2022 will have the weirdest economy in decades

Will Biden get midterms credit for a red hot economy? It's up to him.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Last year saw the highest inflation in almost 40 years, with the Consumer Price Index up 7 percent. "Core" inflation, which leaves out food and energy costs, was a still-high 5.5 percent. The Federal Reserve is now expected to start hiking interest rates in March, well ahead of previous expectations.

It's not all bad news, though. Unemployment is near a record low, with every sign it will continue to fall throughout the coming year. Wage growth is surging, particularly at the bottom of the income ladder. People are quitting jobs and finding new ones at a record clip.

This year will also have a midterm election, and we'll probably go to the polls amid the weirdest economy in many decades — with possibly the highest inflation since the early 1980s but also the best job market since the 1960s. It will be an interesting test case for how economic outcomes influence politics, and we'll see if the Democratic Party can take credit for its genuine successes.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

I'd be a fool to make concrete predictions about what will happen between now and Election Day. However, I can outline two plausible scenarios.

First would be a good future, where inflation settles down but growth and job creation keep ripping. For instance, if the Omicron wave is the last acute phase of the pandemic, that would give businesses time to untangle supply chains while spending rebalances away from goods and towards services.

That's important because though overall consumer spending has roughly followed the pre-pandemic trend, we've seen much more spending on goods and much less on services, as people are staying at home instead of going out to restaurants, theaters, vacations, and so on. This creates inflation because prices tend to be "sticky" downward, meaning they fall slowly even with weak demand. So we have massive spending on goods, bidding the prices up, but the correspondingly weak spending on services means stagnant prices, not a deflationary counterbalance. Once people no longer fear the pandemic, that should end.

Then there's a bad option. If there's another variant after Omicron, we could be in for yet another year of pandemic, and supply chain problems could persist into 2023. We might even begin a true wage-price inflationary spiral, which could lead in turn to drastic interest rate hikes from the Federal Reserve that would create a recession.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

I suspect (setting aside tail risk possibilities like the crypto bubble blowing up the global banking system) the true future will be somewhere in the middle. Given that Omicron is both incredibly contagious and much less deadly than the Delta variant, but also gives cross-immunity to Delta, this spring might really be the point at which COVID stops being a major concern (alas, exterminating the virus entirely is impossible at this point). There's no guarantee, but I'd guess this may be the final phase of intense pandemic life.

However, even if the pandemic fades away, it might be quite awhile before supply chain problems get fully ironed out. As I've previously argued, the weak post-2008 recovery left terrible scars in the form of systematic underinvestment in all kinds of sectors — raw materials, semiconductors, houses, and more. New semiconductor factories take a long time to get operating, and houses take a long time to build (if you can build at all, which is virtually impossible in high-demand states like California because so much land is zoned for single-family homes exclusively). I would not be at all surprised if overall inflation stays at 4 or 5 percent for a year or so even as the pandemic winds down.

Still, let's suppose a middling to positive economy later this year. There are some chronic shortages and prices keep going up in certain areas, but jobs are plentiful and wage increases far outstrip inflation. What does that mean for Biden and the midterms?

On the one hand, many people genuinely hate inflation, especially in the form of gas price increases. Americans have had a decade of rock solid prices and have learned to expect full stores and rapid, free delivery of whatever they want to buy online. Even partly empty shelves and a seven-day delivery schedule is apparently a sign of looming dystopia for lots of folks.

On the other hand, a lot of the worst-off people in our country are doing better than they have in 20 years. Wage growth for the bottom quarter of earners — the people whose backbreaking labor enabled all the cheap conveniences of the post-2008 years — was increasing at a 5.1 percent annual rate in the most recent figures. That's the best rate since 2002, when the economy was still in a post dot-com collapse funk, and it's much higher than income growth for the top quarter, which is just 2.7 percent. There are presently more job openings per unemployed person than at any time in the Obama or Trump presidencies. The unemployment rate is already where it was in 2018 and still falling. We may see the lowest unemployment since the 1960s or even the 1950s, when it dropped below 3 percent.

If my worst-case scenario comes true this year, Biden will be blamed, and Democrats will lose the midterms. That's a clear lesson of history. But whether incumbent parties get credit for good times is less clear. Al Gore, for instance, didn't cruise to victory in his 2000 presidential race despite former President Bill Clinton presiding over a red-hot economy for several preceding years.

Ultimately, whether Biden and his party get credit for an economic boom largely produced by left-wing Democrats' influence on the pandemic rescue packages is a political question. Can Biden harness good outcomes among downscale workers who usually don't vote in large numbers? Can Democrats figure a way to communicate their message that isn't just complaining about biased media coverage? Can union organizers take advantage of favorable conditions to reverse the long decline of the labor movement — if the sudden surge of organizing at Starbucks is just the beginning — and will that energy and organizing strength go into the midterm campaign? And can Biden can use the presidential megaphone to convince people good times are actually good?

