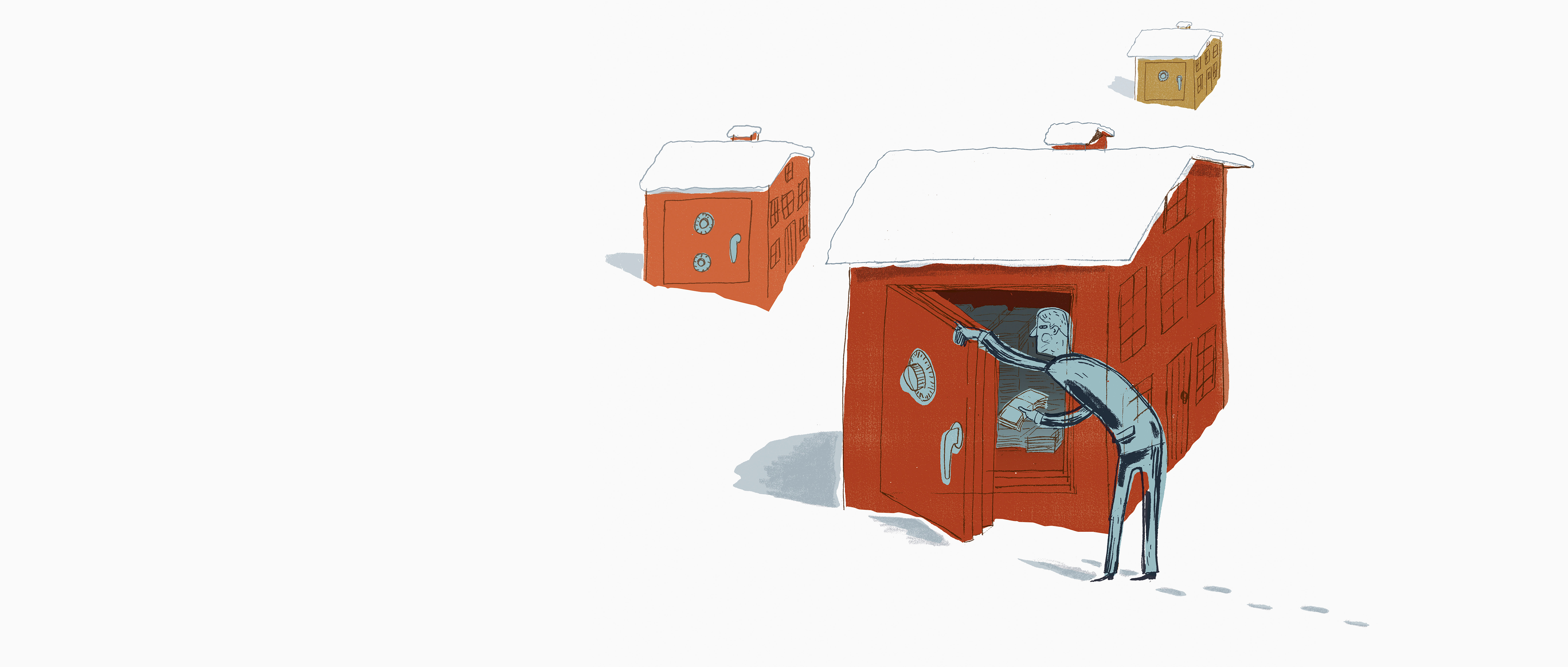

This is why you can't afford to buy a house

Investors have gobbled up housing at a blistering pace — and they're not letting anyone in

Americans are desperate for more affordable housing. Yet 1.4 million residential properties were vacant as of 2017's third quarter. Even more telling: 75 percent of those vacancies weren't owned by a former occupant, but by an investor.

Welcome to America's new housing crisis.

To understand real estate, you first need to understand land, which occupies a very weird place in market economies. Most goods and services respond to changes in price signals: The price goes up or down depending on whether demand or supply is stronger. It's a self-correcting mechanism. For example, if a wheat shortage drives up the price per bushel, that price will fall when more wheat finally comes to market.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Not so with land. No matter how much the price changes, the supply remains fixed. Which means the price can't self-correct.

Now throw skyrocketing inequality into the mix. A certain slice of the population just keeps getting more and more money — so much money that they don't know what to do with it all. If they keep it in a bank account, it won't grow — in fact, it will likely shrink with inflation. So they'll need to invest it, preferably in a diverse portfolio of stocks, bonds, and — you guessed it — real estate.

Thus property becomes just another financial asset, like a security, where rich people park their money. Indeed, 23 percent of residential homes for one to four families, occupied or not, are owned by investors at this point.

Across major American cities like Miami and New York — and elsewhere in Canada, England, Australia, etc. — luxury apartments at the high end of the market are increasingly sold to anonymous buyers for cash. That's driving prices into the stratosphere. The story can take a xenophobic tinge, since sometimes the money is foreign — from Russian oligarchs or Chinese business elites. But the real point here is that wealth and income inequality inevitably collides with the weird market nature of land to produce this dynamic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Long-term changes and policy choices have led to a collapse in jobs outside of major American cities. Needless to say, that's driving demand for housing way up where employment is still plentiful. So big cities like New York, San Francisco, etc. are ground zero for this sort of land speculation.

Meanwhile, rural America's affordability crisis isn't so much about prices being super high. It's that incomes are so low that a lot of people can't afford even the more modest prices. A lot of the housing stock is also in disrepair, and people can't afford to fix it. Government investment and subsidies used to help, but they've been slowly cut back since the 1980s. Meanwhile, the states and cities with the highest vacancy rates for investor-owned properties tend to be in the South and the Rust Belt: Flint and Detroit in Michigan; Youngstown, Ohio; Southbend and Indianapolis in Indiana; and others in Kansas, Mississippi, and Alabama.

If you're just a regular homeowner in one of these areas who's trying to sell the place you live in, you've got a good incentive to eat a loss and take what money you can. That's hardly ideal, but at least it means the market clears. But someone treating housing like an investment likely has a bigger portfolio. That gives them a lot more cushion to just sit on a vacant property and wait for someone who can pay at the price they want. In the cities, properties are vacant as well, but investors don't need to wait as long for a buyer who can meet their preferred price point. So housing speculation in urban and rural areas become weird mirror images of each other.

This extractive model of housing ownership also shows up when big investors and Wall Street firms own rental properties. They hike rents aggressively, gouge renters on fees, and come up with all sorts of technical excuses to evict tenants who can't afford the prices anymore because they're already bled dry.

To solve this crisis, many commentators focus on deregulation: If you allow developers to build more units on the most in-demand land, you'll have more housing supply. It's certainly not a bad idea, but at this point things are bad enough that any reasonable deregulation just won't be sufficient.

Ultimately, we need to acknowledge the crucial role that inequality itself plays in the housing crisis, and do things to squash it: hike income taxes at the very high end way up, and tax wealth and capital much more aggressively.

Another possible solution that really targets speculation specifically is a national land value tax. That's a tax, not on the value of the whole property, but just on the value of the land. As the price of land goes up, the tax goes up, incentivizing the owner to develop the land, rent it, whatever, to earn more income from it and keep ahead of the tax burden. Use it or lose it, essentially.

Finally, we could use all that tax revenue to finance more options sheltered from market forces, like public housing and public land trusts.

A house (or apartment) is a home, not a financial asset. It's there to serve human needs. As we learned in 2008, when markets forget that distinction, bad things happen.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Gavin Newsom and Dr. Oz feud over fraud allegations

Gavin Newsom and Dr. Oz feud over fraud allegationsIn the Spotlight Newsom called Oz’s behavior ‘baseless and racist’

-

‘Admin night’: the TikTok trend turning paperwork into a party

‘Admin night’: the TikTok trend turning paperwork into a partyThe Explainer Grab your friends and make a night of tackling the most boring tasks

-

Find art, beautiful parks and bright pink soup in Vilnius

Find art, beautiful parks and bright pink soup in VilniusThe Week Recommends The city offers the best of a European capital