How to make the Federal Reserve the people's bank

You should have an account with the Federal Reserve. Everyone should.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve is not exactly a beloved American institution. Polls suggest that as much as half of the population doesn't understand what the central bank does, or what it is. And even among those who do have some Fed familiarity, many see it as an arcane, elite institution, far removed from most Americans, yet wielding immense power over the economy.

Perhaps it's time to make some radical changes to the Fed — and turn it into a true people's bank. That's the proposal in a compelling new paper from The Great Democracy Initiative.

As is, the Federal Reserve is a bank for other banks. Just like your bank gives you a place to store your money, the Fed performs those same services for your bank. That means only banks and other major financial institutions can have an account at the Fed.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Why not let everyone have an account at the Fed?

This would transform the central bank into a kind of nonprofit public option for basic banking services. Imagine the Federal Reserve building out storefronts and ATMs in every neighborhood across the nation, offering a free account with no fees and a debit card to any person or business that wants one — and even paper checks for a small fee. Great Democracy dubs these, well, FedAccounts.

We can safely assume that at this point, the Fed does not have the customer service know-how to pull this off. But it certainly has the resources to figure it out. The Fed owns an enormous portfolio of assets, and funds its staff and operations from the returns, while remitting what's left to the Treasury. The Fed could just rechannel some of those remittances — which have run over $90 billion a year recently — into building out this national FedAccount infrastructure. (Before you start caterwauling about the folly of blowing all this dough on a new program, please note that Great Democracy predicts that offering Fed accounts for all would actually expand the Fed's portfolio and its returns.)

There's little risk here. Remember that the Fed creates all the money in our system. It literally isn't possible the Fed to overextend itself and collapse. It can always just print more money. As such, FedAccounts would be totally safe, and would never be at risk of a bank run or bankruptcy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The paper's authors — Morgan Ricks, John Crawford, and Lev Menand — argue that this would be a big source of macroeconomic stability. Right now, corporations and big financial firms trade in a lot of short-term debt that can go bad and cause crashes. FedAccounts would replace that debt with a totally safe instrument that's still liquid.

FedAccounts could also work wonders for the poor and working class.

Right now, tens of millions of Americans get by with no bank account whatsoever. They make too little money, and in too sporadic a way, to make them profitable customers for private banks. And the standard fees banks charge can also be too heavy a burden. This leaves predatory institutions like payday lenders as the only source of financial services for these Americans.

There are already proposals out there for the U.S. Postal Service to provide basic banking services to these Americans. But FedAccounts could accomplish essentially the same thing. Indeed, the Postal Service would need some banking institution to backstop these services, so the paper just suggests that the Fed and USPS provide these services as a joint effort. FedAccounts would be free and charge no fees. Ricks, Crawford, and Menand suggest the Fed stay away from actually extending anyone credit. But then the Postal Service side of this partnership could easily offer low-income Americans small-dollar loans at far better rates than they get from payday lenders and other financial predators.

FedAccounts could also revolutionize monetary policy. Right now, when the Fed wants to stimulate the economy or cool it off, it tries to raise or lower the interest rate that banks charge one another. Then it hopes those changes trickle out into the broader economy. It's an ungainly setup that often involves implicit subsidies to big finance.

But with FedAccounts for all, the central bank would have a direct channel to every American. If it wanted to juice aggregate demand, it could simply dump new money into everyone's FedAccount. This wouldn't be credit or a loan that would have to be paid back. It would be money creation and infusion into the economy, directly to Americans. If the Fed wanted to slow down aggregate demand, it could increase the interest rate it pays to people's FedAccounts, encouraging more saving everywhere. (The central bank already does this for the big banks it currently serves.) The Fed could even experiment more with negative interest rates on everyone's FedAccount if needed.

Admittedly, this would require a serious rethink of monetary policy strategy. Paying out a higher interest rate might encourage more saving. But for Americans short of cash, the extra money could itself become new spending. The point, though, is that monetary policy would finally be undertaken in a more egalitarian fashion, with the benefits and costs meted out to everyone equally.

