Budget 2016: 'We should all be worried', warns IFS

Leading think-tank criticises economic policies that will 'lower wages and living standards'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Budget 2016: £4bn of cuts, but Osborne to confirm big infrastructure spend

15 March

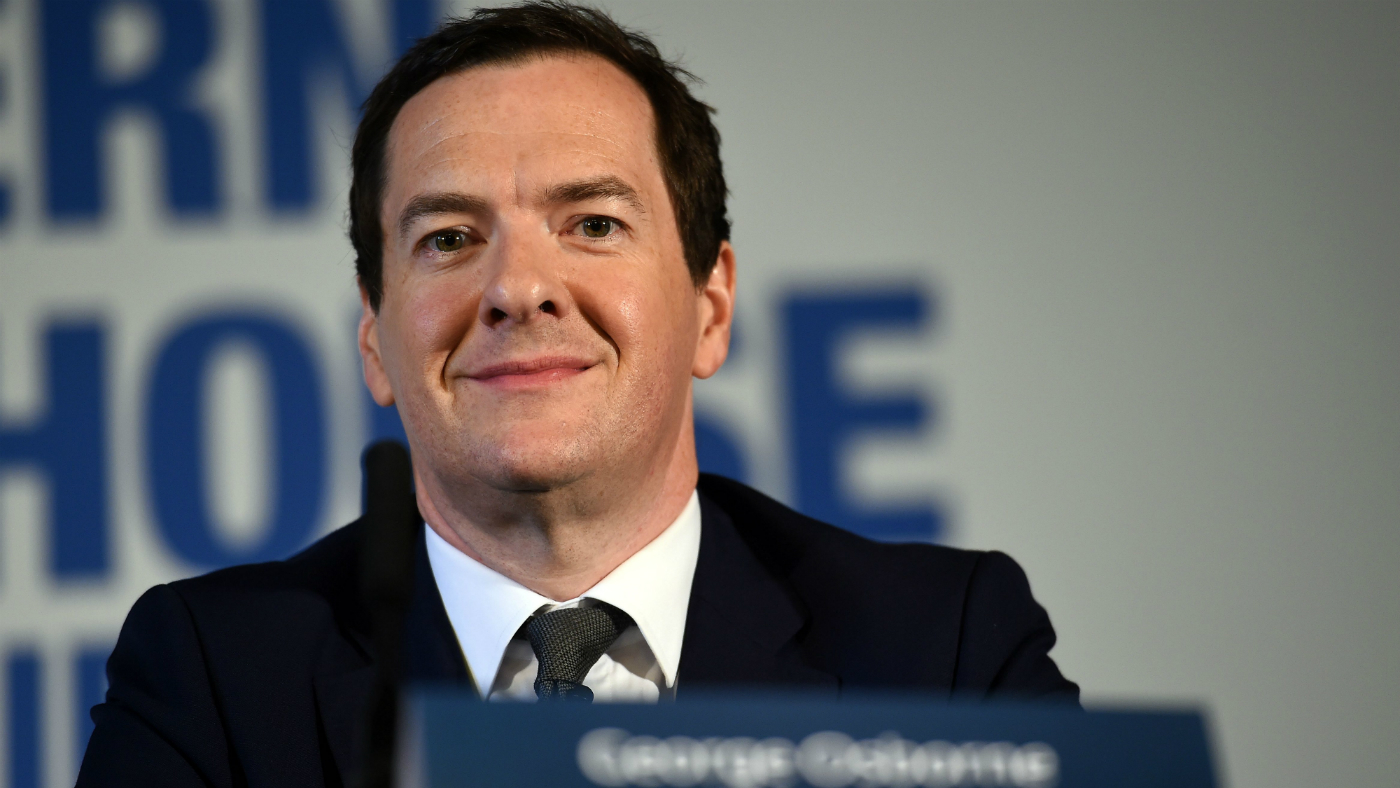

Later this week, Chancellor George Osborne delivers his latest set-piece fiscal policy review in the form of his first regular Budget under the majority Conservative government. So what can we expect?

When is it?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Tomorrow, 16 March. As usual, Osborne (pictured above) will stand at the dispatch box at around 12.30pm, following the conclusion of Prime Minister's Questions.

What is the economic context?

Much less positive than it was when the Chancellor delivered his two Budgets last March and July, or his Autumn Statement at the end of November. Growth was, at that time, forecast by the Office for Budget Responsibility at 2.4 per cent for this year, but the Daily Telegraph predicts this is likely to be reduced in line with the likes of the Bank of England to around 2.2 per cent.

This would still make the UK one of the best performing developed economies this year, but would hit tax receipts from businesses and individuals and so squeeze the public purse.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What will this mean?

Osborne has set himself a mandate to move the public finances into the black within five years, so he may have to take more remedial action to keep plans back on course. Borrowing is already above the target he set for this point in the year and unless the total deficit for February and March halves compared to last year, he'll miss his full-year forecast by perhaps £5bn or more.

The Times estimates the "black hole" in the economy from lower growth is £18bn, which will need to be filled if Osborne is to stick to his legally enshrined targets.

How might this be made up?

Some easy revenue-raisers are in the firing line, according to Sky News, including petrol duty, which has been frozen for four years, and taxes on alcohol. The sharp slump in oil prices means levies on petrol could now be increased without too much impact on consumers' pockets.

The Guardian also predicts an increase in the "stealth tax" on insurance premiums introduced last year, while The Sunday Times forecasts as much as £6bn could be raised through an increase in the tax on bank profits and a one-off £16bn through the sale of the taxpayer-owned loan book of the defunct Bradford & Bingley.

There could additionally be another tax avoidance clampdown, says Sky News, in the form of the closing of a loophole allowing celebrities and others to be paid indirectly through "personal service companies" and earn their income through "dividends" that are taxed at much lower rates.

What about spending cuts?

Osborne has admitted he might have to impose further austerity measures just four months after he eased spending cuts at a more optimistic Autumn Statement. He told the BBC's Andrew Marr Show on Sunday that he could look to cut as much as 50p in every £100 the government spends, which would equate to around £4bn a year.

This could mean more painful reductions in the budgets of non-protected government departments – and the government has already announced it is reforming the personal independence payments to disabled people. Essentially, the budget will go up by less than originally planned – around £1.2bn – and campaigners reckon as many as 600,000 people could get less money.

Might Osborne pull a rabbit from the hat again?

There were similar predictions that borrowing figures would not meet targets back at the Autumn Statement but in the event, Osborne announced much more benign numbers that allowed him to actually soften his austerity measures. He might do so again, as government bond interest rates are still falling amid market turmoil and the costs of servicing debt could be as much as £5bn a year lower.

There are also predictions of a big boost in income in January and February from stamp duty on property sales as buy-to-let investors rush to beat a tax hike coming in April.

The Times also cites comments from one economist that new cuts might be announced but could be "uncosted", meaning they would not actually hit any budgets yet and could be unwound in the event the economy improves. Martin Beck, an adviser to Ernst & Young Item Club, said we should "take talk of spending cuts several years in the future with a pinch of salt".

What do the Chancellor's critics say?

Labour is adamant it is on the right side of the economists' arguments in calling for an increase in spending on infrastructure rather than more cuts. It says low borrowing rates are an opportunity and announced its own "fiscal credibility rule" last week, guaranteeing a future Labour government would balance the day-to-day budget while probably borrowing more to invest.

Osborne is trying to head off this criticism by pledging a £380m down-payment on big railway projects, including the HS3 line between Leeds and Manchester, which could ultimately cost up to £5bn, and the Crossrail 2 project in London that will come in at £28bn. It's all part of the funding earmarked for the National Infrastructure Commission announced at the Autumn Statement last year.

What about another pensions revolution?

There has been talk of another major reform of pensions that could raise taxes in the short term and save as much as £4bn a year in the long run. But Osborne abandoned this to avoid a Conservative rebellion on what would amount to a major removal of savings incentives for middle class earners, many of whom would effectively have been "double-taxed" on their retirement pot.

Can we expect another giveaway, then?

It's unlikely to be a budget of big giveaways, but Osborne will want some positive surprises and loves the political theatre of a populist move to round off his announcemenbts. He has hinted he could move to deliver on manifesto pledges of tax cuts for the lowest paid by raising the personal allowance – and for the middle classes, by raising the higher-rate 40 per cent band, which is catching more people every year.

We've already had the news that people on working tax credits and universal credit are to be given an incentive of as much as £1,200 to help them put aside money in savings, while there could also be incentives introduced for those who sell goods online to boost their income.

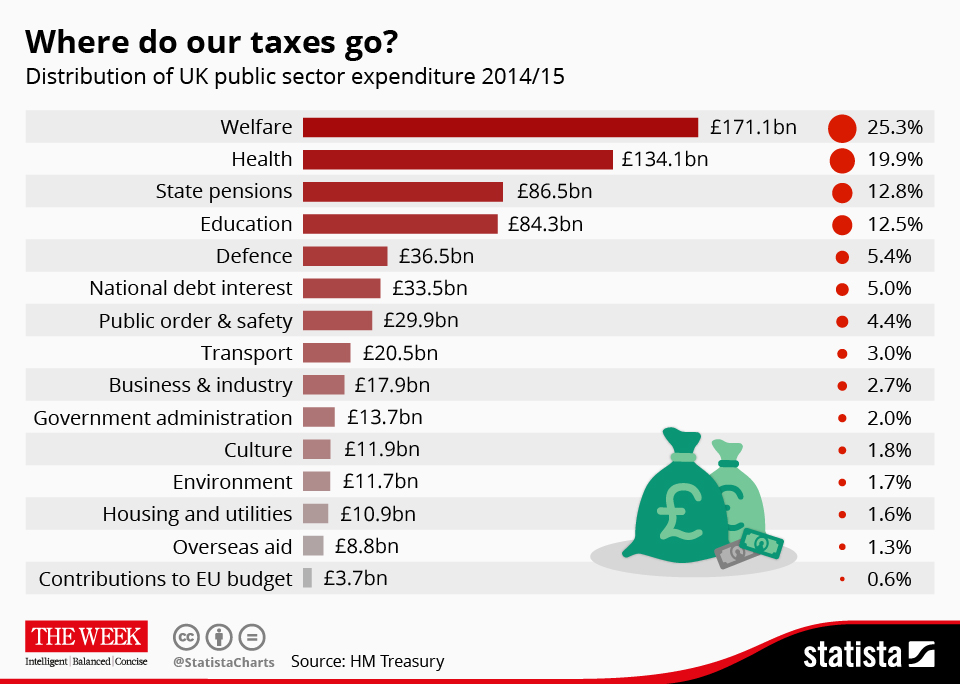

Infographic by www.statista.com for TheWeek.co.uk

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

Do Tory tax cuts herald return of austerity?

Do Tory tax cuts herald return of austerity?Today's Big Question Chancellor U-turns on scrapping top rate tax but urges ministers to make public spending cuts

-

What is the Northern Powerhouse?

What is the Northern Powerhouse?In Depth George Osborne’s think tank was designed to devolve power and boost the North’s economic output

-

Hammond to announce departure from Osborne policies

Hammond to announce departure from Osborne policiesSpeed Read Chancellor to tell Tory conference 'we must change with the times' in move away from predecessor

-

Budget 2016: is George Osborne about to make more cuts?

Budget 2016: is George Osborne about to make more cuts?In Depth Chancellor hints at further austerity measures during interview at G20 meeting in China

-

Budget 2016: Osborne in line for another £20bn+ windfall

Budget 2016: Osborne in line for another £20bn+ windfallSpeed Read Lower debt servicing costs could offset weaker tax revenues as a result of market turmoil

-

UK growth to surge in spite of global turmoil

UK growth to surge in spite of global turmoilSpeed Read Consumer spending will help country remain insulated from global trade headwinds, says forecaster

-

Osborne makes fresh case for austerity in warning over 'cocktail' of risks

Osborne makes fresh case for austerity in warning over 'cocktail' of risksSpeed Read World Bank also sounds alarm over "perfect storm" of worldwide economic problems.

-

Autumn Statement 2015: McDonnell offers advice to 'comrade Osborne'

Autumn Statement 2015: McDonnell offers advice to 'comrade Osborne'Speed Read Shadow chancellor has a 'Chairman Mao moment' in his response