The cost-of-living support available from government

Downing Street says no further measures will be rolled out before new PM is in place

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Boris Johnson has ruled out the introduction of any new emergency measures to help struggling UK households cope with soaring costs before he quits Downing Street.

The prime minister’s official spokesperson said there were no plans for a Cobra meeting to address the cost-of-living crisis before either Liz Truss or Rishi Sunak take over in No. 10 in September. The “bigger challenges” for family budgets “are coming towards the end of the year”, the spokesperson added.

Annual energy bills are “now forecast to top £4,200 from January”, said The Guardian, and soaring inflation and an interest rate hike to 1.75% are also hitting households across the UK. Here is the government support currently available.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

£400 energy bills discount

As part of the government’s cost-of-living support package, every household in England, Scotland and Wales will receive a £400 energy bill discount. Administered by energy suppliers, the discount “will be paid to consumers over six months with payments starting from October 2022, to ensure households receive financial support throughout the winter months”, said Gov.uk.

The payment was initially intended to be a £200 reduction to be repaid in instalments over five years, but has now been doubled and does not need to be repaid.

Households in council tax bands A-D in England are also getting a £150 rebate to help pay rising bills. Most eligible households have already received this rebate through their council tax bill.

Analysts have warned that the payments are “not enough to make a dent” in soaring energy bills. Dr Craig Lowrey, a principal consultant at Cornwall Insight, told BBC Radio 4’s Today programme that high energy costs were “very much a long-term problem for households that is going to need concerted and enduring action by the government to help manage that.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

£650 Cost of Living Payment

Almost eight million households on means-tested benefits are eligible for a one-off Cost of Living Payment of £650, which is being paid in two instalments. A lump sum of £326 was paid out in July, and the “second instalment of £324 will follow from the autumn”, according to the Department for Work and Pensions.

The payment is being made to people who receive any of the following benefits: Universal Credit, income-based Jobseeker’s Allowance, income-related Employment and Support Allowance, Income Support, Working Tax Credit, Child Tax Credit and Pension Credit. There is no need to apply, and the payment is paid straight into recipients’ bank accounts.

£300 Pensioner Cost of Living Payment

Households that receive the Winter Fuel Payment, which is paid to nearly all homes with at least one person of pension age, will receive an extra £300 in November and December to help cover the rising cost of energy.

Pensioners who claim pension credit will receive this payment in addition to the £650 support for those on benefits. The government will make these payments directly to eligible households.

£150 Disability Cost of Living Payment

People on disability benefits will receive a one-off payment of £150 from September. This includes people on Disability Living Allowance, Personal Independence Payment, Attendance Allowance, Scottish Disability Benefits, Armed Forces Independence Payment, Constant Attendance Allowance and War Pension Mobility Supplement.

Household Support Fund

The government has announced a further £500 million of support via the Household Support Fund, first introduced in September 2021, which will now run until March 2023. The fund provides households with payments to help with essentials like food, utilities and clothing.

Distributed by local councils, eligibility varies according to area and is generally assessed by a person’s financial ability to meet basic needs.

National Insurance Contribution threshold rise

National Insurance starting thresholds rose to £12,570 from July 2022, which the government says will “benefit 30 million working people with a typical employee saving over £330 a year”.

But Channel 4 has said that for those who are self-employed the change is worth only £250 a year, adding it “does nothing for those who were already earning below the National Insurance threshold, those who are not in work, or pensioners”.

Tax breaks for self-employed workers

From April 2022, self-employed individuals are not liable for Class 2 National Insurance contributions on profits between the Small Profits Threshold and Lower Profits Limit. It means that lower-income self-employed workers could see a tax-bill reduction of up to £165 a year.

Reduced Universal Credit taper rate

Sunak’s autumn budget reduced the taper rate of Universal Credit from 63% to 55% and increased work allowances by £500. The government says the change means that “1.7 million households will on average keep around an extra £1,000 on an annual basis”.

Fuel duty cut

The government cut fuel duty by 5p a litre in March, which it said “represents savings for consumers worth almost £2.4 billion”. But the RAC has said the fuel duty cut looks “paltry” when compared to action taken by other European countries and said the UK government had done “the least to support drivers through the current period of record high fuel prices”.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

Why is pizza in decline?

Why is pizza in decline?In the Spotlight The humble pie is getting humbler

-

Is $140,000 the real poverty line?

Is $140,000 the real poverty line?Feature Financial hardship is wearing Americans down, and the break-even point for many families keeps rising

-

Fast food is no longer affordable for low-income Americans

Fast food is no longer affordable for low-income AmericansThe explainer Cheap meals are getting farther out of reach

-

Why has America’s economy gone K-shaped?

Why has America’s economy gone K-shaped?Today's Big Question The rich are doing well. Everybody else is scrimping.

-

Penny-pinching: Elon Musk looks at the cent to cut costs

Penny-pinching: Elon Musk looks at the cent to cut costsIn the Spotlight Musk's DOGE claims that millions can be saved if production on pennies is slashed

-

The big deal: Why are fast-food chains suddenly offering discounts?

The big deal: Why are fast-food chains suddenly offering discounts?Today's Big Question After inflation and price hikes, a need to bring customers back

-

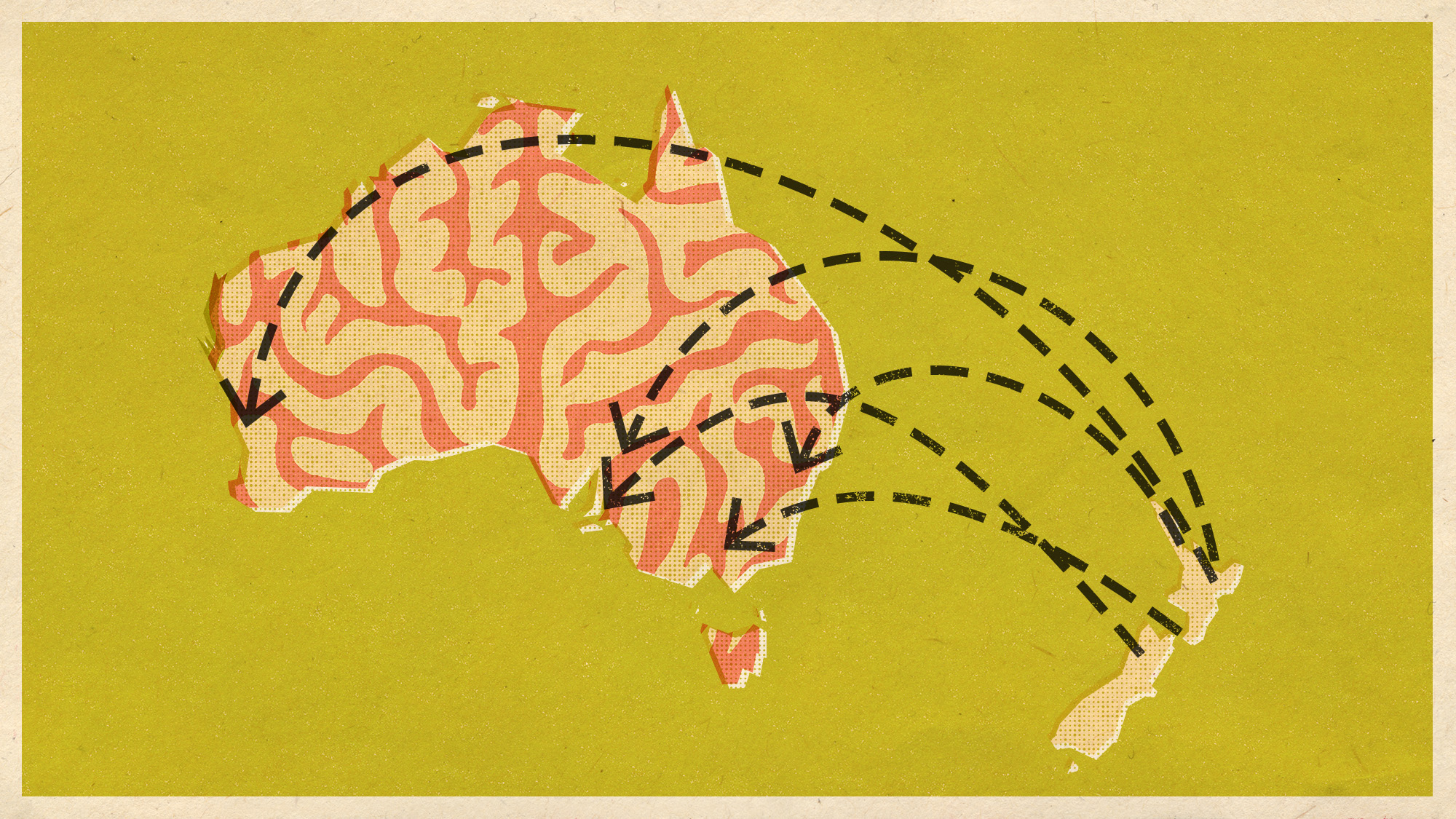

'Brain drain' fear as record numbers leave New Zealand

'Brain drain' fear as record numbers leave New ZealandUnder The Radar Neighbouring Australia is luring young workers with prospect of better jobs