The Federal Reserve is a creation of the government, meant to serve the public good. But its governance structure prioritizes the needs of big finance, tilting monetary policy to the preferences of Wall Street. Activists and reformers are already pushing for reforms that would democratize how the Federal Reserve is run.

We should democratize the services the Federal Reserve provides, too. Ricks, Crawford, and Menand may have shown us how.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

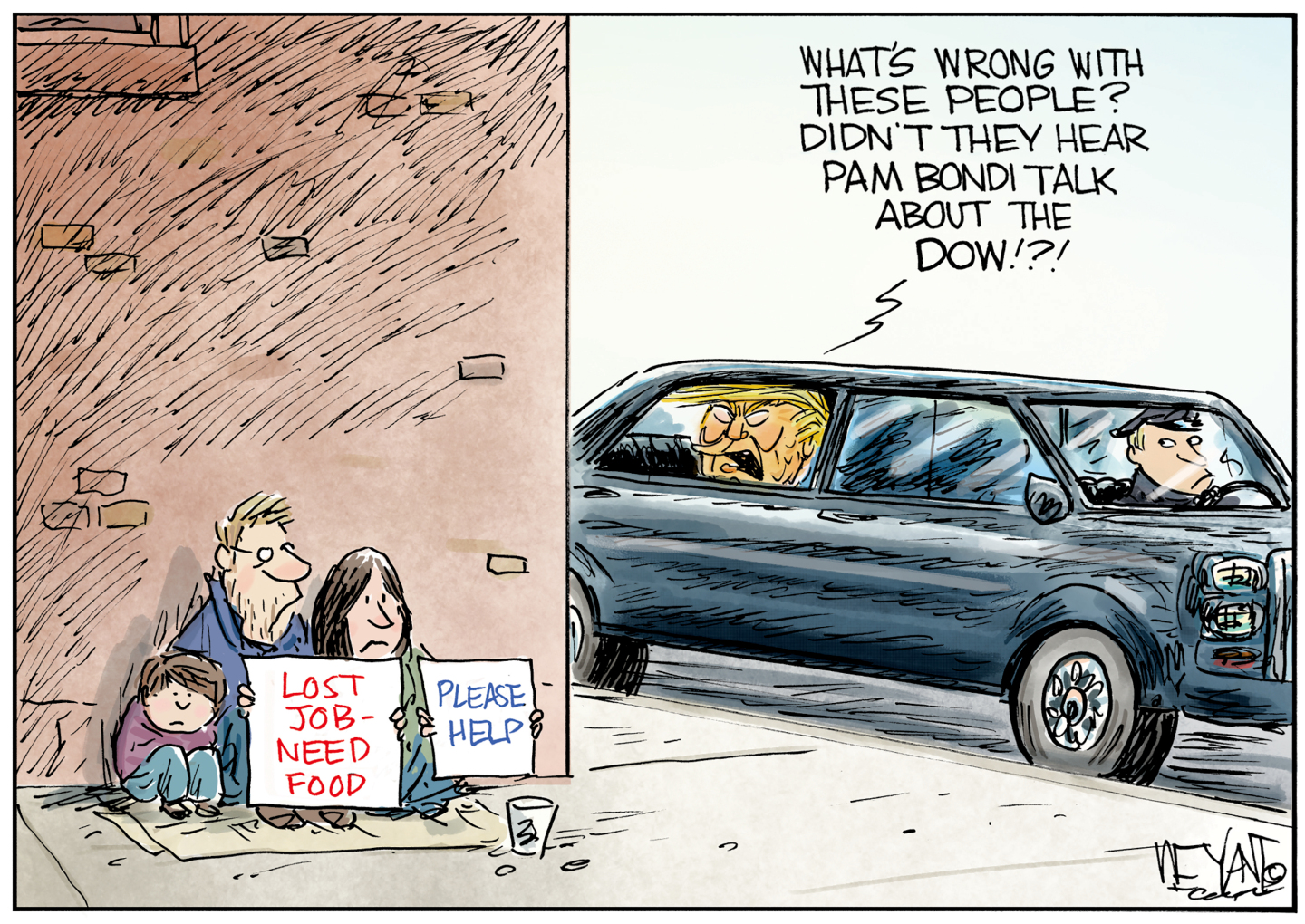

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred