Open banking and the politics of payments

Companies in the news include Amazon, Visa, Mastercard, Afiniti, LV=, and Unilever

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Amazon/Visa/Mastercard: payment politics

Amazon’s move to ban UK-issued Visa credit cards from January is an “odd” and “unfortunate” decision, remarked Visa boss Al Kelly. Top marks for diplomacy, said Louise Beaumont on City AM, but there’s no mistaking the threat to his company. Amazon claims that Visa (which plans to hike fees from 0.3% to 1.5% on UK card purchases in the EU) “charges too much”. It’s an old bugbear, but until recently even a retail behemoth like Amazon wouldn’t have risked picking a fight with Visa.

The emergence of “open banking” – enabling third-party providers to move cash directly from bank accounts to merchants – has changed all that. The retailer is now betting that “access to Amazon trumps loyalty to Visa”.

“The good times are coming to an end for one of business’s most enduring duopolies” – Visa and Mastercard, said Lex in the Financial Times. The emergence of fintechs such as Klarna and Pockit has seen to that. Well, maybe, said Michiel Willems on City AM. Mastercard, which has also announced increases to UK/EU interchange rates, appears mysteriously exempt from Amazon’s ban. Or is it mysterious? Amazon’s “merciless move to block Visa”, which will inconvenience millions of Brits, is likely to lead to rapid uptake of its own credit cards – “which are issued by Mastercard”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

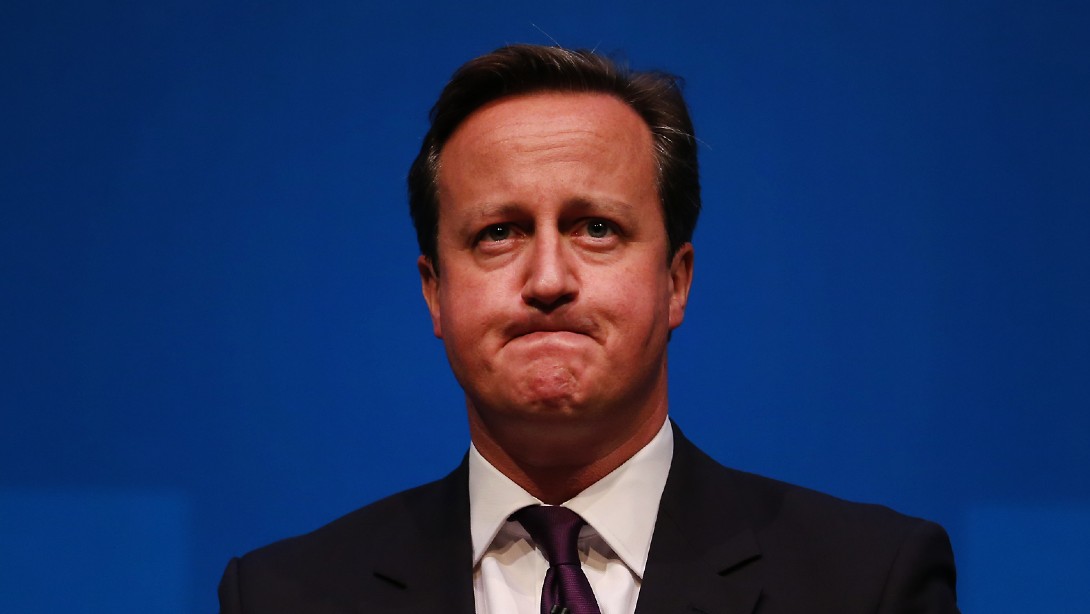

2. Afiniti: the PM and the princess

David Cameron’s post-political career has been “tarnished” by his role as an adviser to the collapsed bank Greensill, said Rupert Neate in The Guardian. Recent events at Afiniti – the Bermuda-based software firm for which he served as “advisory chair” – do not improve matters.

Cameron resigned last week after a former employee, Tatiana Spottiswoode, accused the firm’s multimillionaire founder, Zia Chishti, of sexual assault in a US Congress hearing. Chishti, who denies the allegation, has also resigned, said the Mail Online. This week the position of Princess Beatrice, who served as “vice-president of strategy and partnerships” and is on maternity leave, was still unclear.

Spottiswoode’s claims are very serious: she alleges that Chishti, a serial entrepreneur who founded the call-centre specialist in Washington in 2005, “groomed” her, “then pressured her into sex and assaulted her, leaving her with cuts and bruises and symptoms of concussion”.

Afiniti, whose clients include Sky and the AA, is one of a growing number of “racy firms” who have “stuffed advisory boards with the great and good”, said Jamie Nimmo in The Sunday Times. That practice is now under growing scrutiny. Cameron remains advisory chair of the US biotech Illumina, which won a £123m UK Government contract in 2019. He was cleared last month of “unregistered” lobbying activity on its behalf.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

3. LV=: mutual mess

It is now almost a year since the mutual insurer and pensions group LV= (formerly Liverpool Victoria) announced a £530m takeover by the US private equity group Bain, said James Sillars on Sky News. Opposition to the move has been building for months – fuelled by attempts by rival mutual Royal London to gatecrash proceedings. But matters are reaching a climax. Ahead of a “knife-edge vote”, LV=’s board has upped efforts to persuade its members of the merits of the buyout, which, according to CEO Mark Hartigan, is “the only deal that keeps us going”.

Still, the terms are hardly enticing. LV=’s 1.2 million members will receive “a cash payment of just £100 each if the deal goes through”. The 297,000 members owning “with profits” policies (who legally own the group) will get “an extra £52 worth of enhancements” to their future payouts. Royal London is still lurking on the sidelines. Even at this late stage, it would be wise to invite it “to make a politically palatable counter-offer”, said Nils Pratley in The Guardian. “At the very least, the would-be white knight would be forced to clarify its intentions.”

4. Unilever: reading the tea leaves

In a deal that has been stewing for two years, Unilever has finally sold its tea division – ending a relationship with top brands such as PG Tips and Lipton that dates back decades, said Hannah Boland in The Daily Telegraph. The 34-brand-strong division, called Ekaterra, has been bought by the European buyout group CVC Capital Partners for €4.5bn. The sale is a reflection of changing tastes, as consumers opt for coffee, kombucha or high-end teas.

As Unilever’s finance boss, Graeme Pitkethly, once observed: those who “drink five or six cups of builders’ tea a day [are] unfortunately dying at a faster rate than Generation Z and millennials are consuming it”. This hasn’t been an easy sale, said the FT. Two of the three final bidders reportedly “baulked” after getting “ESG jitters” over “concerns about working practices” in Unilever’s Kenyan tea plantations.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man