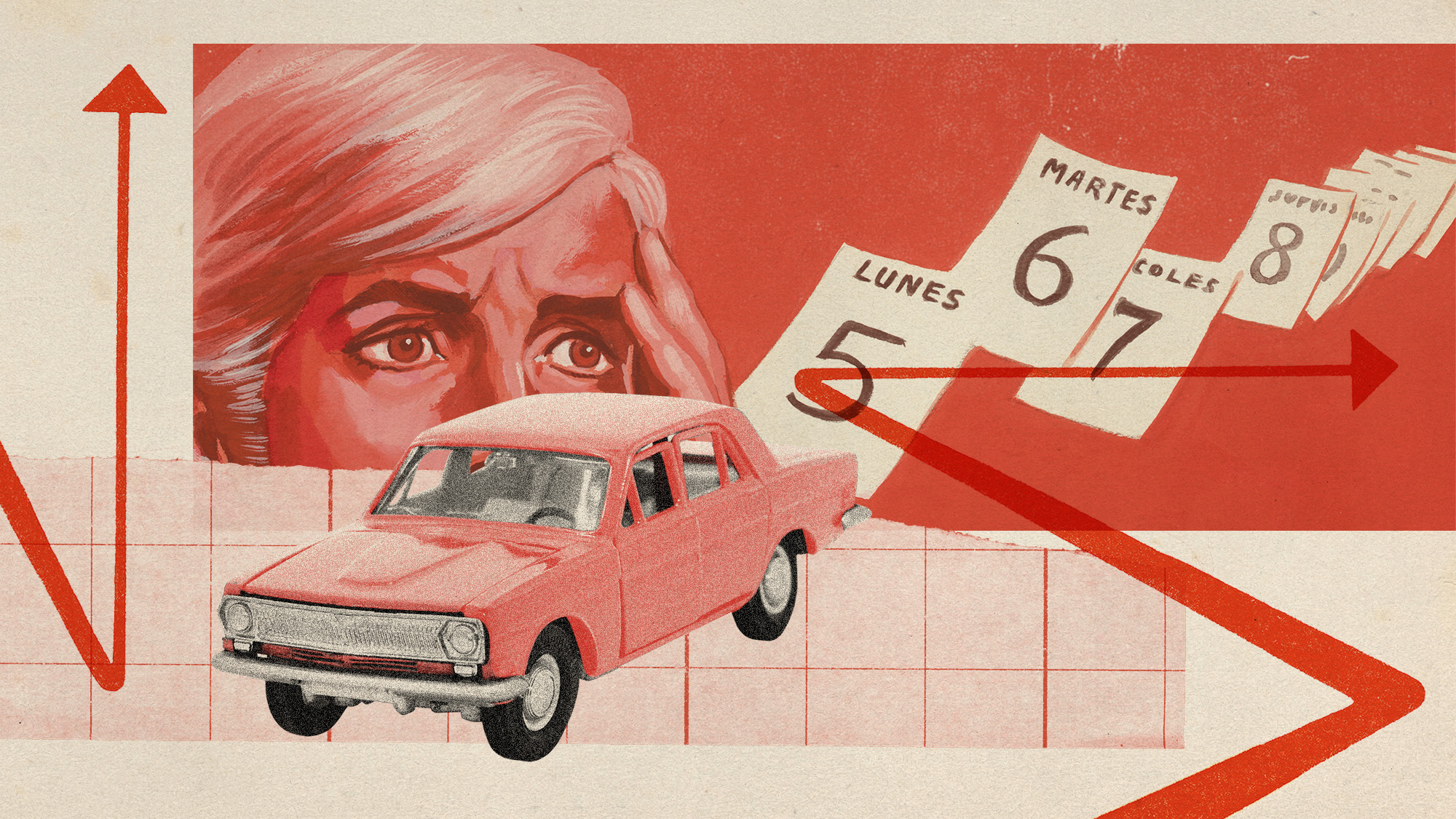

Mis-sold car finance: who will be entitled to compensation

City regulator to launch payout scheme after Supreme Court ruling spares motor industry's 'worst-case scenario'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Customers mis-sold car financing could still be entitled to compensation, despite last week's landmark Supreme Court ruling that sided with lenders.

