Binance: Can the biggest crypto exchange reform itself?

The company's CEO pleads guilty to money laundering

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

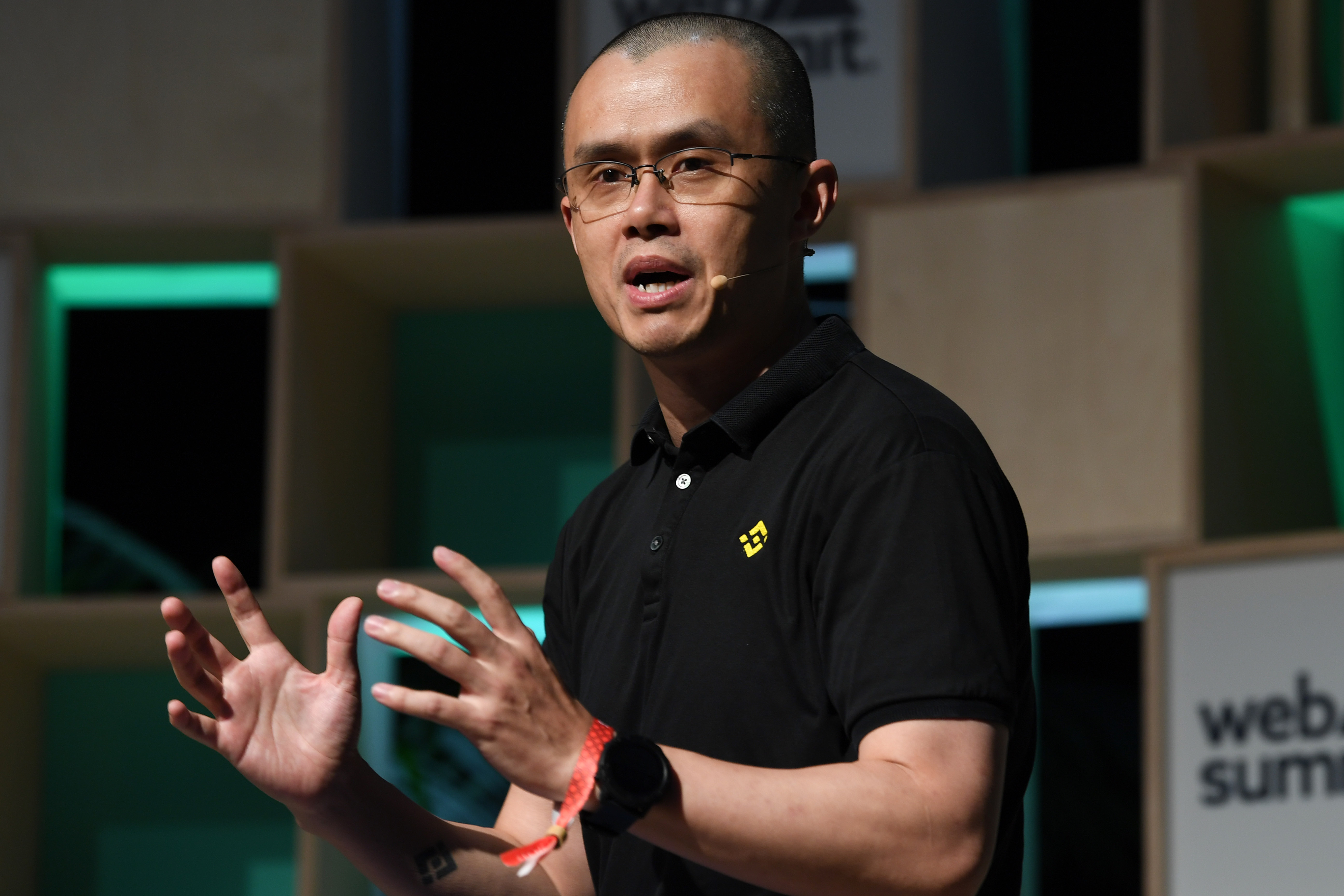

Terrorists, hackers, drug dealers and pedophiles — meet the customers of the world’s largest crypto exchange, said Allyson Versprille and David Voreacos in Bloomberg. Binance "turned a blind eye" to a staggering number of criminal failures, prosecutors said last week in announcing the exchange’s $4.3 billion guilty plea on money-laundering charges. Regulators found chats from Binance’s own compliance chief joking about the exchange "being used to funnel money to Hamas." Bitcoin transactions were commonplace among other terror organizations, including al Qaida and ISIS. Millions of transactions were conducted by people living in Iran, Syria and Cuba, in violation of U.S. sanctions. More than $100 million sat in Binance wallets traced to a Russian darknet marketplace that "sold hacking software, fake IDs and illegal drugs." And more than 1,000 transactions took place involving three marketplaces that dealt in child pornography. As part of the settlement, chief executive Changpeng Zhao agreed to step down and pay a $50 million fine.

Another week, another crypto titan goes down, said James Mackintosh in The Wall Street Journal. Less than a month after FTX leader Sam Bankman-Fried was convicted of fraud, Zhao, the richest man in crypto, pleads guilty to money laundering. The twin kill shots by the Justice Department bolster the argument that "the two main use cases" for crypto are "fraud and crime." Now Bitcoin seems primed for an "inevitable collapse in value." Binance still got off too easy, said Thomas P. Vartanian in The Hill. An organization that evades anti-money-laundering laws is enabling crimes. If it were a bank, "its FDIC deposit insurance may have been terminated, its charter revoked and its doors shuttered." Anyone in management with any involvement in such a scheme should be facing jail time and never be permitted to work in the financial industry again. It’s time to stop quibbling over regulatory action. "If they look like a bank, swim like a security and quack like an exchange, they should be regulated like them."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is not the end for crypto, said Gillian Tett in the Financial Times. But things will probably be different moving forward. Part of crypto’s anti-establishment appeal was that it was "widely viewed as anonymous." That’s clearly not the case anymore — the Binance court documents "describe transactions with Iran," for instance, in vivid detail. A cleaned-up and supervised crypto industry "will make libertarians squeal," but the reform will allow it to be "slowly absorbed into the financial establishment." Binance’s pleading guilty and giving in to "Uncle Sam is a watershed moment," said Henry Farrell and Abraham Newman in The Wall Street Journal. The $4.3 billion penalty is an attention-grabber, but a monitoring agreement as part of the settlement "is arguably even more important." It stipulates that Binance must create "a truly effective anti-money-laundering system." Businesses that want to work with Binance will need to be just as vigilant. The platform will transform "from a scofflaw into a watcher and enforcer on the U.S. government’s behalf." That alone "redefines the relationship between government and crypto."

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com