The daily business briefing: March 30, 2022

The Biden administration prepares tougher fuel economy standards, the FTC accuses Intuit of misleading TurboTax customers, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Biden administration to impose tougher fuel economy standards

The Biden administration plans to announce tougher vehicle fuel economy standards, reversing former President Donald Trump's rolling back of mileage requirements tightened by the Obama administration, Reuters reported Tuesday, citing federal officials. Transportation Secretary Pete Buttigieg and National Highway Traffic Safety Administration (NHTSA) Deputy Administrator Steven Cliff are expected to unveil the administration's plans in a "major announcement" on Friday, the Transportation Department said. The NHTSA in August proposed raising Corporate Average Fuel Economy requirements by 8 percent a year for 2024 through 2026 vehicle models, which would increase the fleetwide mileage average by 12 miles per gallon in 2026 compared to 2021, and reduce fuel costs by $140 billion for new vehicles sold by 2030.

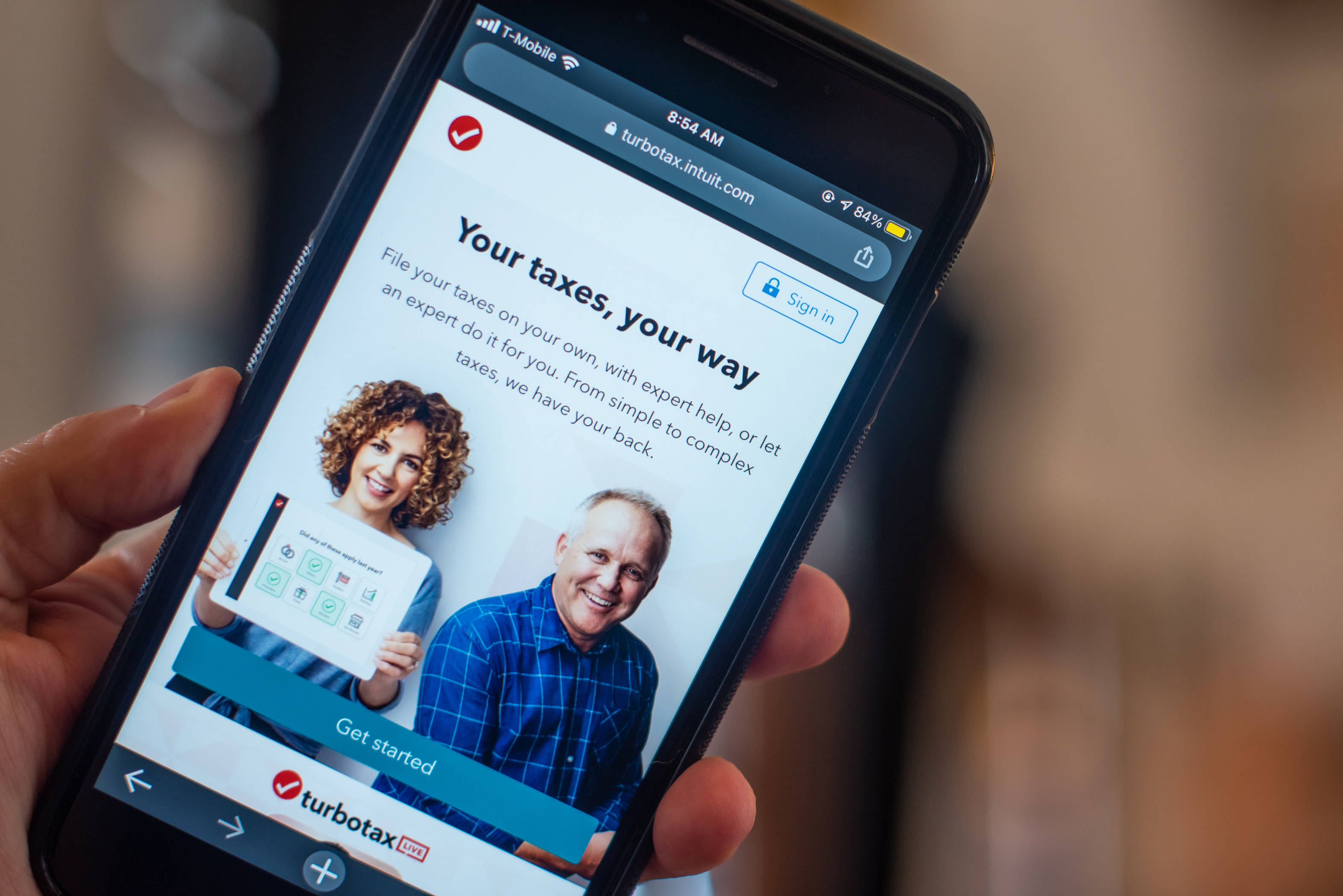

2. Regulator accuses TurboTax maker Intuit of misleading consumers

The Federal Trade Commission is suing TurboTax maker Intuit, accusing it of misleading consumers with ads promising "free" tax filing even though millions wind up being ineligible for the no-charge software option. "TurboTax is bombarding consumers with ads for 'free' tax filing services, and then hitting them with charges when it's time to file," said Samuel Levine, director of the Bureau of Consumer Protection, in a statement. "We are asking a court to immediately halt this bait-and-switch." The consumer protection agency said about two-thirds of tax filers in 2020 were ineligible for various reasons, including being gig workers or having farm income. Intuit said it would fight the suit, saying its ads resulted in "more Americans filing their taxes for free than ever before."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Job openings remained near record highs last month

Job openings hovered near record highs at 11.3 million last month as the number of people quitting their jobs remained little changed at 4.4 million, the Labor Department reported Tuesday. The number was roughly the same as in January, and down slightly from December's record. Hires edged up to 6.7 million, an increase of 263,000 over the previous month. After dropping at the height of COVID-19 lockdowns two years ago, the rates at which prime-age workers aged 25 to 54 who are working or seeking jobs have bounced back to pre-pandemic levels, although economic growth is so strong that there aren't enough workers to meet demand. About three million people have not yet returned to the workforce. Some economists say companies need to lure workers back by offering better pay and benefits.

The New York Times Bureau of Labor Statistics

4. Stock futures fall after 4-day winning streak

U.S. stock futures fell early Wednesday after rising for a fourth straight day on Tuesday. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down by 0.3 percent and 0.4 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were down 0.6 percent. The Dow and the S&P 500 rose 1 percent and 1.2 percent, respectively, on Tuesday. The tech-heavy Nasdaq jumped 1.8 percent, returning to within 10 percent of its record high as Wall Street rebounded from losses fueled by Russia's invasion of Ukraine. "The market's now up almost 10 percent in the last 10 days, so we've had a pretty incredible rally in a very short time," Stephanie Lang, chief investment officer at Homrich Berg, told CNBC. Lang warned, however, that stocks could remain volatile through 2022.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Poll: Anxiety about inflation highest since 1985

Americans' level of concern about inflation is at its highest point since 1985, a Gallup poll released Tuesday found. Seventeen percent of respondents said "high cost of living/inflation" was the most important problem currently facing the United States, up from 8 percent in January. An additional 15 percent said the biggest problem was either "fuel/oil prices" or the "economy in general." Fifty-nine percent said they worry "a great deal" about inflation, including 79 percent of Republicans, 25 percent of Democrats, and 63 percent of independents. Data from the Bureau of Labor Statistics show that consumer prices increased by 7.9 percent between Feb. 2021 and Feb. 2022, the biggest one-year jump since 1982.

Gallup Bureau of Labor Statistics

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low