The subtle racism of centrist Democrats

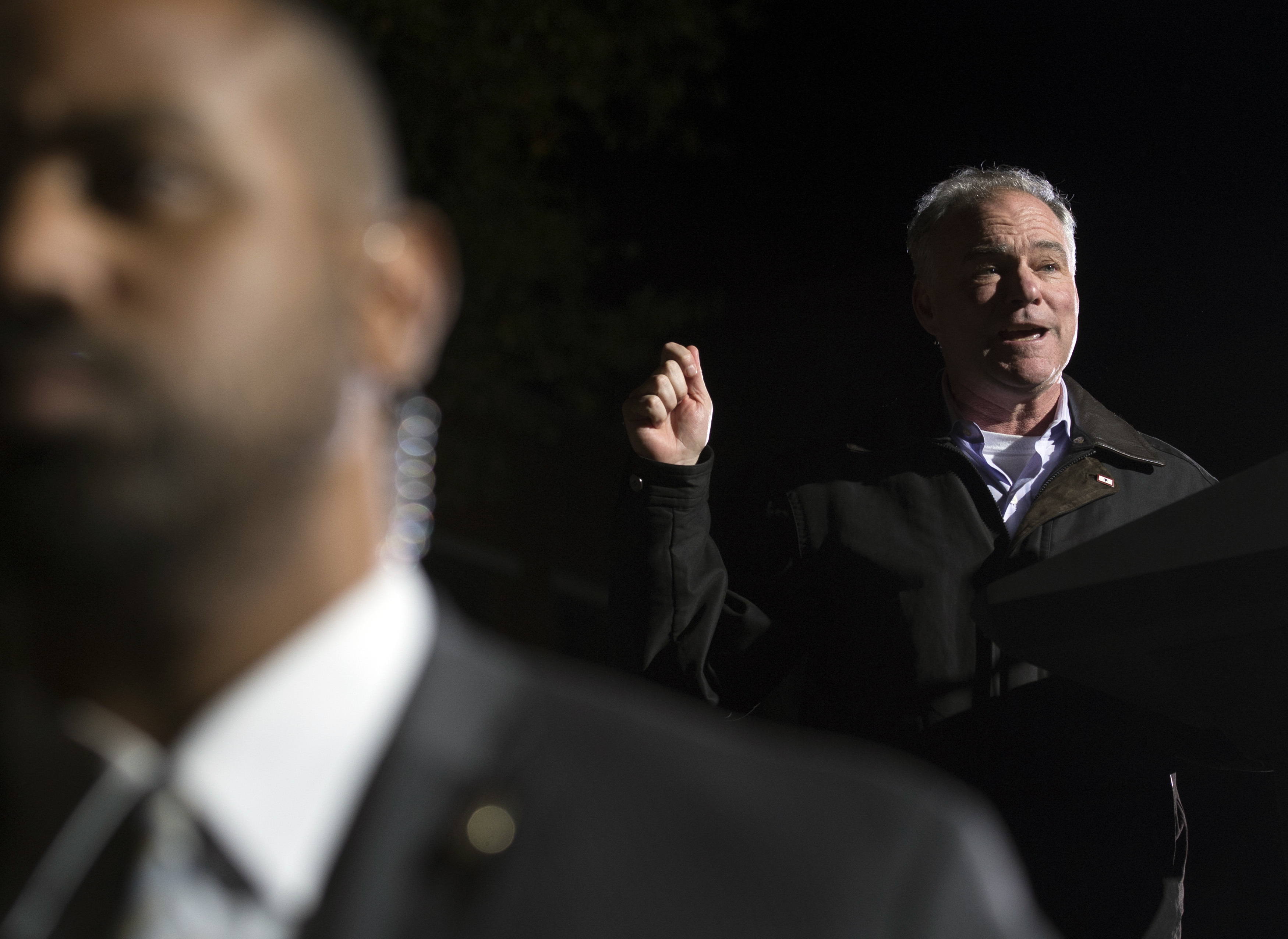

How moderate liberals like Tim Kaine and Doug Jones are trying to feed their black constituents to predatory banks

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Quisling Senate Democrats are collaborating with congressional Republicans and President Trump to roll back the Dodd-Frank financial reform bill. So far they have broken a filibuster, and the bill looks set for passage. It's an immensely horrible idea that significantly raises the risk of a future financial crisis.

However, it should also be emphasized that this deregulation package is racist both in specifics and in general effect. It's a perfect demonstration of how centrist Democrats sell out their most loyal voting bloc to predatory Wall Street banks.

So what is in the bill? As David Dayen explains in great detail (along with Elizabeth Warren), it's a core of maybe somewhat-justifiable reforms for smaller banks that has been larded up with a slew of handouts and deregulations for quite large banks — not the very biggest, but ones of the size that helped touch off the 2008 crisis, like Countrywide Financial. "Congress is unlikely to pass much significant legislation in 2018, so lobbyists have rushed to stuff the trunk of the vehicle full," Dayen writes. However, perhaps most egregious in regulatory terms, there are also a set of regulatory rollbacks that Citigroup lobbyists got added to the bill which would benefit the very largest banks.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What's more, proposed fixes for some of this stuff are all scams, as Dayen patiently explains in another post.

Now, Sen. Bob Corker (R-Tenn.) has introduced an amendment which would undo most of these latter Citi-written provisions. The fact that a Tennessee Republican is balking at this banker handout tells you how bad this is. And the fact that centrist Democrats are being squirmingly dishonest about the contents of the bill tells you they know exactly what moral wrong they are committing. (And it's anybody's guess whether Corker's amendment will get a vote.)

Financial deregulation in general is racist for two main reasons.

The first is relatively passive: Deregulation raises the risk of a general economic crash, which harms African-Americans disproportionately due to their being clustered on the bottom of the income ladder. Since blacks tend be poorer than whites and are often the last hired and first fired, they get the worst of it when a recession hits.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But the second reason is actively racist: Banks have long tended to directly prey on black people, whether it was abusive contract selling decades ago or shoving middle-class black families who qualified for normal home mortgages into subprime loans during the housing bubble. (Or as Wells Fargo employees called it, tricking "mud people" into "ghetto loans.")

The ensuing foreclosure crisis — carried out by banks and mortgage servicers, and powerfully enabled by centrist liberal and then-Treasury Secretary Tim Geithner — was one of the great epochs of black wealth destruction in U.S. history. From 2007-2016, average black home wealth declined by 28 percent, while the average home wealth of whites fell by only 16 percent. (Over that same period, the mostly-white top 1 percent, whose wealth is mostly in stocks, increased its wealth by $4.9 million on average.) To this day, blacks and Latinos have far greater trouble getting home loans than whites.

This shouldn't be too surprising. In general, it's easier to squeeze profit out of a defenseless population through deception and force than it is to conduct rigorous underwriting and analysis.

That brings me to the most morally odious part of this bill: its rollback of data-gathering requirements intended to prevent lending discrimination. As Zach Carter explains:

The Senate could vote as early as Thursday on a [Sen. Tim] Kaine-sponsored bill that deliberately undermines the government's ability to enforce laws against racial discrimination in the housing market. The legislation would block the Consumer Financial Protection Bureau from collecting key data showing when and where families of color are being overcharged for home loans or steered into predatory products. [HuffPost]

I once argued that the recent self-presentation of centrist liberals as being fire-breathing defenders of social justice was a sham — the product of a cynical attempt to beat back the left. When Hillary Clinton argued that breaking up the biggest banks would not "end racism," she obscured the immensely important role financial institutions have had in racist exploitation in this country.

But now we see centrist liberals — up to and including Clinton's 2016 running mate — will go farther than that and actually take affirmative steps to enable bankers' racist exploitation.

A few months ago, when Doug Jones won his extraordinary come-from-behind victory in the Alabama Senate race, there were many articles celebrating the eye-popping margins he posted among black men and women. We see now how that loyalty is repaid: by feeding those constituents into the blood-slicked maw of Wall Street.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred