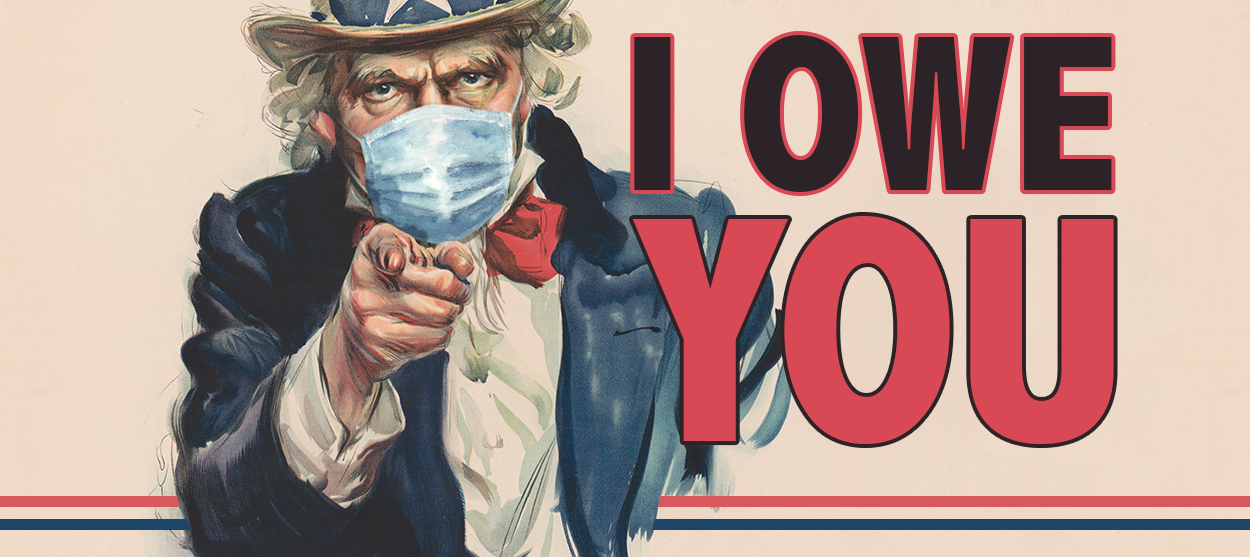

There is no reason to worry about the national debt right now

Get ready for a bunch of baseless fear-mongering about the cost of the coronavirus response

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The United States government is borrowing big time. The novel coronavirus pandemic has thrown tens of millions out of work and cratered tax revenue, while Congress passed a gigantic economic rescue package that was about twice as large as President Obama's Recovery Act, with more to come. The national debt — which had already risen sharply in recent years thanks to President Trump's tax cuts — is soaring.

As a result, we are already seeing the beginning of an austerity narrative in the elite media. Even in the pit of the worst economic crisis since the 1930s, reporters like Carl Hulse and Peter Baker at the The New York Times, and David J. Lynch of the The Washington Post, are starting to wring their hands over the debt.

These voices will probably remain muted for as long as the emergency holds. But if and when recovery starts, they will get much louder — especially if Joe Biden wins the presidential election in November, because Republicans will pivot instantly from their current free-spending ways to demanding austerity to harm him politically. It is critical to strangle this line of thinking before it can take hold.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The austerity narrative does not rely on an argument so much as free-floating neurosis. By this view, debt is bad by definition, and must eventually be paid back. The "bill will come due, as it always does," writes Hulse. "U.S. leaders will need to find an exit from the extraordinary levels of government borrowing," writes Lynch, and that means building support for a "blend of tax increases and spending cuts needed to shrink the mammoth post-crisis debt[.]"

This is wrong on multiple levels. First, sovereign debt does not need to be paid back — it can and typically is simply rolled over indefinitely. Unlike a household, the American state is immortal, has the best credit of any institution on the planet, and borrows in the world's reserve currency which it can print at will. Lynch anxiously worries about the U.S. publicly-held debt-to-GDP ratio reaching 106 percent — which the Committee for a Responsible Federal Budget, an organization that exists solely to promote austerity, projects will happen in the aftermath of coronavirus — but this is not the first time the U.S. has been in such a position. At the height of the Second World War the ratio also exceeded 100 percent, yet no "tipping point" was reached.

Second, as John Maynard Keynes wrote in The General Theory of Employment, Interest, and Money, so long as the economy is short of full employment, there is no limit to the amount America can borrow. The mechanism by which too much borrowing theoretically harms the economy is through a spiral of rising inflation and interest rates. Nothing like this has happened since the early 1980s, and it was not caused by over-borrowing in that case anyway. Today, even before the crisis started, we were not close to a full-employment, inflationary economy, as evidenced by rock-solid prices for the last 12 years straight. But the "Great Lockdown" economic crash caused by the coronavirus pandemic means there are suddenly millions more unemployed workers and enormous idle productive capacity, which has knocked inflation and interest rates flat on their backs. Until all workers are employed and all factories are working at full capacity, there cannot be an inflationary spiral.

It follows that the major danger regarding debt at this moment is not borrowing too much, but borrowing too little. As my colleague Jeff Spross points out, if we don't do enough to rescue the economy, we will be stuck in the same mass employment/low growth sandpit we were trapped in for years after the Great Recession. We have spent over a decade learning at brutal cost why austerity is wretched policy, but debt scaremongers have apparently learned nothing from the last 12 years of economic history. Indeed, a 2012 study by economists Brad DeLong and Larry Summers demonstrated that even by the terms of the austerians, borrowing during a depression can literally pay for itself by preventing damage to the economy and thereby boosting future tax revenue.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

All this is not to say that there are no legitimate reasons to oppose an enormous national debt. As economist Thomas Piketty points out in his book Capital and Ideology, one negative is that most debt is held by the rich, and any interest payments on it are therefore a subsidy for the wealthy. After the Napoleonic Wars, for instance, the U.K. paid down most of its enormous resulting debt by spending 2-3 percent of national income on debt service (about a third of tax revenue, or 2-3 times as much as it spent on education) for an entire century — and thus kept a class of upper-class parasites in country estates for three generations.

That is a minor concern for the medium term in America. The debt being issued right now is at near-zero interest rates, and much of it in any case is being bought by the Federal Reserve (meaning much of this "borrowing" is really being financed by printing money). Interest payments to the Fed are no worry at all, because it remits all its profits back to the Treasury Department. But if we were to reach full employment and interest rates begin to rise, that might lead to annoying and unfair interest costs.

Debt scolds simply assert that the only way to deal with this is through austerity, because by their cramped worldview "responsible" policymaking is all about inflicting pain on the population. Citizens must be forced to drink their tough medicine — that is, accept tax hikes and cuts to Social Security and Medicare. But as Piketty argues, the smart way to deal with a potentially burdensome debt is not by austerity, but through a wealth tax. Treasury bonds are assets, and they would be included in any wealth tax. The government could effectively cancel its debt down to a manageable level if need be.

Still, that is a tenth-order worry at best right now. If we end up in a position to worry about interest payments, that will be exceptionally good news. It will mean we somehow got back to full employment and full production. But if we let the austerians once more seize control of the budget policy narrative, as they did from 2010-2013, we will never get there.

CORRECTION: An earlier version of this article said wrongly that the Committee for a Responsible Federal Budget had miscited the previous debt record. The CRFB's calculation referred to debt held by the public, not total debt. We regret the error.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred