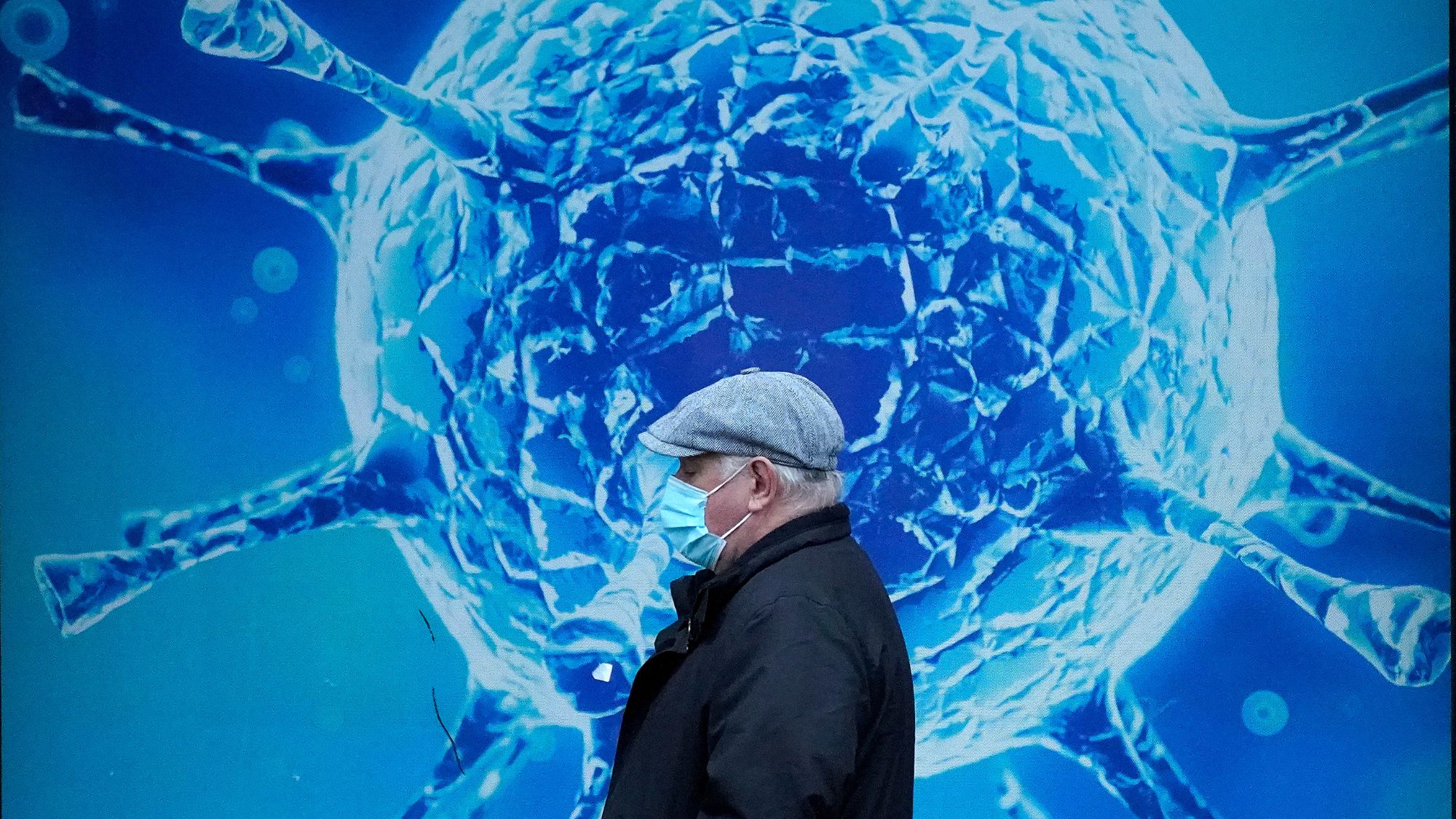

What is coronavirus doing to the global economy?

Markets plunge as both supply and demand grind to a halt worldwide

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Fears are growing about the economic impact of the coronavirus outbreak as markets worldwide suffer significant losses.

The new coronavirus, which causes Covid-19, is “the major uncertainty in the global economy” and has “the potential to trigger a worldwide recession”, says Forbes.

Last week, the Washington-based Institute of International Finance painted a dire picture of the situation by claiming that global GDP growth could be as low as 1% this year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But this week an oil price crash – dubbed Black Monday – followed by a second major crash after the World Health Organization (WHO) formally declared a pandemic on Wednesday has seen analysts lower their expectations even further, with countries now enacting drastic policies and pledging sweeping spending plans to combat the crisis.

But what exactly is happening to the global economy, and what are countries doing to halt it?

How has the coronavirus impacted the global economy?

Since the outbreak began in Wuhan, China in December 2019, businesses and governments alike have struggled as it spreads to an increasing number of countries.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Regions hit by the coronavirus have so far experienced a “double whammy”, with business operations across Asia, Europe and the US being “disrupted by factory closures, quarantined workers and shortages of components, crimping the availability of goods and services – a so-called supply shock”, The Wall Street Journal reports.