We'll find out soon enough.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

The ‘mad king’: has Trump finally lost it?

The ‘mad king’: has Trump finally lost it?Talking Point Rambling speeches, wind turbine obsession, and an ‘unhinged’ letter to Norway’s prime minister have caused concern whether the rest of his term is ‘sustainable’

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

‘They’re nervous about playing the game’

‘They’re nervous about playing the game’Instant Opinion Opinion, comment and editorials of the day

-

Memo signals Trump review of 233k refugees

Memo signals Trump review of 233k refugeesSpeed Read The memo also ordered all green card applications for the refugees to be halted

-

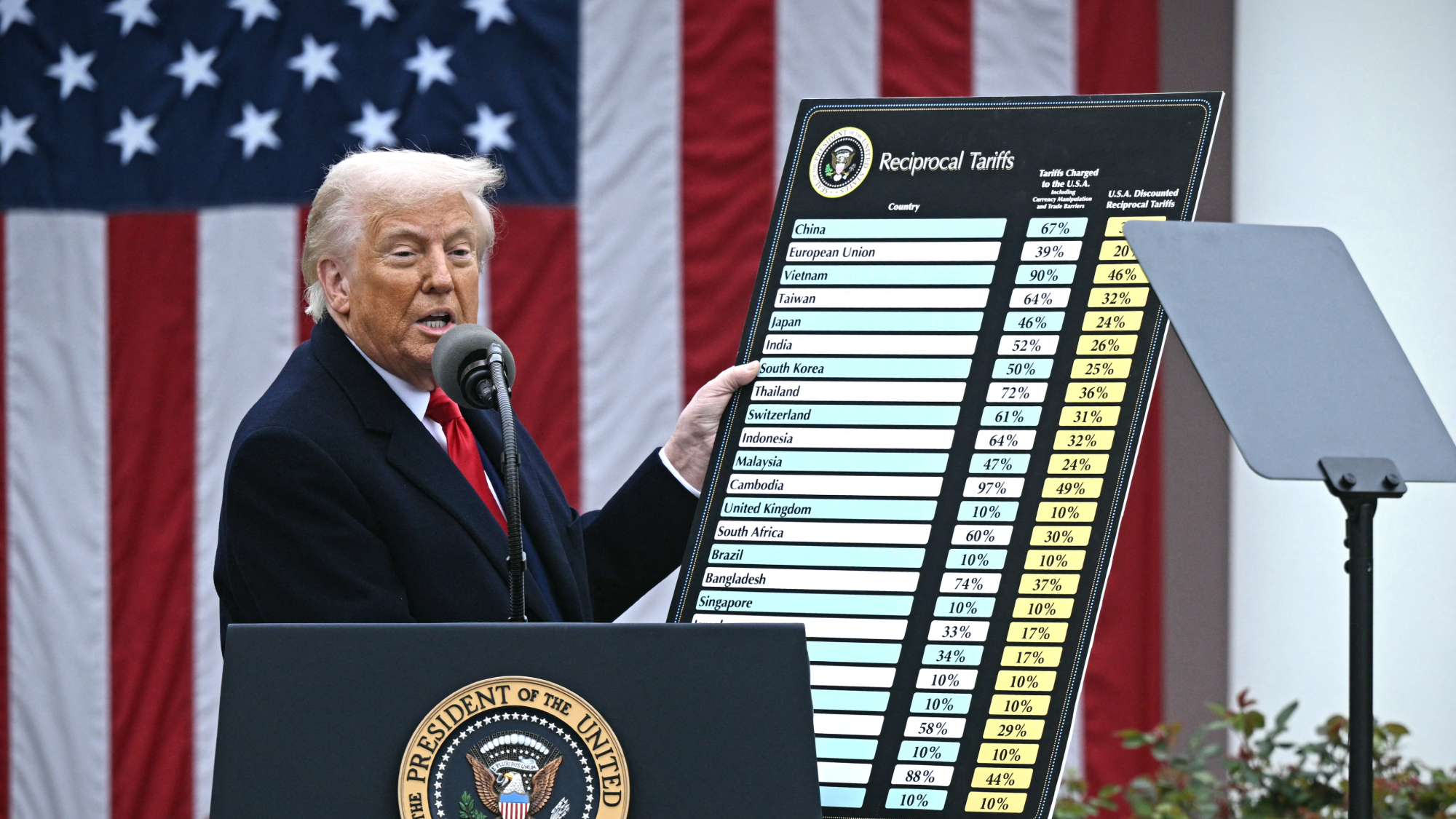

Tariffs: Will Trump’s reversal lower prices?

Tariffs: Will Trump’s reversal lower prices?Feature Retailers may not pass on the savings from tariff reductions to consumers

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June