This health-care tax could spark a GOP civil war

It seems we're headed for a big clash on taxes ...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

We may be on the brink of a full-blown Republican civil war. And the spark that could explode this powder keg is a little known investment tax.

This tax has long divided the two parties. But now it's dividing Republicans, too.

Democrats argue that the GOP's health-care reform effort is little more than a weak excuse to cut taxes for the wealthy. And a pretty transparent one, really, given that the GOP also wants to cut Medicaid spending to help pay for this upper-class tax cut.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

At least that's how Democrats are framing it.

At the heart of the left's politically potent claim is the net investment income tax. Passed as part of the Affordable Care Act in 2010, the levy is an additional 3.8 percentage point tax on capital gains and dividends for rich and upper-middle-class Americans. Democrats argue that having wealthier Americans pay more to help ensure more Americans receive decent health care is well worth it.

Many conservative Republicans, especially the "supply-siders," have long made axing this tax a top priority. They view it as anti-growth and one big cause for the lethargic economic recovery.

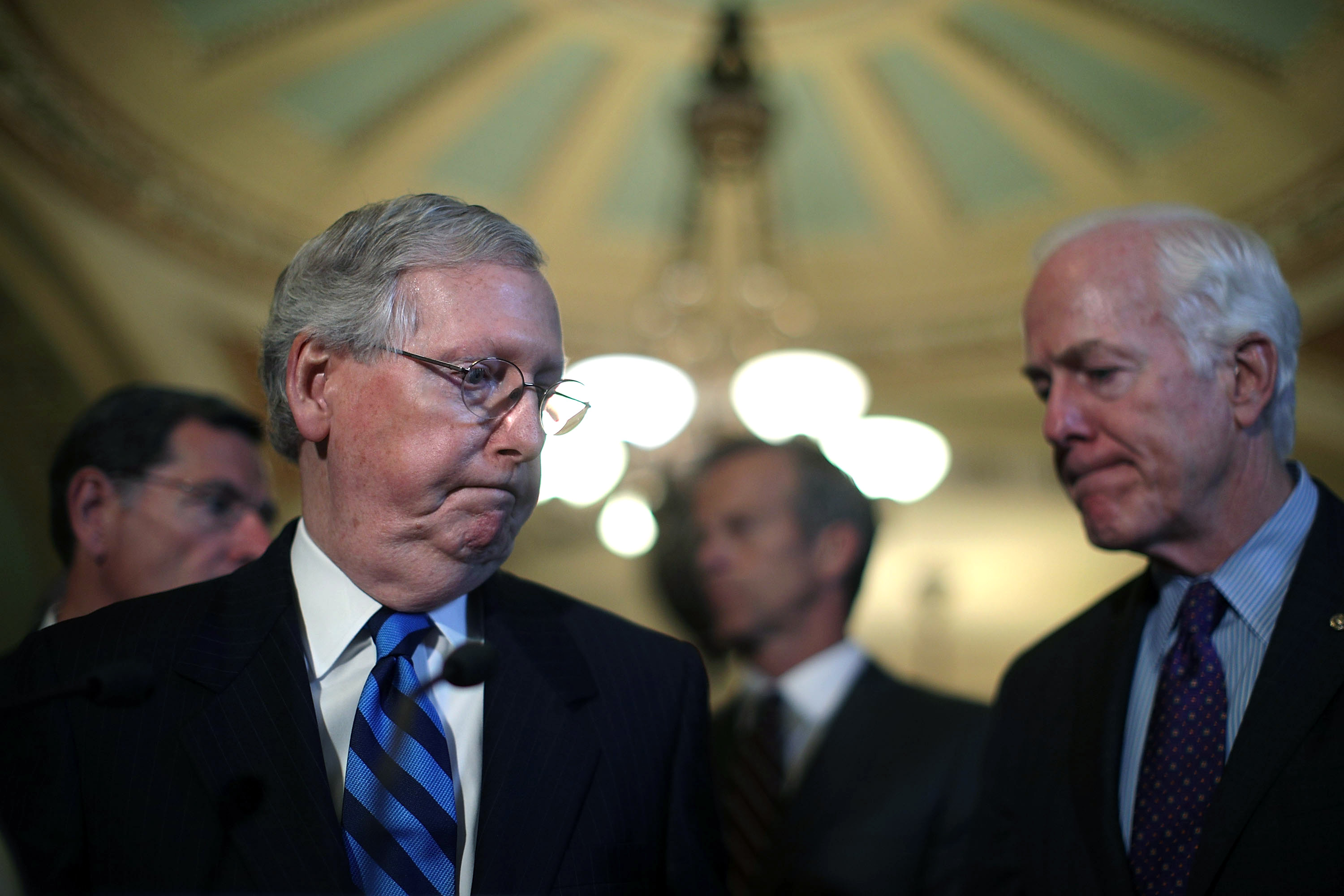

But the GOP's Senate leaders, who are struggling to marshal 50 "yes" votes out of their 52-seat caucus, are trying to keep the tax. Facing a backlash from conservatives like Rand Paul, who have branded the GOP bill, a new version of which is set to be released today, as "ObamaCare Lite," and a revolt from moderates who fear that voting to take health care from tens of millions Americans will be electorally suicidal, Mitch McConnell and Co. are now trying to use at least some of the tax revenue to make the bill more generous to lower-income Americans, and thus get the moderates to vote for passage. Sen. Bob Corker (R-Tenn.), for instance, says it's unacceptable "to have a bill that increases the burden on lower-income citizens and lessens the burden on wealthy citizens." If the tax stays, maybe the Corkers of the world would get on board.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

And for now, at least, it looks like the tax is staying. Which means the anti-tax activist wing of the party is sort of going nuts. The Club for Growth called the tax "an anathema to conservatives as it suppresses economic growth and opportunity throughout our nation." And this from Grover Norquist of Americans for Tax Reform: "The faster we get the capital gains tax cut down, the faster we'll get further growth and investment." Conservative economist Brian Riedl even claims "killing the [tax] is key to unshackling the sluggish economy."

Now, the conservative anti-tax activists do have a point. The U.S. income tax code is biased against investment. That causes less capital accumulation, which in turn is probably a drag on labor productivity and living standards. Lower investment taxes reduce this distortion. Raising investment taxes is thus an inefficient way to finance broader health-care coverage versus, say, a value-added tax.

But here we are.

Is killing this tax, estimated to raise about $20 billion a year over the next decade, really the key to supercharging growth in an $18 trillion economy? After all, the downshift in U.S. productivity growth began well before ObamaCare was passed, when investment tax rates were considerably lower. Also, despite ObamaCare's higher investment tax rates, stocks are at record highs and the $69 billion invested last year in U.S. startups was the second best year in the past decade. The best was 2015.

Investors may not like these taxes. But it's difficult to argue that they're truly dampening Americans' appetite for risk taking and badly jamming the gears of the American Growth Machine.

This is not to defend investment taxes in general. Altering how we tax investment should definitely be part of comprehensive tax reform. (Though perhaps we should actually raise investment taxes to pay for lower corporate taxes and fewer tax breaks.)

But for conservative lawmakers who have been promising for seven years to repeal and replace ObamaCare, is this investment tax really the hill to die on? Because make no mistake: If conservative lawmakers insist on gunning for this investment tax, Republicans' flailing effort to replace ObamaCare with a bill of their own might well fall apart entirely.

Moreover, there is a growing mismatch between the GOP's Trump-enthralled working-class voters and the party's traditional economic platform of low taxes on "job creators" and free trade. Do agitated and disillusioned working-class voters in Michigan who have been promised a swift repeal of ObamaCare (whether such a repeal would be good for them or not is debatable, I know) really want to see the whole effort scuttled over relatively marginal taxes on dividends?

There is also a tension within the traditional GOP. It wants to cut taxes, yet at the same time worries about the historically high national debt. Which is it? You can't have both.

It also looks like the Republicans will be keeping ObamaCare's 0.9 percent Medicare surtax on upper-income earners. That will surely enrage the party's aggressively anti-tax wing. But it also may presage the GOP's future — and its future conflicts.

The health-care battle marks an important step away from the party's tax-cutting obsession. Don't expect anti-tax conservatives to go down without a fight.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.