Democrats are so, so wrong about the GOP tax bill

Their hysteria might just outweigh the GOP's incompetence

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Somehow, the hysterical Democratic response to the GOP's tax-reform bill has managed to be worse than the fumbling Republican disunity that created this legislation. Rather than giving voters a sense that Democrats could govern effectively and realistically, liberals have just matched Republican incompetence with their own ridiculous hyperbole and panic.

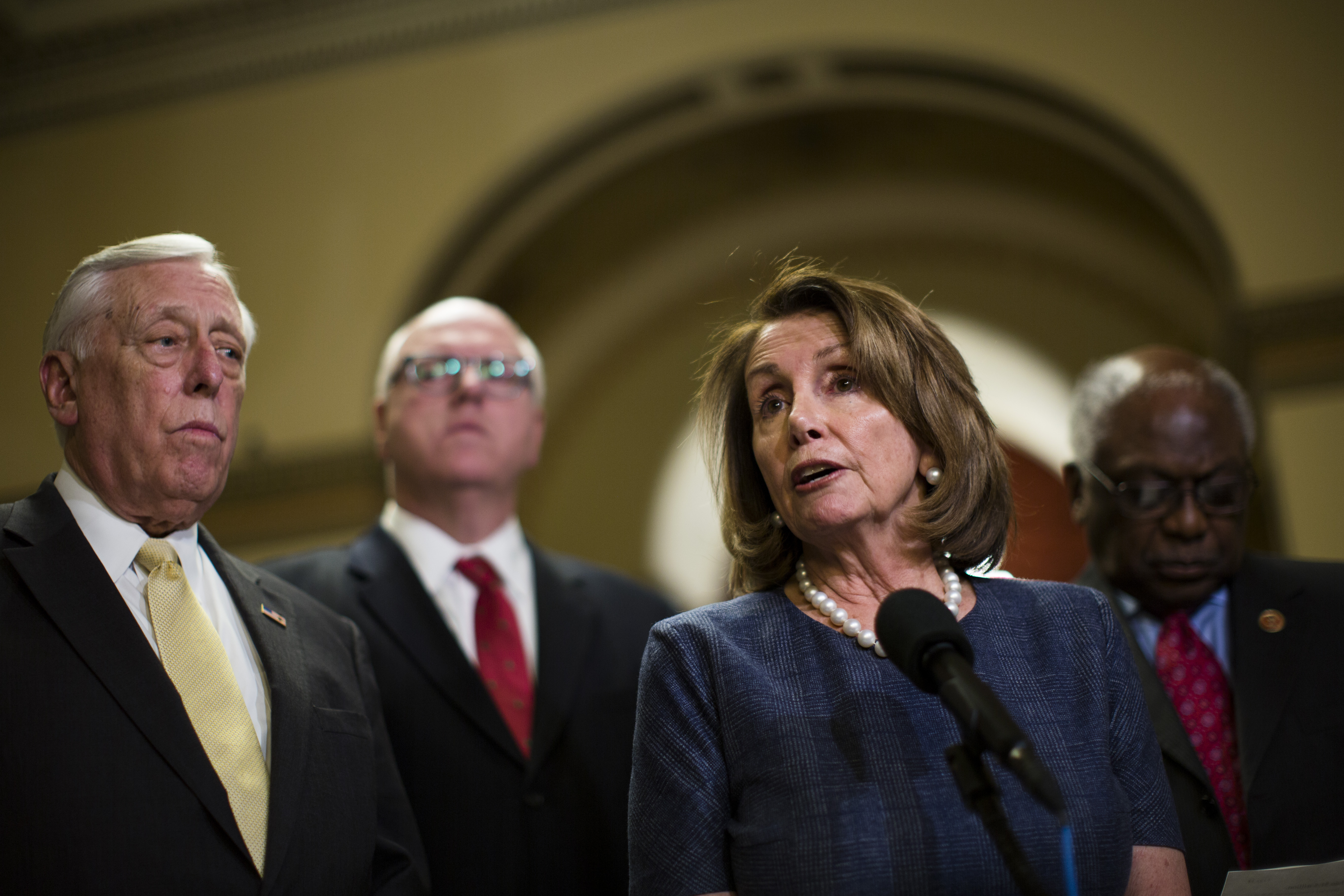

On Monday, House Minority Leader Nancy Pelosi (D-Calif.) led her party's response with a measured assessment of the bill as "Armageddon." That was a reference to the inclusion of a repeal of ObamaCare's individual mandate in the Senate version, which would eliminate the most unpopular part of the Affordable Care Act. Pelosi then followed up that assessment with a claim on the House floor that the bill is "the worst bill in the history of the United States Congress." Pelosi claimed that Republicans had achieved this historic accomplishment because the bill "involves more money, hurts more people, increases the deficit by so much more." Pelosi's attacks mirrored others, such as Sen. Bernie Sanders' claim that Republicans were "looting the Treasury," and laments by liberal celebrities and media figures that "America died tonight," and that there was no going back after this collapse.

It doesn't take a historian to poke a few holes in the apocalyptic fantasies of Pelosi and Co. While assessment of acts of Congress are subjective in nature, it's safe to say that neither the House nor Senate tax bill comes close to the awful nature of, say, the Fugitive Slave Act of 1850, which required Northern states to return runaway slaves to their Southern masters. Then there's the Sedition Act of 1918, which made dissent a crime, or the Gulf of Tonkin resolution, which enabled a massive expansion of the Vietnam War in 1964. Economically, as every fan of Ferris Bueller's Day Off knows, the Smoot-Hawley Tariff Act of 1930 magnified the Great Depression in both the U.S. and Europe, creating instability and chaos that allowed an opening for the Nazis to come to power in Germany two years later.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Even on the narrow merits of Pelosi's criteria, her claims are ludicrous. The CBO projected that the Senate version of the tax bill would add $1.5 trillion to the deficit over 10 years. The two budgets passed under full Democratic control by Pelosi, Harry Reid, and Barack Obama (FY2010 and FY2011) had combined deficit spending of close to $2.6 trillion in just those two years. That doesn't count the $1.4 trillion deficit in the FY2009 budget passed by Pelosi and Reid with signoffs by both George W. Bush and Obama, which was an increase in deficit spending of nearly $1 trillion over FY2008. Granted, these budgets were passed during and in the immediate aftermath of the Great Recession. But still, Pelosi's sudden interest in deficit control is at least as remarkable as the sudden disinterest evinced by her opponents across the aisle.

Far from raiding the Treasury, the Senate tax bill reduces revenue over 10 years by $1 trillion. That's not an insignificant number, of course, but it represents a drop from a projected $46 trillion to $45 trillion over that period, a reduction of about 2.17 percent overall, although much of the reduction comes in the first five years. The purpose of that is to provide an economic stimulus, which would make it just a little more expensive over 10 years than the impotent Pelosi-Reid-Obama stimulus package of early 2009, which cost $800 billion in a single year and proved only that shovel-ready jobs really didn't exist.

The real problem with the Republican tax reform effort is the opposite of Pelosi's claims. The flaw isn't that it goes too far — it doesn't go far enough. A few years ago, Republicans debated whether a tax-system overhaul should adopt a flat-tax model that would eliminate social engineering and crony capitalism, or the "fair tax" consumption-based model that would end the income tax altogether. Instead, Republicans have only offered tweaks to the existing system for individual taxes, and in the Senate version hardly even that much; it retains the same number of brackets and just distributes the deductions a little differently. It's only a mild adjustment to the status quo of individual taxes, not a groundbreaking effort to put America on the path of simplicity and fairness. (It does reduce the corporate tax rate much more significantly, but this is hardly some undemocratic travesty of justice.)

True national leaders in the Democratic Party would cast the bill for what it really is — an unimaginative tweak with little hope for real impact. Of course, that can also be said about the Republican leadership that produced this bill, only they probably will find the conference report so divisive that the final version may not pass in either chamber, let alone both. American voters will remain stuck between the hysterics and the incompetents, and wonder which party will get its act together first — or if either of them ever will.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Edward Morrissey has been writing about politics since 2003 in his blog, Captain's Quarters, and now writes for HotAir.com. His columns have appeared in the Washington Post, the New York Post, The New York Sun, the Washington Times, and other newspapers. Morrissey has a daily Internet talk show on politics and culture at Hot Air. Since 2004, Morrissey has had a weekend talk radio show in the Minneapolis/St. Paul area and often fills in as a guest on Salem Radio Network's nationally-syndicated shows. He lives in the Twin Cities area of Minnesota with his wife, son and daughter-in-law, and his two granddaughters. Morrissey's new book, GOING RED, will be published by Crown Forum on April 5, 2016.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred