America's disappearing IPOs

America used to have hundreds of initial public offerings a year. Last year we had a mere 147. What happened?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What happened to all the IPOs?

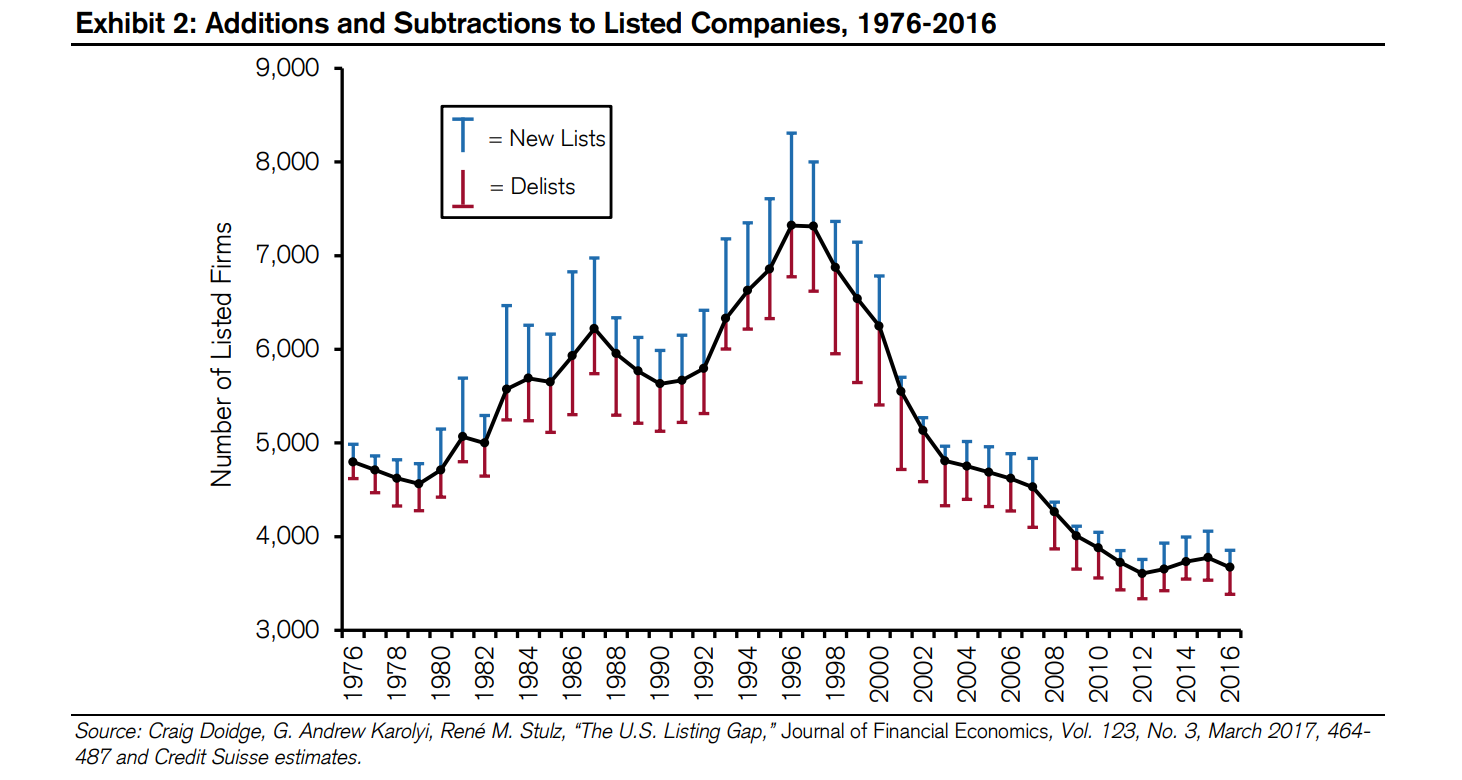

It wasn't so long ago that the market for initial public offerings — in which a promising and often young private company first allows public investors to buy its stock, often as a way to raise money and invest in the future — was booming. In the two decades before 2000, America was averaging some 300 IPOs a year. In fact, volume was considerably higher than that from 1990 to 2000, reaching 706 in 1996, for example.

Then they fell off a cliff. Last year, there were a mere 147. What happened?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Regulatory red tape is partly to blame. For instance, the Sarbanes-Oxley Act, passed in 2002, tightened disclosure rules and made IPOs more difficult and costly. But there's much more to it than red tape. After all, lawmakers also passed the Jump-Start Our Business Start-Ups Act in 2012 to ease some of those regulatory burdens. (The "JOBS Act." Get it?) But IPOs barely twitched in response.

Another explanation is the general rise of bigness and concentration among companies. It's not just that IPOs have disappeared. The number of publicly traded companies has collapsed as well, from a peak of 7,322 in 1996 to 3,761 last year. Indeed, the volume of publicly listed companies follows the overall trend of IPOs: modest in the 1970s and 1980s, then ratcheting way up in the 1990s, before plunging to hitherto unseen lows in the 2000s and 2010s.

This doesn't mean there's less money in the market than there used to be. There's actually considerably more. Total market capitalization of listed firms is now 136 percent of GDP, compared to 105 percent in 1996. It's just concentrated in fewer and fewer companies.

Over the last few years, there have been fewer companies publicly listed on the stock market than there have been in decades. And these business share some key characteristics. First, they're big. Businesses with fewer than 5,000 employees are less likely to be publicly listed. They're also old. Companies that have been around for less than 10 years are way less likely to be listed. Young companies made up roughly 40 percent of all listed companies in the early 1980s. That number climbed to 57 percent in the late 1990s. It's around 28 percent today.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If you look at the graph above, you'll see that tons of companies are delisted from the public stock market each year. Many businesses simply fail. But a lot of them are just getting bought out as mergers and acquisitions have increased. America hasn't enforced antitrust law with any teeth since the 1980s. After years of neglect, the problem of market concentration and monopoly power has become especially severe.

An IPO used to be the way a new firm "came of age." But these days, a promising company often gets gobbled up by a larger, already established competitor instead.

Another critical thing to consider is the rise of private investment outside of the public stock markets.

Investment from venture capitalists, private equity, and all other private sources has doubled in the last decade, and now outpaces public investment. Venture capitalists alone committed $28.2 billion in new investments in the first quarter of 2018, and roughly $84 billion for all of 2017. By contrast, IPOs raised just $17 billion in the first three months of this year, and $50.9 billion in 2017.

A lot of new startups (especially in Silicon Valley) are just staying private a lot longer, well past the point in their development when they would have gone public in previous decades. An IPO requires a lot of paperwork, plus plenty of fees for bankers and consultants. Being publicly traded comes with much tougher disclosure rules. Meanwhile, other laws have made it easier to access private investment. It's not surprising to see more companies going that route.

But what does this all mean? Is it actually good that America is seeing fewer IPOs?

Some critics argue that fewer IPOs and fewer listed companies mean the investment world is less democratic; smaller public investors have fewer ways to diversify their portfolios. (Even with easier rules, regulations still largely limit private investment and capital ventures to the big boys.)

This would be a more compelling complaint if 70 percent of all American wealth wasn't owned by 10 percent of the population already. "Democracy" is an entirely relative term in the investment world, public or private. The public stock markets themselves have evolved into a mechanism for extracting wealth from companies rather than creating jobs. And these days, many IPOs function less as a way to invest in growth and more as a way to enrich a company's founders and early investors.

A more compelling analysis might concentrate on the rise of market concentration and inequality. The failure to properly enforce antitrust law allows more wealth and power to concentrate at the top. That in turn feeds the supply of private equity and the perpetual reliance upon it. This whole retreat to fewer, bigger companies — and to private investment with less disclosure and fewer participants — could well lead to less dynamism and growth in the economy overall.

All of which is to say: The demise of IPOs and publicly listed companies isn't necessarily a problem in and of itself. But it points to some larger trends in the U.S. economy that really should worry us.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.