The daily business briefing: March 24, 2023

House lawmakers grill TikTok's CEO over alleged security threat, House Republicans fail to override Biden's veto preserving ESG rule, and more

- 1. House committee grills TikTok CEO over alleged security threat

- 2. House GOP fails to override Biden's veto preserving ESG rule

- 3. Ford says EV division losing billions like any 'startup'

- 4. Block shares fall as short seller questions user numbers

- 5. Stock futures dip as Deutsche Bank troubles renew financial concerns

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. House committee grills TikTok CEO over alleged security threat

House lawmakers on the Energy and Commerce Committee on Thursday grilled TikTok CEO Shou Zi Chew about concerns China could use the popular video-sharing app to gather data on users and spread misinformation, posing a security threat. "To the American people watching today, hear this: TikTok is a weapon by the Chinese Communist Party to spy on you and manipulate what you see and exploit for future generations," said Committee Chair Cathy McMorris Rodgers (R-Wash). Chew said TikTok is "free from any manipulation from any government." Days earlier, the White House said TikTok's China-based parent, ByteDance, would have to sell its stake in TikTok's U.S. operations or face punishment, possibly including a ban.

2. House GOP fails to override Biden's veto preserving ESG rule

House Republicans tried Thursday to override President Biden's first veto but fell short. The GOP-led House voted 219-200 in favor of overcoming Biden's veto of a resolution seeking to retract a Biden administration rule allowing retirement fund managers to take into account environmental, social, and governance (ESG) factors when selecting investments. Overriding the veto would take a two-thirds majority in the House and Senate. Critics call ESG "woke capitalism," and argue it is bad for investors and unfair to some companies, including oil giants. Supporters argue it gives fund managers the option of investing in companies that are taking stands on important issues that help society and can pay off down the road.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Ford says EV division losing billions like any 'startup'

Ford Motor said Thursday its electric-vehicle division would lose about $3 billion this year. The carmaker said the EV operations, called Ford Model e, lost $2.1 billion last year. Ford released the figures as it provided details on a new financial reporting structure that will divide its data into three categories — Ford Model e, Ford Blue traditional vehicles, and Ford Pro commercial vehicles — instead of reporting profit and loss by region, as it did previously. CFO John Lawler dismissed concerns about the EV losses. "After 120 years, we've essentially refounded Ford," he said. "Startups lose money as they invest in capability, develop knowledge, build volume and gain share."

4. Block shares fall as short seller questions user numbers

Block shares plunged on Thursday after short-seller Hindenburg Research said Jack Dorsey's payments company, formerly known as Square, "obfuscates" its Cash App user numbers. Hindenburg said a two-year investigation revealed that the company reported data "filled with fake and duplicate accounts." Hindenburg also said Block imposes "predatory loans and fees" on lower-income people and minorities it claims to serve. Block said the Hindenburg report was "factually inaccurate and misleading." Block shares closed down about 15 percent, wiping out $6.5 billion in market value, after falling as much as 22 percent.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures dip as Deutsche Bank troubles renew financial concerns

Stock futures fell early Friday after a spike in the cost of insuring against a default by Deutsche Bank fueled fresh concerns about the health of the global banking system. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 1.0 percent and 0.8 percent at 6:45 a.m. ET. Nasdaq futures were down 0.5 percent. Germany's Deutsche Bank shares fell 13 percent in pre-market trading after its credit-default swaps spiked, stoking anxiety after Swiss regulators forced a UBS acquisition of rival Credit Suisse following the collapse of U.S.-based Silicon Valley Bank. The turmoil put big U.S. banks under pressure, dragging down shares of Bank of America, Wells Fargo, JPMorgan Chase, and Citigroup.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

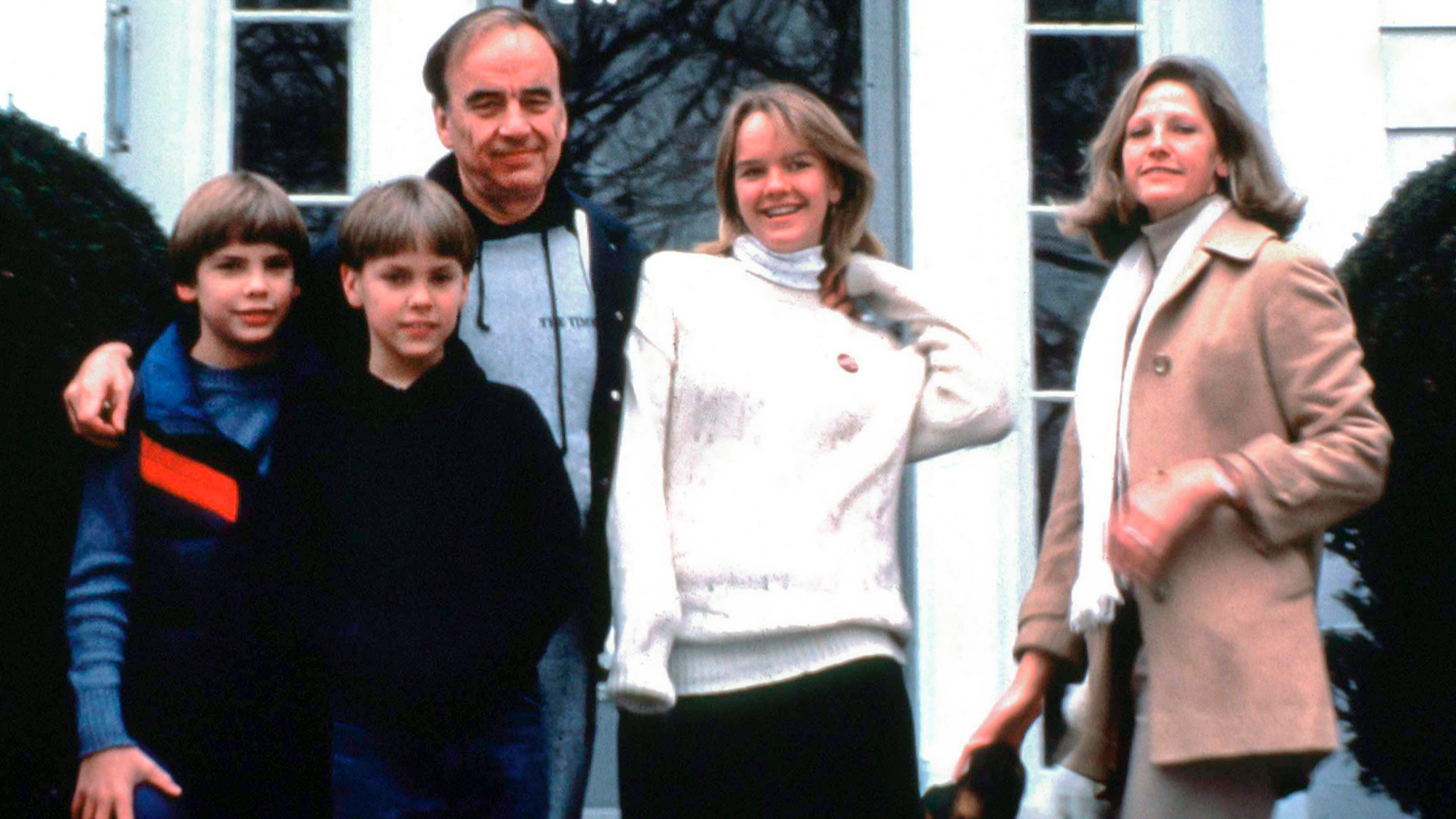

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

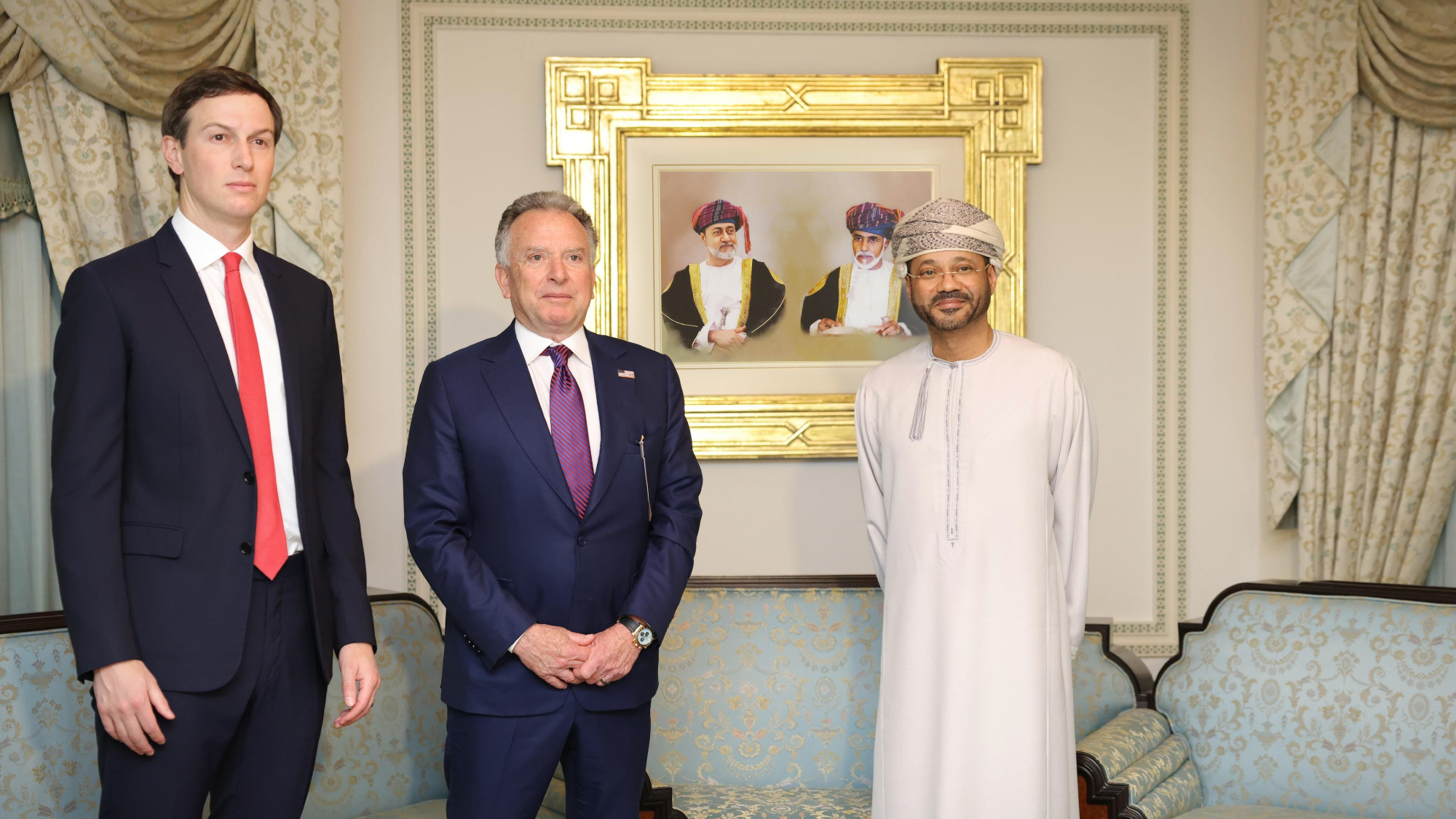

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more