Trump says he won't benefit from his tax plan. That's nonsense.

Let's look at all the ways the president will benefit from his own tax plan

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

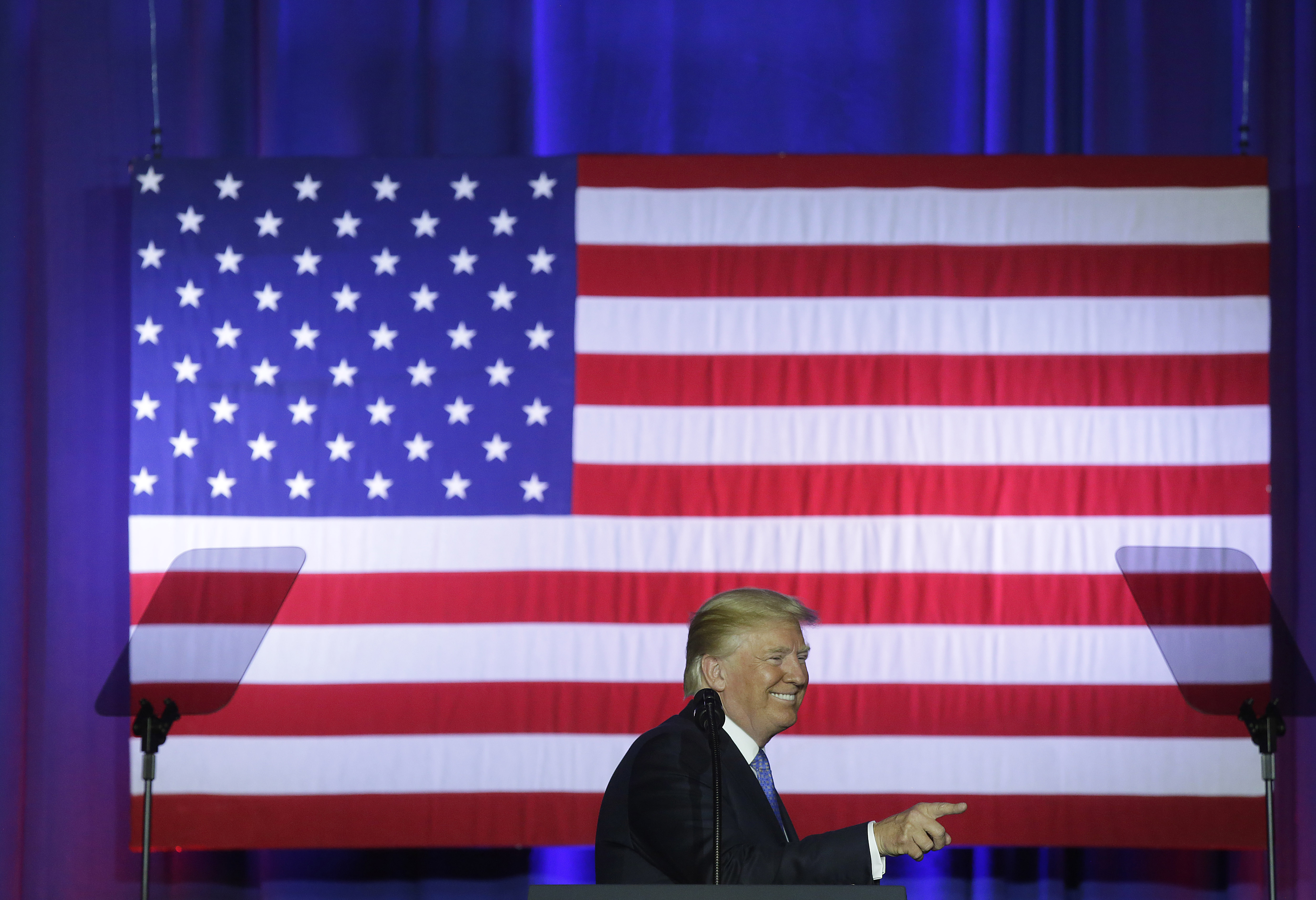

President Trump wants you to know that his push for tax cuts isn't about him. As he said during his big unveiling on Wednesday, the new tax proposal is only to help "low-income and middle-income households, not the wealthy and well-connected. They can call me all they want. It's not going to help. I'm doing the right thing, and it's not good for me. Believe me."

If you've been paying close attention for the last couple of years, you know that when Trump says the words "believe me," it is a clear signal that he's lying. This is no exception.

Trump has been adamant that he won't profit from his tax plan. Asked by a reporter whether he'd benefit from the plan, the president responded, "No, I don't benefit. I don't benefit. In fact, very, very strongly, as you see, there's no — I think there's very little benefit for people of wealth."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is one way that might possibly be true: if Trump pays no taxes at all, in which case his taxes can't go down any further. Of course, it's impossible to know for sure, since unlike every president in the last half-century, he refuses to release his tax returns. But if we set aside that no-tax possibility, we can look at the plan to see the ways Trump and other rich people would get a windfall from the changes he wants to make to the tax code. And there are plenty.

The top rate comes down from 39.6 percent to 35 percent. That may not seem like a huge cut, but the more you make, the more it's worth. If you're a corporate CEO with a $10 million salary, you get a tax break of hundreds of thousands of dollars, which might just be enough to buy that Rolls-Royce Phantom you've had your eye on.

Still, Trump might be right that this particular tax cut won't benefit him — but that would only be true if he instead benefits from other parts of his tax plan, as we'll outline below.

The Alternative Minimum Tax disappears. The AMT was put in place so rich people couldn't use a bunch of fancy loopholes to get out of paying taxes; if your income is over about $200,000 and your tax liability is unusually low, you might have to pay the Alternative Minimum Tax. And Donald Trump has in the past. Remember back in March when reporter David Cay Johnston got a hold of the first two pages of Trump's 2005 tax return? They showed that in that year, he had to pay an AMT of $38 million. If he killed the AMT, he wouldn't have to worry about that again.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Pass-throughs get special status. Many businesses are organized as "pass-through" entities, which means that any profits the business makes flow to a person or persons, who then pay taxes on that income at regular income tax rates. Some of those businesses are small, like the corner hardware store. But some of them are quite large, and most pass-through income goes to people paying income taxes at the top rate of 39.6 percent. Since the Trump tax plan taxes all pass-through income at 25 percent, that would represent a huge tax cut for them.

And guess who owns a collection of over 500 business entities, nearly all of which are pass-throughs? Can you guess? I'll bet you can.

The estate tax disappears. Republicans will insist that eliminating this tax (also called the inheritance tax) is about helping small businesses and farms, which is utterly bogus. Heirs pay zero tax on the first $5.49 million of an estate, which is why it is only paid by one in every 500 estates. If you know any farms that are worth more five and a half million dollars, that's no family farm, that's a conglomerate — which is why tax getting assessed on farms is vanishingly rare.

But Donald Trump's estate would most certainly be one of those one in 500. In practice, wealthy people often take advantage of various loopholes and schemes to shield their estates from the tax, but since we know so little about Trump's finances, let's assume that his entire estate would be subject to it. He claims to be worth $10 billion. That number is almost certainly wildly inflated. Forbes pegs the actual figure at $3.5 billion. At the 40 percent estate tax rate, Trump's proposal to eliminate the inheritance tax would save his family $1.36 billion in taxes on that $3.5 billion.

Let's spare a moment's consideration for poor Ivanka, Don Jr., Eric, Tiffany, and Barron, forced to divide a mere $2.14 billion between them when The Donald departs this mortal coil. Will Ivanka stay up nights darning their moth-eaten socks so they can avoid frostbite in the winter? Will Eric beg for alms on Fifth Avenue? Will Don Jr. go on African safari not for the sheer joy of putting a slug through the brain of a rare and exotic animal but so the family can have food to eat? Will they have to sell all those gold-plated toilets? If the plan passes, they won't have to worry, thank goodness.

The president himself and the people who work for him could have done what Republicans in earlier times did, patiently explaining that tax cuts for the rich are necessary so those noble job-creators can go out and spread their largesse on the rest of us. They've decided instead to just lie about it, claiming that the rich are getting nothing at all. As chief economic adviser Gary Cohn said on Good Morning America on Thursday, "The wealthy are not getting a tax cut under our plan." But of course, they are, and it'll be a big one. And that includes the president himself.

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred