fargo and Lending Club, compared with 17 percent for the average cash-back credit card. Personal loans are also speedy, with applicants often getting their cash within 48 to 72 hours. But be sure to read the fine print to calculate exactly how much you're saving. Some personal loans offer variable rates, and many lenders charge up-front fees.

Brexit's big investing lesson

Investors who rushed for the exits in the aftermath of the Brexit vote "are kicking themselves now," said Gail MarksJarvis at the Chicago Tribune. Retirement savers may ultimately see losses in some of their mutual funds as a result of the referendum and subsequent market swoon, but "the destruction has been mild compared to what you might have imagined." The stock market has regained nearly all it lost since roughly $3 trillion was wiped out in the immediate panic following Britain's decision to leave the EU. Bonds, meanwhile, "did just what they're supposed to do," protecting investors against big swings in the stock market. As usual, those with a diversified portfolio and the patience to ride out the turmoil came out fine.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

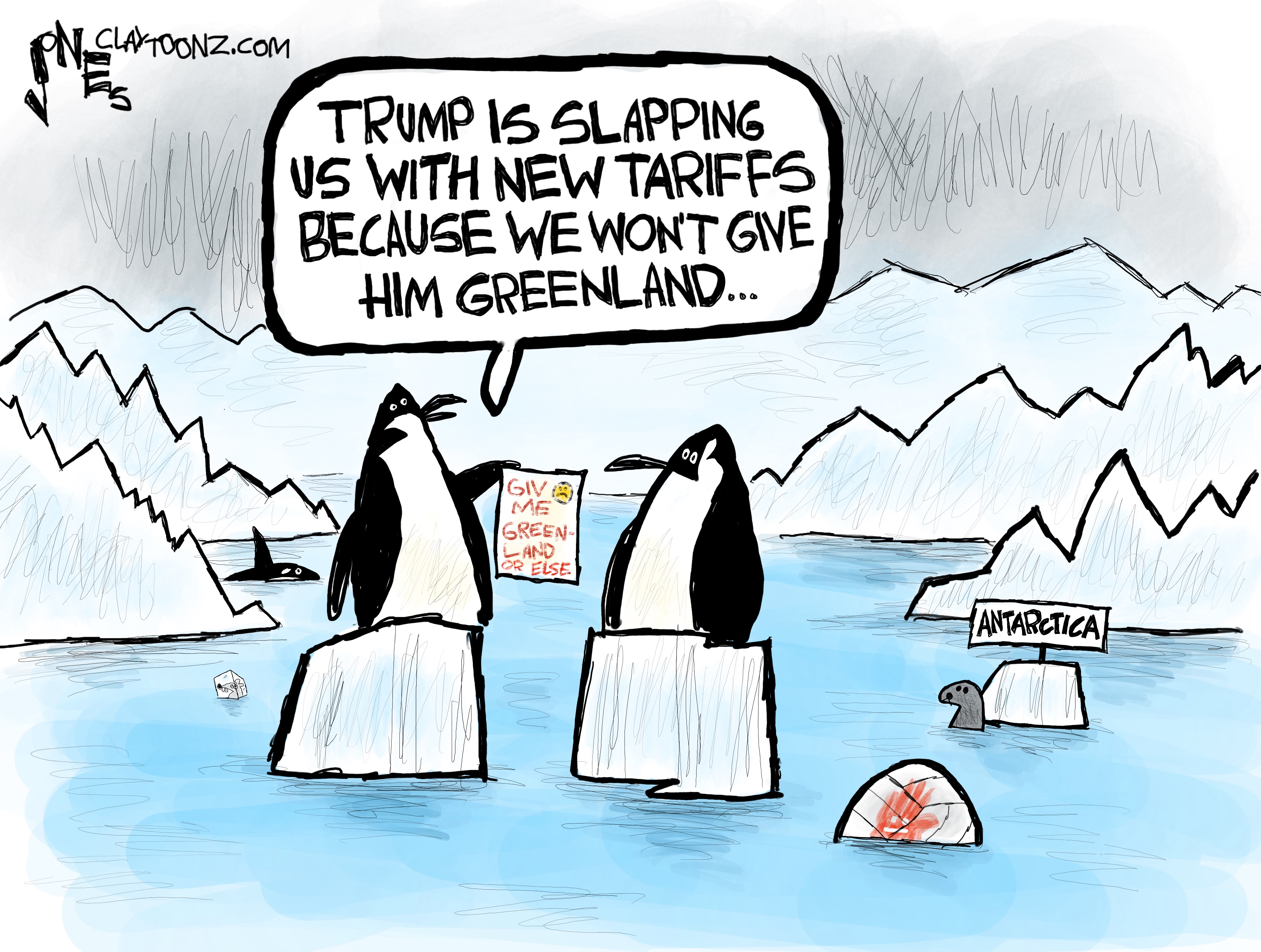

Political cartoons for January 19

Political cartoons for January 19Cartoons Monday's political cartoons include Greenland tariffs, fighting the Fed, and more

-

Spain’s deadly high-speed train crash

Spain’s deadly high-speed train crashThe Explainer The country experienced its worst rail accident since 2013, with the death toll of 39 ‘not yet final’

-

Can Starmer continue to walk the Trump tightrope?

Can Starmer continue to walk the Trump tightrope?Today's Big Question PM condemns US tariff threat but is less confrontational than some European allies

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy