The Budget 2020 in a nutshell

Chancellor Rishi Sunak announces £30bn stimulus package for coronavirus

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Chancellor Rishi Sunak lifted constraints on government spending and borrowing today as he announced his first Budget.

Sunak used the Budget announcement to warn that the rapid spread of coronavirus will have “a significant impact on the UK economy”.

The chancellor said that up to 20% of the UK workforce is expected to be off work at any one time.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But Sunak added that his £30bn fiscal stimulus is one of the “most comprehensive responses [to coronavirus] of any government around the world to date”.

The Budget was the first for the new chancellor, who took the position after Sajid Javid resigned in February. Here is what Rishi Sunak announced:

Coronavirus response

The chancellor used the Budget to set out the government’s economic strategy to deal with coronavirus.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

He pledged “whatever extra resources the NHS needs… whether it’s millions or billions of pounds, whatever it needs, whatever it costs”.

The chancellor announced he would suspend business rates entirely for the coming year to protect retailers as markets continue to suffer as a result of the crisis. And he extended the 100% discount to retail, leisure and hospitality businesses with a rateable value below £51,000.

Smaller business, who already do not pay business rates, will be provided with a £3,000 cash grant per business. The £2bn cash injection will be used to support those smaller businesses.

Business rate discounts for pubs are to rise from £1,000 to £5,000 this year.

Statutory sick pay will be available to anyone advised to self-isolate, regardless of whether they are experiencing symptoms. They will be able to get a sick note through NHS 111.

But while the availability of statutory sick pay has changed, the level has not, as economist Samuel Tombs points out.

For those, such as the self-employed and gig economy workers, who do not qualify for sick pay, receiving benefits will be made easier.

Contributory Employment and Support Allowance benefit claimants will be able to claim sick pay on day one, not after a week, and the minimum income level will be removed from universal credit.

There will be a £500m hardship fund made available to local authorities tackling the virus to help vulnerable people.

The cost to businesses of under 250 people of having someone off work for up to 14 days will be refunded. A total of £2bn will be allocated to cover businesses.

Small firms will be entitled to “business interruption” loans of up to £1.2m.

The total measures to respond to coronavirus total £7bn, in addition to £5bn of emergency response funding that Sunak said he is making available to the NHS and other public services.

NHS

The chancellor announced that the health service would increase the immigrant surcharge for NHS use to £624, with a discount for children.

People “should get out what they put in”, says the chancellor.

The current amount is £400 per year of visa, or £300 per year for students, says the government advice for those making immigration applications.

Sunak announced over £6bn of funding in this parliament to support the NHS, aimed at delivering 50,000 more nurses and 50 million more GP surgery appointments.

And the chancellor announced that work will start on building the 40 new hospitals promised by the government.

But fact-checker FullFact has previously pointed out the 40 new hospitals claim might actually be the government reconfiguring just six.

Growth and borrowing

The chancellor said that without the coronavirus, the trajectory of the UK economy “would have led to growth of 1.1% in 2020 and 1.8% in 2021, then 1.5%, 1.3%, and 1.4% in the following years”.

The 1.1% rate of growth would be the lowest since 2009.

But he claimed that the Office for Budget Responsibility (OBR) said that as a result of his plans, “growth over the next two years will be 0.5% higher than it otherwise would have been”.

The chancellor said the OBR forecasts a likely increase in borrowing, from 2.1% of GDP in 2019-20 to 2.4% in 2020-21 and 2.8% in 2021-22.

But the effects of the coronavirus could throw those figures dramatically off course, says the National Institute of Economic and Social Research.

Minimum wage

When New Labour introduced the minimum wage in 1999, it was opposed by the Conservative Party.

But the Conservatives now support the idea, and Sunak pledged to increase the national living wage to two-thirds of median earnings by 2024. Treasury forecasts suggest that would be more than £10.50 an hour.

