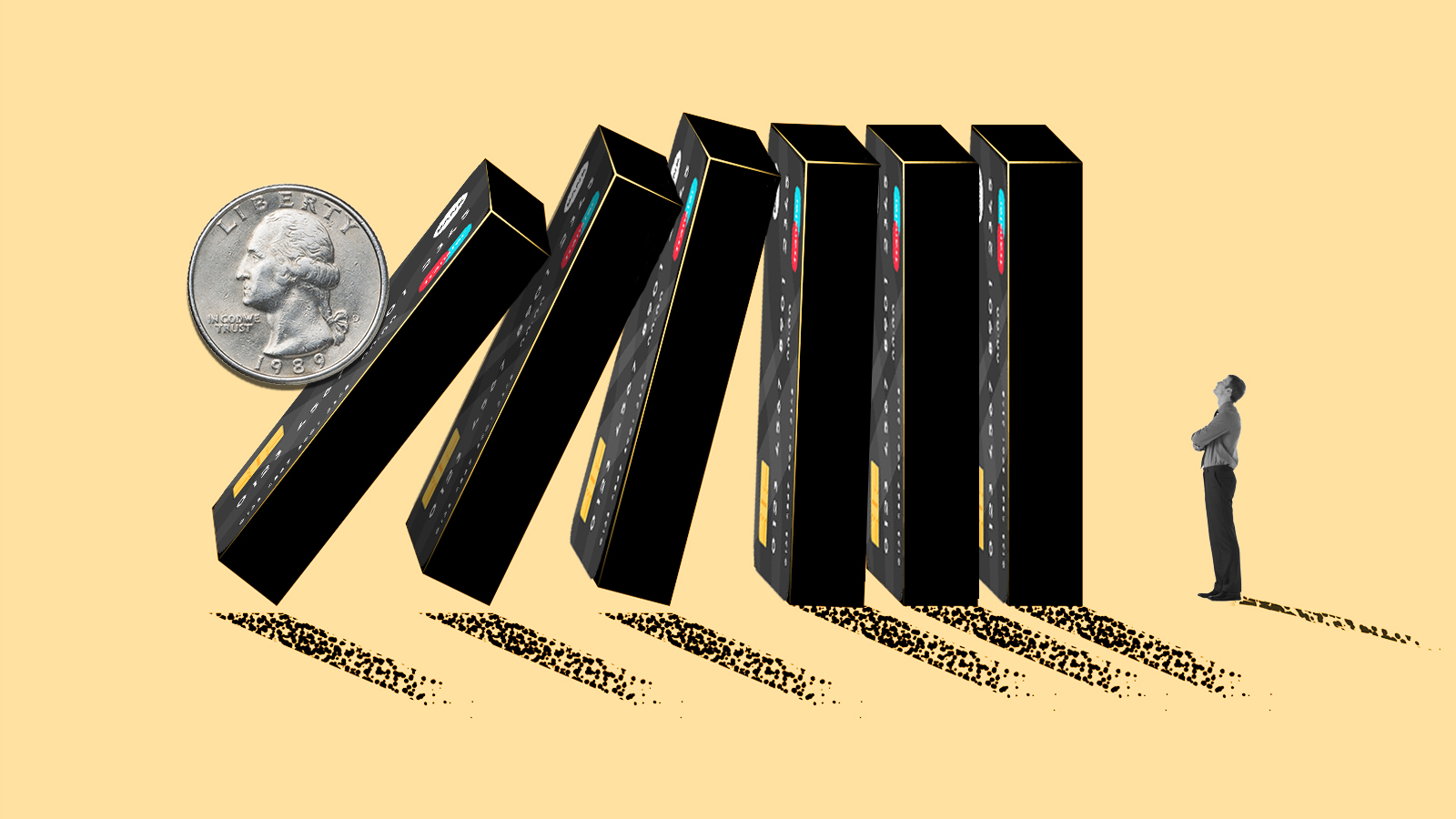

Are American consumers facing a credit crisis?

U.S. credit card debt has risen above $1 trillion. Can we afford it?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Is it time for your household to rein in its spending? The Washington Post reported that American consumers are increasingly falling behind on car loan and credit card payments, a "troubling signal of consumer stress" that is "most acute for lower-income earners" who mostly spent down the stimulus money they socked away during the pandemic. Throw in inflation and high interest rates and it's clear that "consumers are under pressure," said one analyst.

How much pressure? American credit card debt reached a "record high" of $1.03 trillion during the second quarter of 2023, Moneywise reported. And not all the money is getting paid back: Credit card delinquencies rose to 7.2% during the quarter — "passing pre-COVID levels" — and car loan defaults hit a similar level. That's taking a toll on retailers. CNN reported that Macy's says the spike in delinquencies is hurting its business. "I think the credit card revenue is an indication of some of the pressures that we're actually seeing on the consumer," said Adrian Mitchell, Macy's chief operating officer.

All those delinquencies "may be a harbinger of economic troubles ahead," Fox Business added. Defaulting consumers "raise the pressure on small- and medium-sized banks" that are already struggling in the wake of a series of bank failures earlier this year. That could have an even wider impact: Wells Fargo recently predicted a "short, moderate recession" because consumers are "exhausting their credit."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What the commentators said

What's behind the rising debt and delinquencies? "Look in the mirror," Imani Moise wrote at The Wall Street Journal. The situation is fueled by a variety of factors, but they include "consumers' continued spending and a smaller share of borrowers paying off their statements in full." The recent trend of higher interest rates should have slowed spending but "many credit-card users haven't felt burdened by higher rates." That may not be sustainable. Discipline is important, but difficult. Said one analyst: "We humans tend to overestimate our capacity for self-restraint."

Actually, that $1 trillion in credit card debt "is a sign of consumer strength," Karl W. Smith wrote for Bloomberg. The debt level follows the business cycle "rising as the economy expands and shrinking as it contracts." Right now, it's still rising — unemployment has been below 4% since the beginning of 2022. And consumers are spending less than 10% of their income on debt payments, down from a high of 13.2% in 2007. The conclusion? "You should never bet against the American consumer."

Or maybe Americans are using credit cards to simply make ends meet. "With prices of goods and services rising, consumers are increasingly using credit cards to cover expenses," Ann Carrns wrote for The New York Times. That's particularly true of younger adults. But they'll have a tougher time doing that when student loan payments resume in October after a pandemic-induced break. For those folks, "'significant' lifestyle and budget changes" are probably on the way.

What next?

Indeed, the return of student loan payments may only make the credit situation worse, Fox Business reported. A recent survey found that a third of respondents expect their monthly debt obligations to rise by $1,000 a month or more — and some of those folks believe they'll use credit cards to manage the sudden fiscal squeeze.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But some relief could be on the way, Frontline reported. The rise in inflation has resulted in larger late fees on credit card balances, thanks to a federal law that allows "to adjust their late fees as inflation rises." Federal regulators are looking at stepping in, with a rule that would limit late fees to $8 for the first month a cardholder is late with a payment — down from current highs of $30 for first-time violators.

For now, though, Americans are still spending. Retail spending rose in July, despite all that debt — and actually enabled by it. "American consumers are going to buy stuff," Marketplace noted, "as long as they have jobs."

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day