France and Britain find unity in banker-bashing

But there's no sign of the US following suit, despite polls showing anger at bank execs

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

France is set to follow Britain's lead in levying a 50 per cent tax on bankers' bonuses over €27,000. Chancellor Angela Merkel has also voiced her support for the measures, though it appears German bankers are likely to forestall any action by reforming rules on pay and bonuses themselves.

But crucially, neither the US nor Switzerland are showing any inclination to follow suit. The Swiss federal finance ministrycleverly ducked the issue, saying taxation in the decentralised country was largely up to Switzerland's 26 cantons.

In the US, talk of pay reform has died down after the initial anger at AIG and Goldman pay-outs. With the powerful financial services lobby committed against any measures to restrict compensation, there is little political will to challenge the status quo.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"You'll see politicians talk about it, but they won't actually do it," Paul Miller, managing director of mid-size investment bank FBR Capital Markets in Washington, explained in the New York Times.

But after weeks of evidently strained relations between Britain and France, Christine Lagarde, the French finance minister, did not begrudge Britain's lead in curbing banker pay - though noted it was a French idea. So there.

"We have been advocating this for a long time, and we are delighted to see that Gordon Brown is taking that stand," Mme. Lagarde said. "The president," she added, "thinks he is brave to take on the City."

Still, there are signs that the banks are going to act pre-emptively rather than allow themselves to be set on by politicians and treasury officials. Goldman Sachs announced its 30 top executives will get year-end bonuses in stock they can't sell for five years. Under the Goldman plan, the share allocations can be repossessed if the firm finds the recipient failed to gauge, analyse or warn of risk.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How effective the Goldman measure will be in curbing public anger at the "vampire squid" and its $16.7 billion 2009 bonus pool, remains to be seen. "They're trying to take the heat off the very large amounts of compensation they're going to pay," said compensation consultant Alan Johnson, who noted the value of Goldman bonuses was not being reduced, just carefully deferred.

While British and French bankers may legitimately feel picked on, American bankers may not be out of the woods. Two-thirds of Americans say they have an unfavourable view of financial executives and more than half say big financial companies are only out to enrich themselves, according to a Bloomberg poll.

With ratings like that, it may not be long before ambitious legislators make a move.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

Is the US in recession?

Is the US in recession?Today's Big Question ‘Unofficial signals’ are flashing red

-

Doing the hustle: Are side gigs a sign of impending recession?

Doing the hustle: Are side gigs a sign of impending recession?In the Spotlight More workers are 'padding their finances while they can'

-

Frozen pizza sales could be a key indicator of a recession

Frozen pizza sales could be a key indicator of a recessionThe Explainer Sales of the item have been increasing since the pandemic

-

Trump tariffs: five scenarios for the world's economy

Trump tariffs: five scenarios for the world's economyThe Explainer A US recession? A trade war with China? How 'Liberation Day' could realign the globe

-

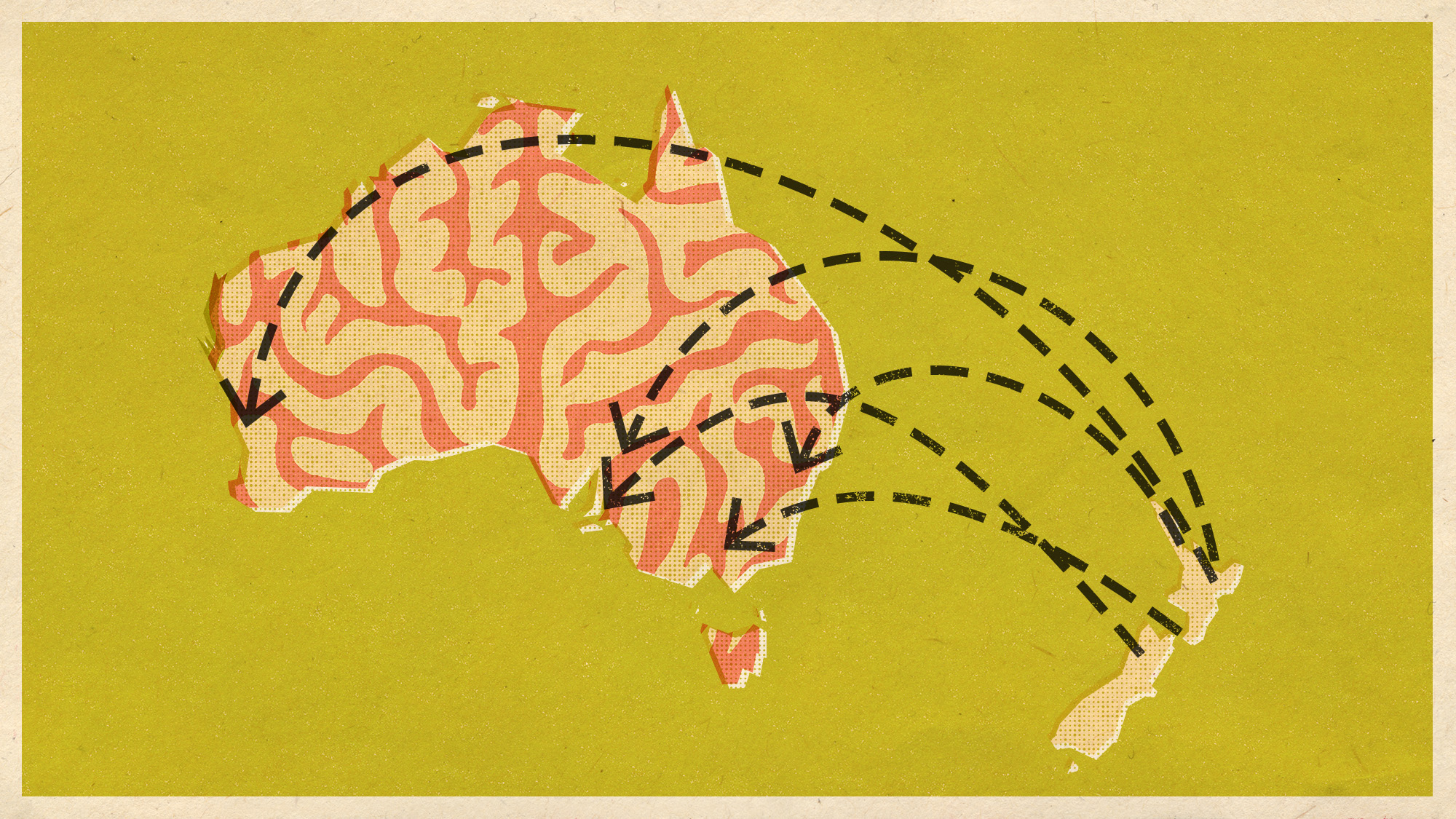

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs