Here's what's in the Democrats' big climate, health care, and tax package, the Inflation Reduction Act

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Senate on Sunday voted to make major investments in climate change mitigation and sustainable energy production, significant changes in drug and health care policy, and modifications to tax law designed to reduce tax avoidance. The bill, called the Inflation Reduction Act, passed 51 to 50 along party lines, with Vice President Kamala Harris casting the tie-breaking vote. The House is expected to clear it on Friday, sending it to President Biden's desk.

Here's a look at what the legislation would do.

Climate change and energy (Cost: $369 billion)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

- $27 billion to create or support "green banks," which combine with private investments to drive clean energy projects, including in low-income areas.

- $7,500 consumer tax credit for new electric vehicles and $4,000 for used electric vehicles, until 2032, with some income caps.

- Tax credits to encourage power companies to increase green energy.

- $60 billion in incentives and financing for domestic production of solar panels, wind turbines, batteries, critical minerals, electric vehicles, and other manufacturing.

- $60 billion for environmental projects in low-income and disadvantaged communities.

- New limits on the release of methane gas, including fines of up to $1,500 a ton for excess leakage and funds for monitoring and compliance.

- Assured new oil and gas drilling leases on public lands and offshore.

- Tax credits for carbon-capture technology.

Drugs and health care (Cost: $64 billion)

- Medicare will be able to negotiate drug prices for the first time, starting in 2026 with 10 to-be-determined high-cost drugs. This is, Stat's Rachel Cohrs writes, "a BFD."

- $2,000 annual cap on out-of-pocket drug expenses for Medicare recipients, starting in 2025.

- $35 monthly cap on insulin costs for Medicare patients (but not people with private insurance).

- Penalties for Medicare drugs whose prices rise faster than inflation.

- Guaranteed free vaccines for Medicare recipients, starting in 2023.

- Three-year extension of Affordable Care Act subsidies enacted in 2021 that lowered or eliminated premiums for nearly all ACA marketplace customers.

Taxes (Income: roughly $739 billion)

- 15 percent minimum tax on most companies that report $1 billion or more in income to their shareholders.

- 1 percent tax on corporate stock buybacks.

- $80 billion to hire new IRS agents and increase compliance among wealthy companies and individuals; expected to bring in an extra $203 billion. "These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans," the IRS assured Congress.

Sources: The Wall Street Journal, The New York Times, Vox, Senate Democrats, Barron's, Stat News, The Washington Post

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

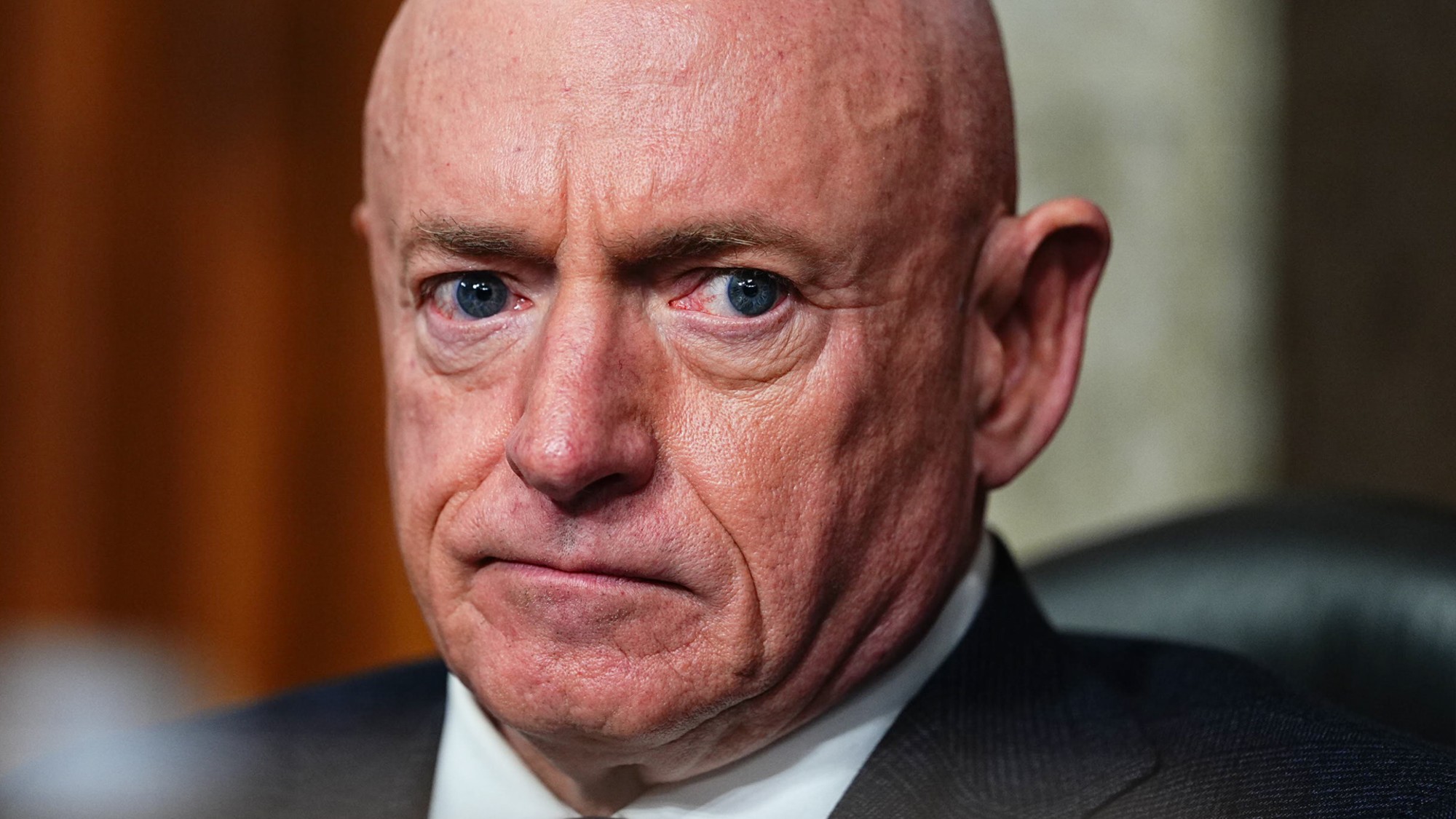

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

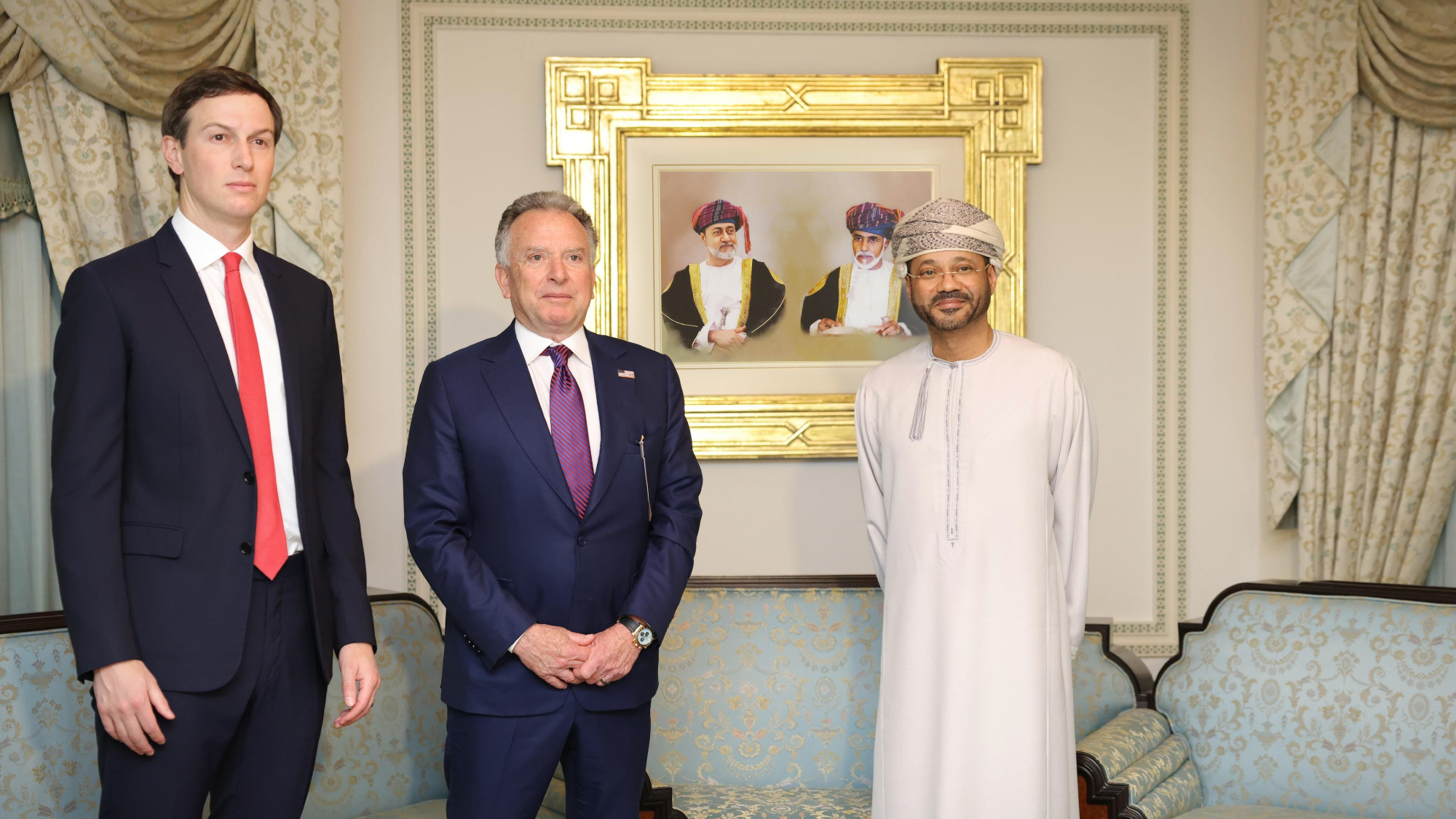

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Pentagon spokesperson forced out as DHS’s resigns

Pentagon spokesperson forced out as DHS’s resignsSpeed Read Senior military adviser Col. David Butler was fired by Pete Hegseth and Homeland Security spokesperson Tricia McLaughlin is resigning

-

Judge orders Washington slavery exhibit restored

Judge orders Washington slavery exhibit restoredSpeed Read The Trump administration took down displays about slavery at the President’s House Site in Philadelphia

-

Hyatt chair joins growing list of Epstein files losers

Hyatt chair joins growing list of Epstein files losersSpeed Read Thomas Pritzker stepped down as executive chair of the Hyatt Hotels Corporation over his ties with Jeffrey Epstein and Ghislaine Maxwell

-

Judge blocks Hegseth from punishing Kelly over video

Judge blocks Hegseth from punishing Kelly over videoSpeed Read Defense Secretary Pete Hegseth pushed for the senator to be demoted over a video in which he reminds military officials they should refuse illegal orders

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

House votes to end Trump’s Canada tariffs

House votes to end Trump’s Canada tariffsSpeed Read Six Republicans joined with Democrats to repeal the president’s tariffs