Are private schools safe from Starmer?

Schools would pay VAT under Labour government but party scraps plans to remove charitable status

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Keir Starmer has abandoned proposals to strip private schools of their charitable status if his party wins the next general election.

In a statement to the i news site on Wednesday, a party spokesperson confirmed that a Labour government would pursue its long-held plan to "remove the unfair tax breaks that private schools benefit from". But, in a marked U-turn on its previous stance, the spokesperson said this "doesn't require removing charitable status".

Speaking to the BBC's Nick Robinson on the "Political Thinking" podcast, Starmer said that removing tax exemptions was not an "attack on private schools", as some within the sector had argued, but rather a way to fund improvements to "the appalling state of our schools".

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the papers say?

"Ending the tax breaks enjoyed by private schools is one of Labour's flagship policies," said Poppy Wood, the i's politics and education reporter. "For several years", the party has said it would do so "partly by ripping up their charitable status" if it were elected.

Starmer "has now scrapped the policy", which would have required "a statutory change to the legal definition of 'charity'" and could have "wider implications for the charity sector", Wood continued. Independent schools had also argued that charitable status helps them to fund scholarships and bursaries "which help widen access" to private education.

But a Labour government would "still press ahead with applying 20 per cent VAT on school fees" as soon as the party came to power, said The Times. Doing so would be "more straightforward" than removing charitable status – though Conservatives say this could still involve "a potentially complex" legislative overhaul.

The VAT proposal has "made private school parents dread the prospect of a Labour government", said Camilla Tominey in The Telegraph. While "elite" institutions may "have the resources to offset any fee increases", many independent schools could find "the extra costs would be simply too much".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Around 7% of students in the UK are privately educated, and the policy "may sound like an automatic vote winner given that most people do not send their children to private schools", said English teacher Kristina Murkett, writing in The Spectator. But "the reality is, at best, more ambiguous and complicated".

And "at worst, it will actually worsen social mobility and undo years of progress in private school philanthropy", she continued.

What next?

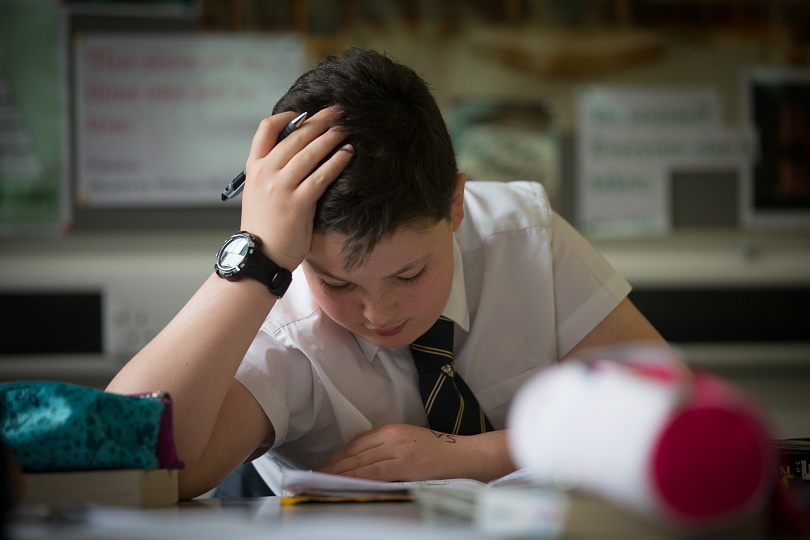

A report published by the Institute for Fiscal Studies (IFS) in July calculated that removing tax exemptions for private schools would raise £1.3bn–£1.5bn a year, equivalent to a 2% increase in day-to-day state school spending in England. In its statement to the i paper on Wednesday, Labour said the money saved would help pay for "desperately needed teachers and mental health counselling in every secondary school".

But a group of headteachers has warned that Labour's "private school tax raid would force pupils out" of some independent institutions, The Telegraph's political reporter Dominic Penna warned earlier this month.

The IFS report concluded it would be "reasonable to assume" that if private school fees rise by an effective VAT rate of 15%, it would result in a 3–7% drop in attendance.

Speaking to the BBC's Robinson, Starmer noted that schools would not necessarily need to "pass" the additional costs of paying VAT on to parents. "Each of the schools is going to have to ask themselves whether that's what they want to do."

Still, some private schools "are likely to celebrate the softening of Labour's position" on the issue, said the Financial Times. Charities "enjoy" exemptions on gifts and donations, as well as capital gains tax, which they would now retain should Labour win the next election.

Labour will now be hoping to "draw a line under confusion" about its plans, said the paper.

Julia O'Driscoll is the engagement editor. She covers UK and world news, as well as writing lifestyle and travel features. She regularly appears on “The Week Unwrapped” podcast, and hosted The Week's short-form documentary podcast, “The Overview”. Julia was previously the content and social media editor at sustainability consultancy Eco-Age, where she interviewed prominent voices in sustainable fashion and climate movements. She has a master's in liberal arts from Bristol University, and spent a year studying at Charles University in Prague.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

How will new V level qualifications work?

How will new V level qualifications work?The Explainer Government proposals aim to ‘streamline’ post-GCSE education options

-

VAT on private schools: a spiteful policy?

VAT on private schools: a spiteful policy?Talking Point Labour accused of 'politics of envy' but some see policy as a moderate 'compromise'

-

The pros and cons of private schools

The pros and cons of private schoolsThe Big Debate Labour intends to scrap private school tax exemptions if it wins the next election

-

How to get a bursary at an independent school

How to get a bursary at an independent schoolfeature Many independent schools offer means-tested bursaries to pupils whose families wouldn’t be able to afford the fees otherwise

-

Labour’s assault on private school tax breaks: a vote winner?

Labour’s assault on private school tax breaks: a vote winner?Talking Point Labour plans to scrap tax breaks for private schools could generate up to £1.5bn in additional revenue, says a leading think tank

-

Rishi Sunak and the importance of maths

Rishi Sunak and the importance of mathsTalking Point Prime minister wants mandatory maths lessons until the age of 18, but critics say the policy doesn’t add up

-

Should private schools be banned? The pros and cons

Should private schools be banned? The pros and consIn Depth Head of private school association says Labour’s proposal is ‘vote loser’

-

Sport psychology in schools

Sport psychology in schoolsSpeed Read School sport can help pupils deal with pressure and stress