The Financial Conduct Authority (FCA) announced it will consult on a payout scheme later this year, just days after a "worst-case scenario for the industry" appeared to have been avoided, said The Times.

"It is the latest twist in a scandal that had caused consternation at the very top of the government over fears of the size of the hit lenders may face."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What was the controversy about?

Between 80% and 90% of cars in Britain are bought with finance: loans paid off in monthly instalments. The cost includes interest added by the brokers who sell the finance plans on behalf of the lender and receive a commission in return.

Before 2021, some car finance lenders had what was called a "discretionary commission arrangement" with brokers in which they earned a higher commission if customers were given a higher interest rate. "This incentivised sellers to maximise interest rates, which meant many were unfairly charged too much," said Sky News.

The practice was banned by the FCA in January 2021, but millions of customers claimed they had already been overcharged and were seeking compensation. Some 80,000 open cases made to the Financial Ombudsman Service were effectively on hold pending the outcome of a court ruling last Friday.

What did the courts rule?

Last October, the Court of Appeal sided with customers, ruling that some commission arrangements amounted to bribes and a breach of the obligation car dealerships had to their consumers. Those affected should be entitled to receive compensation equivalent to the commission, the court said.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

City analysts estimated that car finance providers could have been liable for up to £44 billion in total, which would have made it one of the biggest compensation payouts in British history.

But lenders – and Chancellor Rachel Reeves, who had voiced concerns about the potential impact on economic growth – were handed a reprieve on Friday after the Supreme Court dismissed the two central arguments brought by customers. It effectively found that commercial relationships are based on self-interest, and thus dealers had no duty to act in customers' interest.

The ruling did not let lenders off the hook completely, leaving open the possibility of compensation claims for particularly large commissions.

Will customers get any compensation?

Following the ruling, the FCA has announced it will consult on launching a payout scheme, which will start in October with the first payments expected next year.

The regulator said those eligible will probably be entitled to a payout of no more than £950, depending on the "degree of harm suffered by the consumer and the need to ensure consumers continue to be able to access affordable loans for motor vehicles". Individuals do not need to use costly claims management companies to register their claims and those who have already registered a complaint do not need to take any further action.

While it is "hard to estimate precisely at this stage the total cost to industry", the regulator said it is likely to be between £9 billion and £18 billion, the BBC reported. The industry is "expected to cover the full costs of any potential compensation scheme, including any administrative costs".

Car finance lenders, including some of the UK's biggest banks, had already set aside billions of pounds for potential payouts.

-

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

3 ways to reduce the cost of owning a car

3 ways to reduce the cost of owning a carthe explainer Despite the rising expense of auto insurance premiums and repairs, there are ways to save

-

4 easy tips to avoid bank fees

4 easy tips to avoid bank feesThe Explainer A few dollars here and there might seem insignificant, but it all adds up

-

How to determine the right car for your needs

How to determine the right car for your needsthe explainer Assess your budget, driving habits and fuel costs

-

What is an upside-down car loan and how do you get out of it?

What is an upside-down car loan and how do you get out of it?the explainer This happens when the outstanding balance on a car loan exceeds the vehicle's worth

-

How will the new tax deductions on auto loans work?

How will the new tax deductions on auto loans work?the explainer Trump's One Big Beautiful Bill Act introduced a tax deduction on auto loan interest — but eligibility for the tax break is limited

-

Five best ways to save money at the petrol pump

Five best ways to save money at the petrol pumpThe Explainer You don't have to wait for petrol prices to fall to reduce your fuel costs

-

The best time of year to buy a car

The best time of year to buy a carThe Explainer Some months — and days — are better than others

-

The pros and cons of online-only banks

The pros and cons of online-only banksthe explainer You can get your finances in order without getting off your couch