At the same time, postponed public events and mounting fear are “causing consumers and businesses to hold back, avoiding travel, restaurants and lavish purchases, even where restrictions haven’t been imposed – a demand shock”, the paper adds, noting that the “combined effects risk pushing the economy into a self-reinforcing, downward spiral”.

But things got really bad on Monday. Alongside coronavirus, an oil price war is also fuelling a “broader, global market rout as investors are increasingly panicking over the economic impact” of the virus, Foreign Policy reports.

“Oil prices plunged about 25% in New York and London, dragging down stock markets in Europe and Asia. In New York, stocks fell 1,800 points within minutes of the opening bell before trading was briefly suspended, and traded well down the rest of the day, with the Dow Jones Industrial Average finishing down 2013.76 points or nearly 8%, the worst single-day drop since the financial crisis of 2008,” the news site adds.

Rabobank stated on Tuesday – in the wake of Black Monday – that “a global recession is now all but certain”, while predicting global growth to hit 1.6% of GDP by the end of the year, CNBC reports.

For reference, the world economy grew 2.9% in 2019, according to estimates from the International Monetary Fund.

CNBC reports that the Organisation for Economic Co-operation and Development, the credit ratings agency Moody’s and other financial institutions have “also downgraded their global growth forecasts over the last few days”.

What have governments done?

The crisis has forced many governments’ hands when it comes to offering financial stimulus packages and other policies to stem the fallout.

In the UK, Chancellor Rishi Sunak has announced a £30bn package to help the economy get through the outbreak, suspending business rates for many firms in England, extending sick pay and boosting NHS funding, the BBC reports.

Nevertheless, Sunak warned of a significant but temporary disruption to the country’s economy. Earlier the same day, the Bank of England announced an emergency cut in interest rates from 0.75% to 0.25%, taking borrowing costs back down to the lowest level in history in order to shore up the economy.

In Australia, meanwhile, the federal government will seek to make sure apprentices can keep their jobs amid fears that coronavirus could have a crippling effect on employment, offering up to A$7,000 (£3,500) per apprentice per quarter to keep them in work.

ABC News reports that the move is part of a wider stimulus package which Prime Minister Scott Morrison will announce today, and will be worth more than $15bn, spread over this financial year and until at least March next year.

In the US, things are less clear. On Tuesday, US President Donald Trump labelled his country’s central bank “pathetic” for not cutting interest rates further in the face of the outbreak – an intervention which City AM says “adds to the pressure on the US Federal Reserve to cut rates again after it slashed them by 50 basis points (0.5 percentage points) in an emergency move last week”.

“Our pathetic, slow moving Federal Reserve, headed by Jay Powell, who raised rates too fast and lowered too late, should get our Fed Rate down to the levels of our competitor nations,” Trump tweeted. “The Federal Reserve must be a leader, not a very late follower, which it has been!”

Despite these moves, The Atlantic suggests that confronting the threat of coronavirus “will not be easy” as “a downturn stemming from an epidemic is an unusual one”.

“For one, the coronavirus epidemic has come with extraordinary, intense uncertainty,” the site adds. “Officials are not sure how many cases there are and how deadly the virus is. Businesses and households are uncertain of how long the danger will last and what measures governments might take to counter it. People are afraid, as the market panic demonstrates, and it may take months for that fear to abate.”

-

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’

-

The new Stratus Covid strain – and why it’s on the rise

The new Stratus Covid strain – and why it’s on the riseThe Explainer ‘No evidence’ new variant is more dangerous or that vaccines won’t work against it, say UK health experts

-

Covid-19: what to know about UK's new Juno and Pirola variants

Covid-19: what to know about UK's new Juno and Pirola variantsin depth Rapidly spreading new JN.1 strain is 'yet another reminder that the pandemic is far from over'

-

Vallance diaries: Boris Johnson 'bamboozled' by Covid science

Vallance diaries: Boris Johnson 'bamboozled' by Covid scienceSpeed Read Then PM struggled to get his head around key terms and stats, chief scientific advisor claims

-

Good health news: seven surprising medical discoveries made in 2023

Good health news: seven surprising medical discoveries made in 2023In Depth A fingerprint test for cancer, a menopause patch and the shocking impacts of body odour are just a few of the developments made this year

-

How serious a threat is new Omicron Covid variant XBB.1.5?

How serious a threat is new Omicron Covid variant XBB.1.5?feature The so-called Kraken strain can bind more tightly to ‘the doors the virus uses to enter our cells’

-

Will new ‘bivalent booster’ head off a winter Covid wave?

Will new ‘bivalent booster’ head off a winter Covid wave?Today's Big Question The jab combines the original form of the Covid vaccine with a version tailored for Omicron

-

Can North Korea control a major Covid outbreak?

Can North Korea control a major Covid outbreak?feature Notoriously secretive state ‘on verge of catastrophe’

-

Did Sweden’s Covid-19 experiment pay off in the end?

Did Sweden’s Covid-19 experiment pay off in the end?In Depth Scandinavian country had lower excess death rate than many but immigrants and elderly bore the brunt