The daily business briefing: January 9, 2020

Tesla's stock surges to lift its market value above GM's and Ford's combined, Ghosn lashes out at Japan's justice system, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Tesla stock gains, lifting market cap above GM and Ford combined

Tesla's stock surged by nearly 5 percent on Wednesday, lifting its market value above the combined values of General Motors and Ford for the first time and making the electric-car maker the most valuable automobile company in U.S. history. Tesla shares hit a record high that brought the company's market capitalization to $88 billion. GM and Ford have values of $49 billion and $37 billion, respectively. Tesla has been gaining thanks to an unexpected third-quarter profit, better-than-expected fourth-quarter deliveries, and the deliveries of the first vehicles from its new factory in China. Still, some analysts remain skeptical of Tesla's ability to make consistent profit.

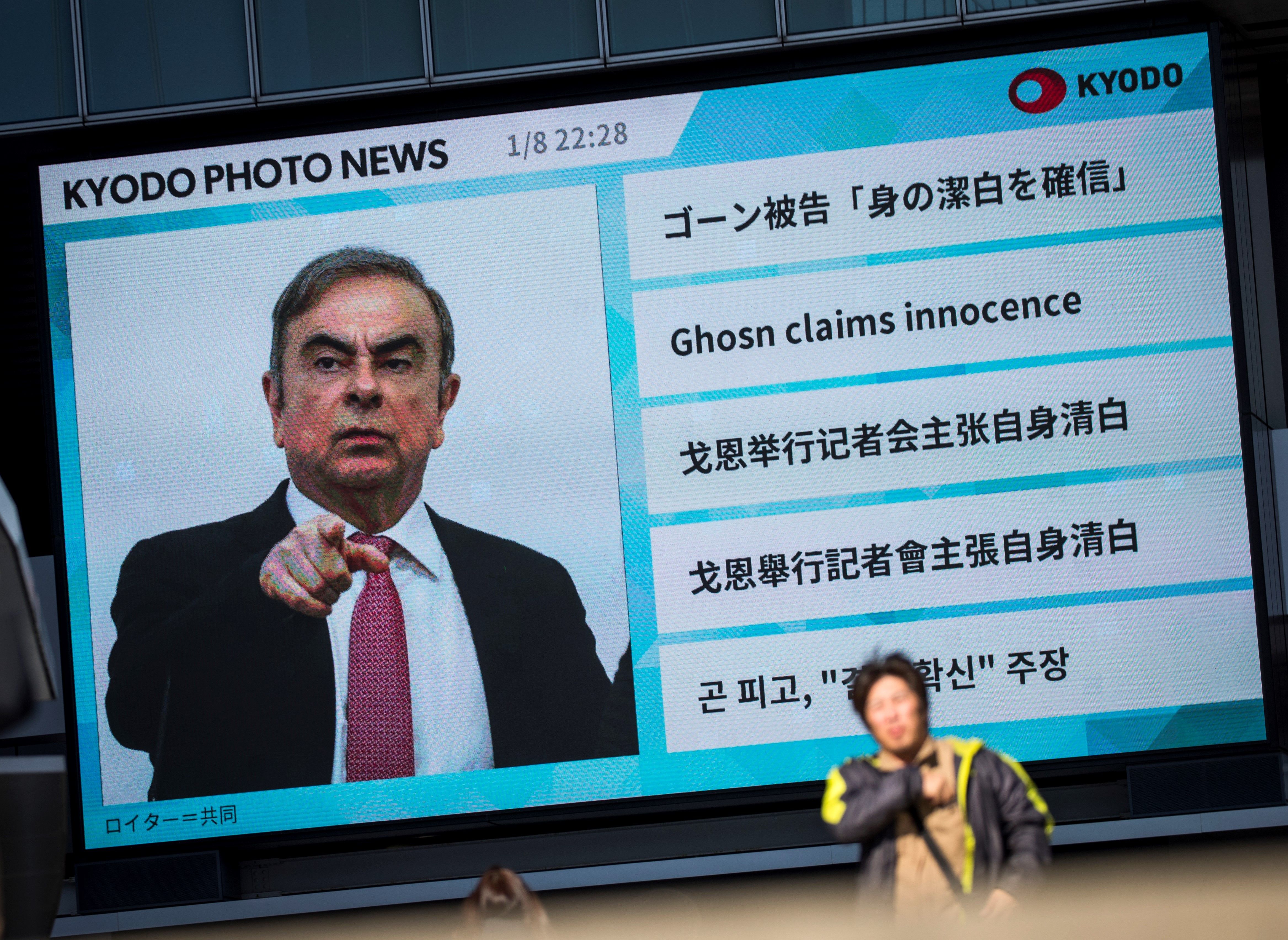

2. Ghosn slams Japan justice system after fleeing house arrest

Former Nissan chair Carlos Ghosn defended himself Wednesday in his first public appearance since escaping from house arrest in Japan and fleeing to Lebanon, where he holds citizenship. Ghosn, who was arrested multiple times in Japan starting in November 2018 on charges of financial misconduct, described the Japanese justice system as "inhumane" and "anachronistic." He spent 130 days in Japanese prison before being placed under house arrest. He said he was only allowed outside of his cell for 30 minutes every day, and was given the chance to shower just twice a week. He also recalled being interrogated for up to eight hours every day with no lawyer present, alleging there are tapes of his prosecutor telling him his situation would worsen if he didn't confess.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. 10 million more Takata airbags recalled

Defunct auto parts company Takata is recalling another 10 million airbag inflators because of the danger they could explode, The National Highway Safety Administration said Wednesday. The recall, which affects vehicles supplied to 14 automakers, could be the last big part of the largest safety recall in auto industry history. Takata agreed to recall tens of millions of defective inflators under a 2015 settlement. At least 24 deaths and 300 injuries were linked to the defect, which involved inflators using a propellant that can explode in a crash, blasting metal shards at vehicle occupants. The parts included in the latest recall were installed in previous repairs but shared the same key flaw as the old inflators.

Car and Driver The Associated Press

4. HP reiterates rejection of Xerox takeover bid

HP Inc. sent Xerox Holdings Corp. a letter on Wednesday repeating its rejection of a takeover offer, saying that "Xerox's proposal significantly undervalues HP." "We reiterate that the HP Board of Directors' focus is on driving sustainable long-term value for HP shareholders," HP CEO Enrique Lores and Chairman Chip Bergh wrote in the letter. Xerox launched its bid to buy HP in November, but HP's board rejected the offer. Xerox later tried to step up the pressure on HP's board by appealing for shareholders' support, then announced earlier this week that it had secured $33 billion in funding for a takeover attempt. Activist investor Carl Icahn, who sits on Xerox's board and owns stakes in both companies, backs the proposal.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures rise after Trump says Iran 'standing down'

U.S. stock index futures gained early Thursday as markets remained focused on an apparent easing of U.S.-Iran tensions. Futures for the Dow Jones Industrial Average, the S&P 500, and the Nasdaq all were up by 0.3 percent or more several hours before the opening bell. All three of the main U.S. indexes shook off early losses on Wednesday to close with gains of 0.5 percent or more after President Trump said Tehran appeared to be "standing down" after firing a barrage of missiles at Iraqi military bases housing U.S. troops in retaliation for the U.S. drone strike that killed Iranian Gen. Qassem Soleimani in Baghdad. Global stocks also bounced back, with Asian markets surging to their best day in weeks and European stocks gaining to lift a key global stock index near a record high.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.