Pension reforms

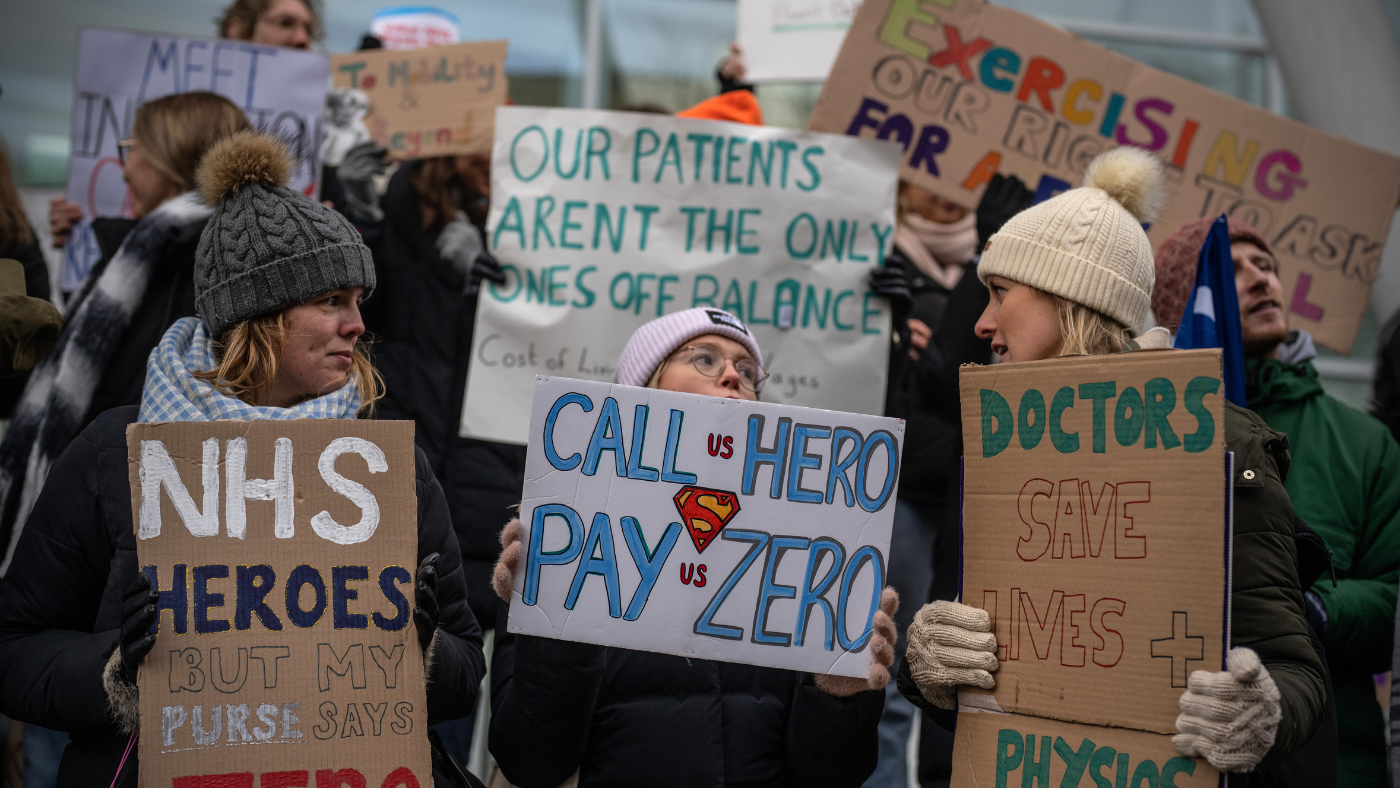

The new chancellor announced a change to pension rules, citing a number of doctors who decided not to work additional hours because it wasn’t worth their while given the loss in pension benefits.

The tapered annual allowance for pensions tax relief will be raised to £200,000.

National Insurance rise

During the election campaign, Johnson promised to raise the NI threshold to £12,500.

Sunak didn’t go that far today, instead announcing a rise to £9,500, from the current threshold of £8,632. The rise is expected to save up to 31 million people just over £100 a year.

The chancellor also raised the employment allowance from £3,000 to £4,000. This will mean that businesses will not have to pay employer National Insurance contributions on the first £4,000 of their annual bill.

Companies that employ military veterans will pay no National Insurance contributions for the first year of their work.

Environment

Sunak announced the government’s first measures aimed at achieving net zero emissions by 2050.

He set out plans for a new plastic packaging tax to come into effect from April 2022, and a new package of tax and spend reforms aimed at making it cheaper to buy zero or low emissions cars, vans, motorbikes and taxis.

Importers and manufacturers of products that have less than 30% recyclable material will be charged £200 per tonne, reports the BBC.

The government will spend £300m on tackling nitrogen dioxide emissions in towns and cities across England and invest £640m on a new “nature for climate fund” to protect natural habitats, including planting 30,000 hectares of trees.

Sunak also announced an end for tax relief on red diesel for most sectors, to take effect in two years.

Red diesel, which is dyed to indicate that it is for off-road and some commercial use only, makes up 15% of all diesel sales and attracts 11.14p per litre in duty, compared with the standard charge of 57.95p. The subsidy costs the Treasury £2.4bn a year. Sunak will keep the relief for farmers, rail and fishing industries.

The chancellor announced £500m in spending on the rollout of new rapid charging hubs for electric cars, so that drivers are never more than 30 miles away from being able to charge up.

