The stocks are falling! The stocks are falling!

The stock market is cratering for no good reason

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The stock market giveth, and the stock market taketh away.

After a year of booming valuations and record-smashing highs, the stock market has been tumbling for days. The Dow Jones Industrial Average, the S&P 500, and the Nasdaq all weakened last week, and then nosedived on Friday, with the Dow plummeting more than 660 points. It was the Dow's worst day since the summer of 2016. It seemed like things couldn't get much worse.

Then Monday rolled around, and stocks went into a catastrophic slide. The Dow absolutely tanked, diving 1,175 points for the day. At one point it was down more than 1,500 points, and somehow plunged 800 points in roughly 15 minutes before righting itself. By day's end, all the gains of this new year had been erased. It was the Dow's worst day in more than six years.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The January jobs report was positive on its face. Unemployment remains low. Nothing major seems to have changed in the last few days.

So what on Earth is going on?

The stock market's relationship to good economic news is somewhat contradictory. More growth means more profits, which Wall Street obviously wants. But more growth also usually means more jobs and higher wages. Higher wages often mean more inflation, and thus a Federal Reserve itching to hike interest rates, which raises the cost of borrowing. That makes investors nervous. Too much growth now thus raises the specter of less growth in the future.

Trading on the stock market is all about maximizing your capital gains. If you're not selling your stock now, it's because you hope to sell it for more later. But if investors decide the Fed is about to spoil the party, and that things won't get much better than they already are, selling your stock starts looking more attractive. Hence the last few days.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If the Fed really is about to rain on investors' parade, a massive selloff would make some sense. But it's not at all clear that's what's happening.

Let's examine that January jobs report, which was released Friday morning, as this is what really seems to have sent investors into a tizzy. The top-line numbers were good: America's economy added 200,000 jobs last month, more than economists had predicted. The December jobs tally was revised up too, from 148,000 to 160,000. And unemployment remained at 4.1 percent, a 17-year low.

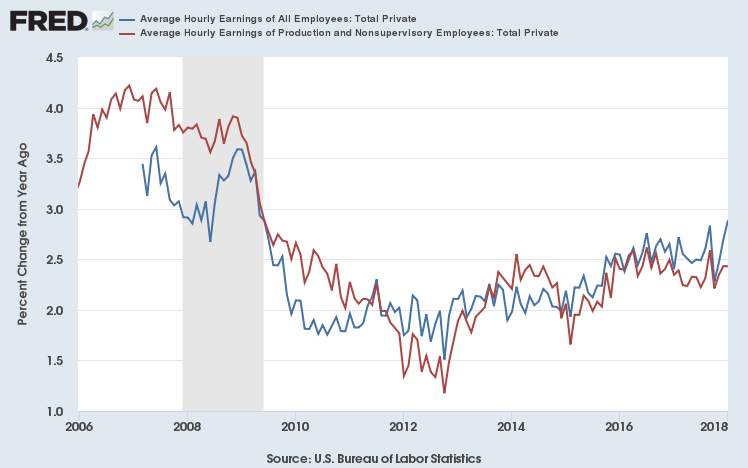

Average hourly wages were 2.9 percent higher in January 2018 than they were in January 2017. The last time the year-over-year change was that high was mid-2009. And that's what spooked investors. "The wage data on Friday was a bit of a shock," said ETX senior market analyst Neil Wilson.

The main thing driver of inflation is companies trying to stay ahead of labor costs. If wages increase, and productivity growth doesn't keep up, the only way to maintain profit margins is to increase prices. If that arms race sets in between employers and employees across the economy, we get rising inflation.

With the unemployment rate lower than it's been in almost two decades, observers have been wondering when companies would finally run out of new workers, and have to start outbidding each other with higher wage offers. Lots of people took that 2.9 percent as a sign that the time has finally come.

"Equities have been caught off guard by what could be a sudden release of pent-up inflationary pressures that will favor labor over capital — a situation not known since the crisis as ultra-low rates have fueled asset prices," Wilson continued.

Of course, there's something deeply perverse about this. So much of our economic conventional wisdom is built around fear of higher pay and more bargaining power for workers.

But when placed in context, there's not all that much to fear. (Or celebrate, depending on your perspective.)

Wage growth (the blue line) basically plateaued over the last year or two. That final jump to 2.9 percent simply returns it to the modestly rising trend it was on before the stall. And that's assuming wage growth continues around 2.9 percent over the coming months and gradually moves higher. January could easily turn out to be a blip. (Also worth mentioning: Wages for production and nonsupervisory employees — the red line — didn't do nearly as well. They're still on a flat line trajectory that's held since 2016.)

To have a serious threat of inflation, America would probably need sustained wage growth of 3.5 to 4 percent. We're not there yet. And at the current pace, it would probably be another year or two before we break into the lowest reaches of that range.

Inflation is about 1.5 percent right now. That's well below the Fed's 2 percent target, where inflation's been stuck for years. Despite what you may hear from many economists (including Fed officials themselves), there's really no mystery to this: As low as the unemployment rate is, there are still millions of Americans out of the labor force who could plausibly be brought back in. Other forces, like the decline of unions, greater use of anti-competitive contracts, and more, are holding down wages as well. Upward pressure on prices isn't nearly as high as the official unemployment rate would suggest.

The Fed is planning three interest rate hikes for 2018. I think that's too much. But let's be honest: The Fed has shown itself to be methodical and data-driven. There's no reason to think newly installed Fed Chair Jerome Powell will change that. If there's no broader data suggesting a jump in inflationary pressure, one month with an unusual spike in wage growth isn't going to inspire more unexpected interest rate hikes. Wall Street was already aware that three hikes in 2018 was the plan well before last week hit, and it was cruising merrily along.

For the moment, everyone might be better served by watching President Trump's Fed appointees. He'll have the opportunity to fill several spots at the central bank. If he goes with more inflation hawks, Trump could change the Fed's institutional calculus. Then the stock market would have reason to anticipate a more aggressive interest rate schedule.

But for now, there's little reason to fear higher wages or labor's rising power. So let's all take a deep breath. Relax. The sky is not falling.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.