The pros and cons of ‘buy now, pay later’ schemes

Payment schemes are booming in popularity but some warn of potential financial risks

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Buy now, pay later (BNPL) schemes have quickly become a popular payment option for consumers in the UK.

A study by loan provider Creditspring found that more people took out BNPL schemes than traditional loans from mainstream lenders in 2021, and “younger adults are among the most frequent users”, said This Is Money.

As the name implies, BNPL schemes work on a system of buying goods on credit and paying for them at a later date. Some offer an interest-free period within which the total sum can be paid off, while others offer interest-free part-payment plans over specific periods.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“If you keep on top of it”, the schemes “can be a sensible way of making sure you’re not hit with a big bill at one point of the year”, said the BBC’s consumer affairs correspondent Colletta Smith. But “it’s always important to check the terms and conditions before you sign up”.

1. Pro: convenient way to borrow

It’s “easier to access BNPL than to qualify for a credit card”, according to Neil Kadagathur, Creditspring’s chief executive. Most providers will carry out a “soft credit check” before approving a consumer for its service, rather than carrying out a full assessment of debts. This type of check won’t leave a “footprint” on your credit record.

Forbes adds that “you’re definitely not imagining it if you have seen a lot more flexible payment offers” over the past few years. BNPL services have quickly been adopted by a range of retailers, so in many cases you can now split payments for clothes or toiletries as easily as you can for pricier tech purchases.

2. Con: borrower misconceptions

Creditspring’s survey found that one in seven respondents thought it was “impossible” to get into debt using BNPL schemes – and that level rose to one in four for respondents under 35 years old.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“Unfortunately, borrowing money never comes without consequences,” said Forbes. Depending on the individual service’s terms and conditions, users can get into hot water over late payments. Forbes warned that BNPL schemes “make impulse buying even easier” and “make tracking your spending considerably more difficult”, making the risk of unwittingly getting into debt more likely.

3. Pro: ‘way to make ends meet’

As prices for household bills soar, splitting payments for larger purchases over several months has proved popular. “Consumers are increasingly turning to BNPL products to manage their finances amid a cost-of-living crunch”, said City AM.

Citizens Advice said it had seen an increase in delayed payment schemes being marketed as a “way to make ends meet”, and acknowledged that “splitting and delaying payments will undoubtedly work for some people in some contexts”. However, it also warned of the potential pitfalls of unknowingly getting into debt.

4. Con: unregulated in the UK

The government is currently looking to introduce regulations across the sector, but at present BNPL is considered the “new wild west of the borrowing industry”, said This Is Money. The Financial Conduct Authority has also been working with some of the large BNPL providers to redraft terms of service so that no user’s account can be suspended, terminated or restricted without notice.

Creditspring’s Kadagathur noted that 15 million people in the UK currently “struggle to access mainstream credit options”. The flipside to the convenience of these plans is that people “in precarious financial situations” may be able to easily access them without vigorous credit checks.

5. Pro: try before you buy

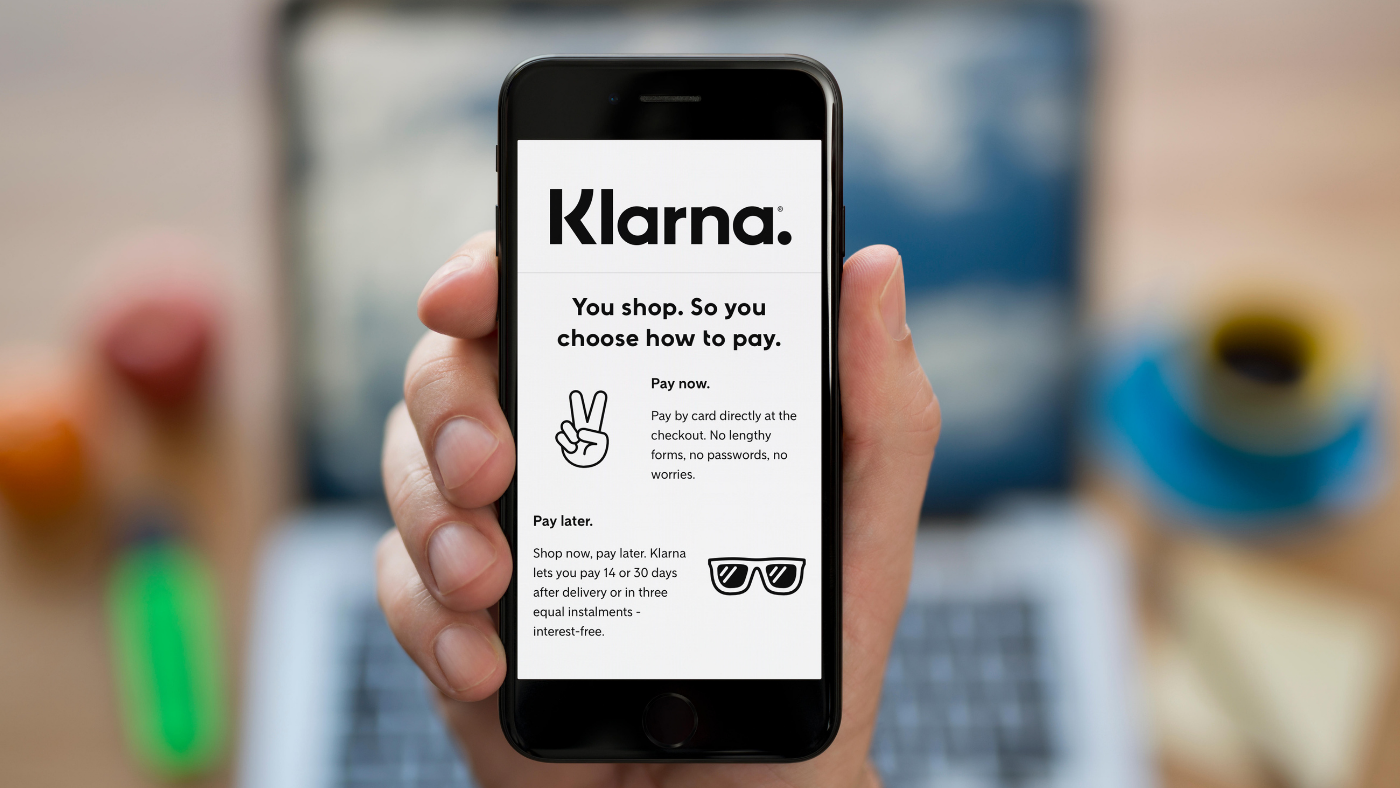

Klarna “has led the UK boom” in BNPL services in recent years, said the Financial Times. And one reason for its popularity is that it allows customers shopping online to “try before you buy”.

Shoppers can use Klarna to order multiple clothing items at once – for instance, a dress in several colours or sizes – and return the ones they don’t want, paying only for the items they choose to keep. One shopper told Refinery29 this allowed her to “shop online as she would in real life, trying on multiple sizes and checking the fit of a piece” before making a final purchase.

6. Con: pay more in the long-run

“The simplicity of the Buy Now Pay Later model is as much its selling point as its Achilles’ heel,” said Metro. Consumers might first hit a financial hurdle by buying items they can’t necessarily afford, but this can become a greater problem if they incur late payment fees or higher interest rates as a result.

MoneySavingExpert said that nearly half of people using BNPLs are “unaware” that they risk being charged a late fee if they miss a payment. And the website notes that many of these companies ensure they have the right to report missed payments to credit reference agencies, meaning your credit score could be impacted in the long run.

Julia O'Driscoll is the engagement editor. She covers UK and world news, as well as writing lifestyle and travel features. She regularly appears on “The Week Unwrapped” podcast, and hosted The Week's short-form documentary podcast, “The Overview”. Julia was previously the content and social media editor at sustainability consultancy Eco-Age, where she interviewed prominent voices in sustainable fashion and climate movements. She has a master's in liberal arts from Bristol University, and spent a year studying at Charles University in Prague.