Fuel duty will remain frozen for another year, despite suggestions that the chancellor would raise duties to disincentivise fuel use and help the climate.

“Taken together, this Budget invests £1bn in green transport solutions,” said Sunak.

Broadband

Sunak announced £5bn of investment to roll out faster broadband across the UK by 2025, to get gigabit-capable broadband into the hardest to reach places.

The chancellor is also expected to announce a £1bn deal to boost 4G coverage, with particular benefit to Wales, Scotland and Northern Ireland.

Broadband providers could be given new powers allowing them to access blocks of flats in cases where landlords are preventing access.

Flood defences

The chancellor doubled spending on flood defence schemes to £5.2bn, following the recent impact of floods across the country. The money will go towards building up to 2,000 flood and coastal defences and protecting 300,000 homes.

Sunak said that £120m of emergency relief will be made available immediately to repair damage caused by the recent floods.

Housing

Sunak said that the government will expand the affordable homes programme with a new, multi-year settlement of £12bn.

He said he will spend £650m on tackling rough sleeping, with the aim of eliminating the problem by the end of the current parliament. The money invested will create 6,000 new places for rough sleepers, he said.

The new measure will be funded by a new stamp duty surcharge on non-UK residents, worth 2%, coming in from April 2021, as outlined in the Conservative manifesto.

Overseas buyers will face the stamp duty surcharge on top of the existing charge for those buying their second property.

Sunak also announced the creation of a new £1bn building safety fund, in the wake of the Grenfell Tower fire, to make sure all unsafe combustible cladding is removed from all housing above 18m high.

Business measures

Sunak announced that entrepreneurs’ relief will be reduced, taking the lifetime limit from £10m to £1m. The chancellor said that this will save the government £6bn over five years, and pledged that this money will be invested back into businesses.

Corporation tax will remain at 19%.

Education

Every region in the UK will get funding for specialist maths schools, the chancellor announced.

Sunak says he will invest £1.5bn over five years to improve the quality of the further education estate.

And £250,000 will be made available to each secondary school for arts activities.

Roads

The chancellor announced £2.5bn in funding to fix potholes, or a £500m bonus each year for the next five years. Across England, some 700,000 potholes were reported in the 2018 financial year. This will be enough to fill 50 million potholes, Sunak said – though there is some doubt about that figure.

He said the government will also go ahead with the A303 project, protecting Stonehenge.

Science and research

The government will be increasing investment in R&D to £22bn a year. “As a percentage of GDP, it will be the highest in nearly 40 years – higher than the US, China, France and Japan,” says the Treasury on Twitter.

Sunak says at least £800m will be invested in a new blue skies research agency, modelled on the US Advanced Research Projects Agency, an “obsession of Dominic Cummings”, says The Guardian.

And the chancellor announced £800m spending to establish two or more carbon capture and storage clusters by 2030.

Other measures

Sunak – as previously indicated – used the Budget to get rid of the 5% VAT on women’s sanitary products – dubbed the tampon tax.

Alcohol duties will be frozen. The government will allocate £1m to promote the Scottish food and drink industry and £10m to help distilleries go green.

The government plans to move 22,000 civil servants out of London, with more than 750 staff from the Treasury and other departments earmarked for a move to a campus in the north.

Devolved administrations will get a funding boost, with an extra £640m for Scotland, £360m for Wales, and £210m for Northern Ireland.

VAT on digital publications, including newspapers, books and academic journals, will be abolished from December.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Is the UK economy returning to normal?

Is the UK economy returning to normal?Today's Big Question Tories claim UK has 'turned a corner' while Labour accuses government of 'gaslighting' public

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Would tax cuts benefit the UK economy?

Would tax cuts benefit the UK economy?Today's Big Question More money in people's pockets may help the Tories politically, but could harm efforts to keep inflation falling

-

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?Talking Point Jeremy Hunt to boost minimum wage while cracking down on claimants who refuse to look for work

-

Sticky inflation and sluggish growth: why does UK economy continue to struggle?

Sticky inflation and sluggish growth: why does UK economy continue to struggle?Today's Big Question Food prices, Brexit and the Bank of England have been blamed for poor economic performance

-

Public sector pay and inflation: what’s the link?

Public sector pay and inflation: what’s the link?Talking Point Economists say government warnings of wage-price spiral are overblown

-

Why UK companies are facing a dystopian, zero-growth future

Why UK companies are facing a dystopian, zero-growth futurefeature In prioritising stability, the Treasury risks ‘stifling enterprise and entrepreneurship’

-

Is the UK facing a ‘cost of doing business’ crisis?

Is the UK facing a ‘cost of doing business’ crisis?Talking Point Mass insolvencies loom as companies face fourfold increases in energy bills