How Democrats can raise taxes without technically raising taxes

Inflation indexing on income taxes has got to go

Earlier this month, the Trump administration scuttled an ill-fated proposal to index capital gains taxes to inflation. Income tax brackets have been indexed to inflation since the 1980s (meaning that as incomes gradually rise due to inflation, taxpayers aren't pushed into paying higher and higher tax rates), and the White House was considering extending that same benefit to people who pay capital gains taxes. It ultimately demurred.

But Democrats — or anyone, really — should take a hint from Trump's decision. It's not just that capital gains shouldn't be indexed to inflation; income taxes shouldn't be either.

Doing away with that indexing would raise plenty of new revenue for the government. But more fundamentally, it would fix a basic misunderstanding about good macroeconomic policy.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The U.S. income tax has several brackets, each with its own tax rate. For a married household, income up to $19,400 is taxed at 10 percent; from $19,401 to $78,950 is taxed at 12 percent; and so forth. This continues through seven brackets, the top of which applies a rate of 37 percent to all income over $612,350. Thus, if you make $70,000 a year, you'll pay 10 percent on the first $19,400, and 12 percent on the remaining $50,600.

But that's just the tax structure for 2019, which you'll pay in April of 2020. When you pay taxes in 2021, the rates will be the same, but the income thresholds — where each bracket ends and the next one begins — will have risen. That's inflation indexing at work.

The Economic Recovery Tax Act of 1981, passed under President Reagan, was primarily a massive tax cut. But it also introduced inflation indexing into the tax code. Before that, the cutoff for each tax bracket would remain the same year after year until Congress explicitly changed it. Thanks to the Economic Recovery Tax Act, those brackets have automatically adjusted with inflation every year since 1985.

Congress should go back to the old, pre-1985 way of doing business. Doing so would have two advantages.

First off, it would bring in a lot of new tax revenue without having to do the politically unpopular thing of actually hiking rates. President Trump and the Republicans did a small-ball version of this reform in their 2017 tax cut law. They didn't end inflation indexing, but they did change the measure of inflation in the tax code to a new version that tends to rise more slowly — thus, the tax bracket thresholds will rise more slowly in the future as well.

According to one estimate, that change will net the government an extra $134 billion in tax revenue over the next 10 years. Now, the old measure of inflation recorded a 45.7 percent rise in the price level between 2000 and 2017, and the new measure introduced by Trump's tax cut law recorded a 39.7 percent rise over that same time period. That's not a huge difference. Thus, while an exact figure is beyond my abilities to calculate, the revenue brought in over a decade by simply getting rid of inflation indexing entirely should be several times that $134 billion haul.

But there's also a much more fundamental point to be made here, about how policymakers should manage the economy, and taxes' role in doing so.

The argument in favor of indexing is that it eliminates "bracket creep." That's when more of a taxpayers' income gets pushed into a higher bracket each year simply due to inflation, and not because of any underlying real increase in the money they take home.

Plenty of economists and experts argue bracket creep damages the economy: By shoving people into higher tax rates, even though their pay hasn't increased, bracket creep discourages economic activity and slows down growth. Furthermore, America endured a brutal run of inflation during the 1970s. By 1980, the annual rate of price increase had briefly topped 13 percent, according to the traditional measure of inflation. As you can imagine, lots of people were attracted to the idea of neutralizing bracket creep.

Here's the problem with that logic: If your economy is experiencing high inflation, like what we went through in 1980, then it needs to slow down. Mainstream macroeconomics assumes that high inflation is evidence of an overheating economy: too much demand chasing too little supply. In which case, to cool inflation off, money needs to be taken out of the economy. And taxes are one tool for doing just that.

In other words, a system of income tax brackets that isn't indexed to inflation would act as a kind of natural thermostat for an overheating economy. As inflation rates rise, bracket creep would shove more people into higher rates more quickly. As a result, the same set of tax brackets and rates would take more money out of the economy than it did before, and help to cool the economy off and bring inflation back down. Bracket creep is a feature, not a bug.

By contrast, brackets that are indexed to rise with the price level are essentially pro-inflation. As the inflation rate increases, the rate at which the bracket thresholds rise increases as well. That's a fiscal stimulus added to the economy right when it's already running too hot. In fact, Russel Long, a Democratic senator from Louisiana at the time, made this exact point, arguing indexing would "make inflation worse by pumping more money into circulation at a time inflation is at its worst."

There are, of course, other ways to remove money from the economy when it overheats. Over the last few decades, we've primarily relied on the Federal Reserve to do that, through interest rate hikes. But the social and human costs of interest rate hikes fall disproportionately on the poor, the uneducated, and minorities, through lower employment rates and lower wage growth. Bracket creep hits people at all income levels, and thus its pain can be spread a lot more evenly across the whole population. This would be even more true if Congress went back to having 30 or so tax brackets, as opposed to the current seven.

For the sake of the government's coffers, for the sake of better macroeconomic management, and for the sake of economic justice, inflation indexing for the income tax should go.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

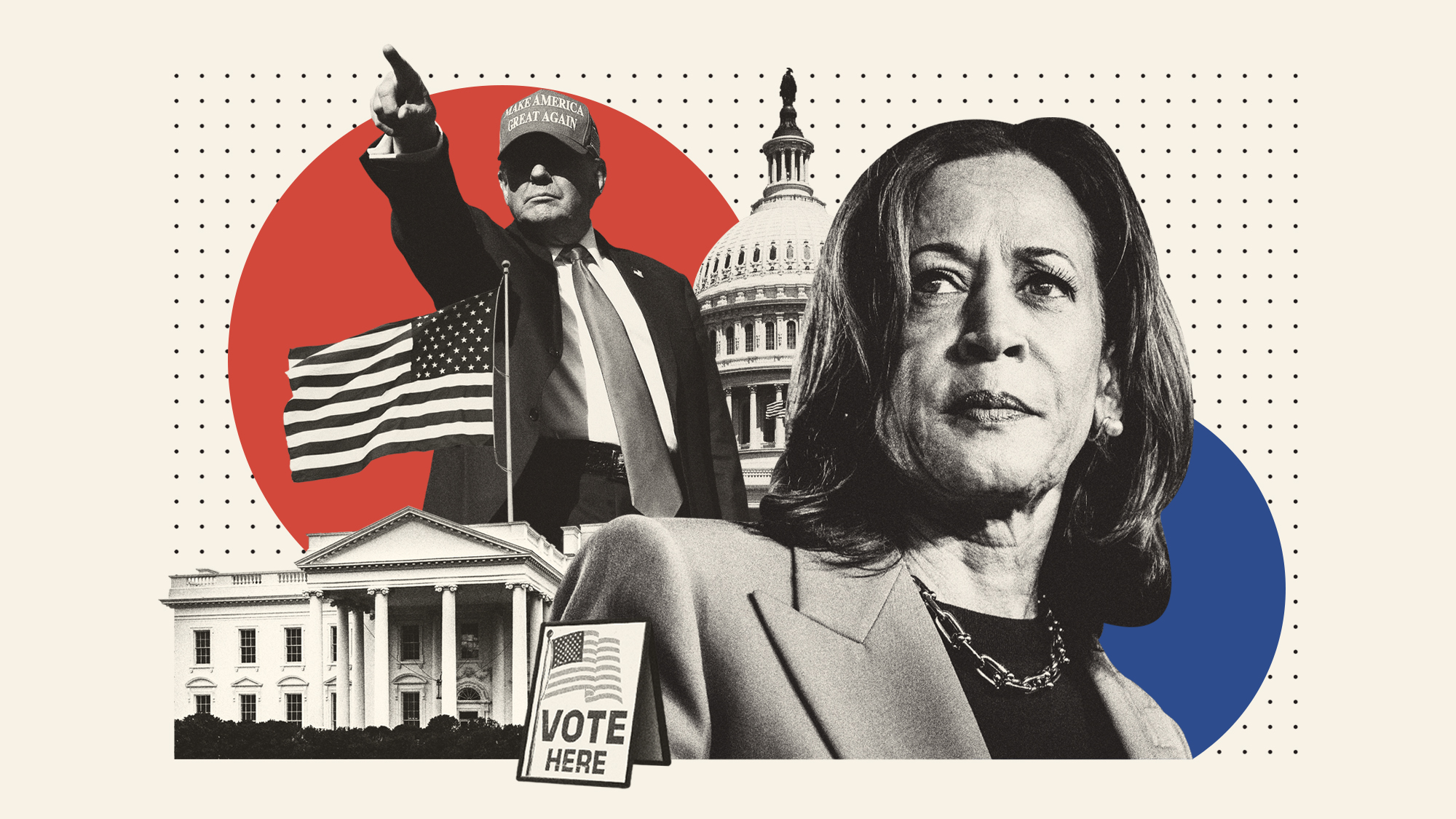

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?