Cyber insurance: more firms seek protection from hackers

'Significant growth' in cyber insurance sales amid rising security breaches such as attack on Target

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

AN INCREASING number of companies are buying cyber insurance to protect themselves from hackers, according to AIG, one of the largest insurers in the United States.

AIG reported "significant growth" with sales of anti-hacking policies jumping 30 per cent last year compared with 2012.

Cyber attacks are believed to be on the rise globally. High-profile incidents include a massive data breach at US retail giant Target last month, which exposed the credit and debit card details of around 70 million customers.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, the market for cyber insurance policies remains "a patchwork of highly-customised policies dominated by a few big insurance providers", says the Financial Times.

"It's an immature market," says Karl Schimmeck, vice president of financial services operations at Sifma, an industry group for financial companies that last year spearheaded a simulation of a cyber attack on Wall Street. "The risks are not very well understood. There's not a lot of historical information that insurance companies can call on to quantify their risk. That's part of the problem."

According to Computer Weekly, cyber insurance tends to cover areas such as the costs of managing a cyber attack, legal expenses, regulatory fines and third party damages.

Last year, a report from Betterley Risk Consultants estimated that the annual gross written premium for US cyber insurance policies was $1.3bn, while credit checking firm Experian said that only 31 per cent of US companies had cyber insurance policies. Many companies remain reluctant to pay for protection because they fear it might not cover the full fallout, says the FT.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The US government is hoping to encourage growth in the market to ensure more companies protect themselves from the financial impact of cyber attacks.

Meanwhile, the UK government is expected to warn companies later today of the increased risk of cyber attacks when conducting mergers and acquisitions, due to sharing information between participants electronically.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Why Britain is struggling to stop the ransomware cyberattacks

Why Britain is struggling to stop the ransomware cyberattacksThe Explainer New business models have greatly lowered barriers to entry for criminal hackers

-

Who are the new-wave hackers bringing the world to a halt?

Who are the new-wave hackers bringing the world to a halt?The Explainer Individual groups and nations are beginning to form concerning partnerships with new ways to commit cybercrime

-

Jaguar Land Rover’s cyber bailout

Jaguar Land Rover’s cyber bailoutTalking Point Should the government do more to protect business from the ‘cyber shockwave’?

-

Airplane crash-detection systems could be vulnerable to hackers

Airplane crash-detection systems could be vulnerable to hackersUnder the Radar 'The idea scares the shit out of me,' one pilot said

-

Elon Musk's DOGE website has gotten off to a bad start

Elon Musk's DOGE website has gotten off to a bad startIn the Spotlight The site was reportedly able to be edited by anyone when it first came online

-

The Internet Archive is under attack

The Internet Archive is under attackUnder the Radar The non-profit behind open access digital library was hit with both a data breach and a stream of DDoS attacks in one week

-

How cybercriminals are hacking into the heart of the US economy

How cybercriminals are hacking into the heart of the US economySpeed Read Ransomware attacks have become a global epidemic, with more than $18.6bn paid in ransoms in 2020

-

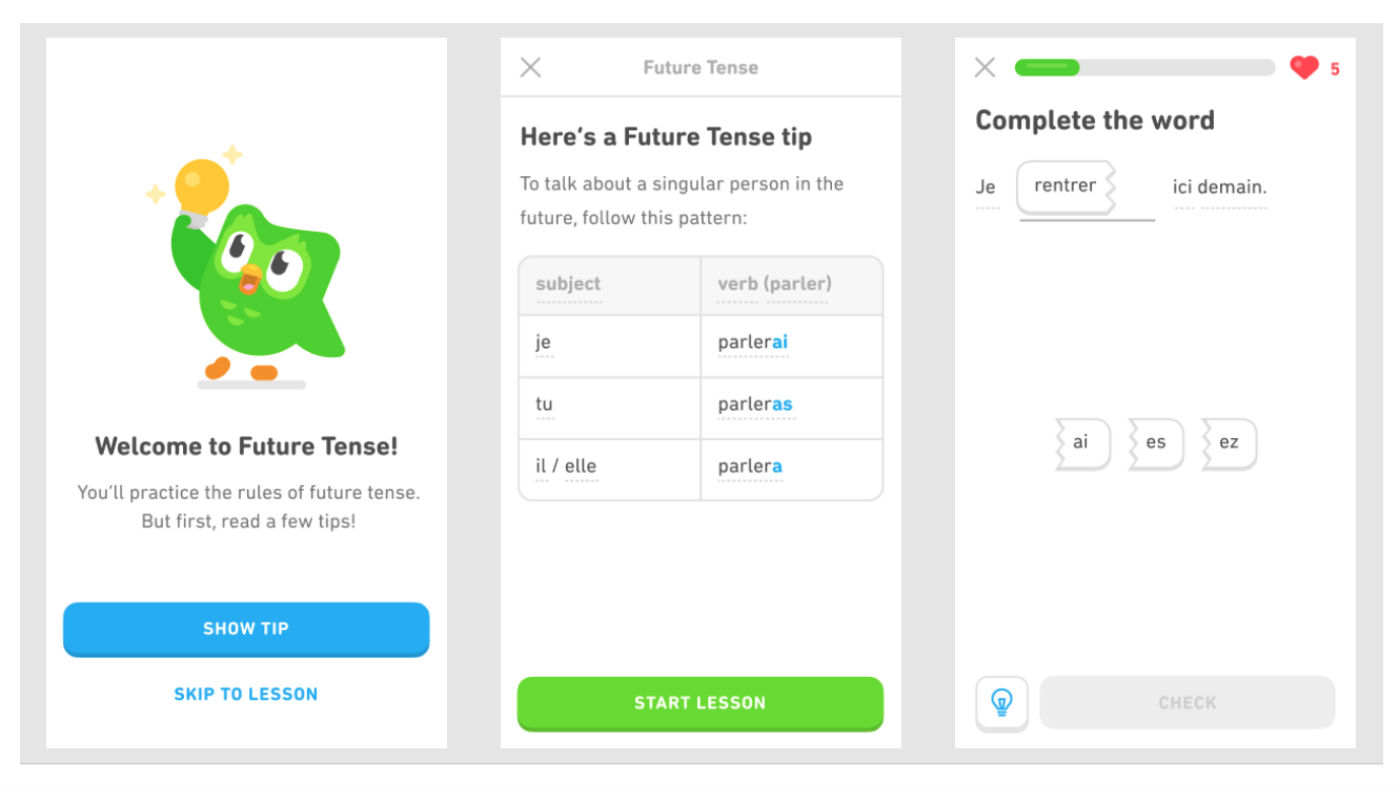

Language-learning apps speak the right lingo for UK subscribers

Language-learning apps speak the right lingo for UK subscribersSpeed Read Locked-down Brits turn to online lessons as a new hobby and way to upskill