China and geopolitics: what the experts think

Covid ructions, second-guessing and capital flight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Covid ructions

Almost a month after Russia’s invasion of Ukraine, turbulence in the oil market shows little sign of ending, says The Economist. The price of a barrel of Brent crude has whipsawed from a peak of $128 to a low of $98. Indeed, “the OVX index of oil market volatility has rarely been higher in the past decade than it has been this month”, reflecting the big geopolitical forces – war, inflation and Covid-19 – now buffeting the world. This week, the latter resumed centre stage on news of an unexpected eight-day lockdown in China’s financial capital, Shanghai. “There were signs of deceleration in China’s economy, particularly in the property sector” even before the latest Covid outbreak. Any sign of the slowdown becoming more broad-based “would mean more tumult for commodities”.

Second-guessing

China’s CSI 300 Index, a benchmark of Shanghai and Shenzhen listed stocks, appeared to take the news in its stride, said Lex in the FT: it fell by less than 1%. But it had already fallen 16% this year, so “the risk of lockdowns has to some extent been priced in”. Yet the sudden restrictions threaten to have “a bigger, lasting influence”. Government officials in Shanghai denied plans to lock down the city just one day before Sunday’s announcement. “That has left investors second-guessing which companies and cities will be next in line to be affected.”

Capital flight

Many are taking no chances, said Pete Sweeney on Reuters Breakingviews. A study by the Institute of International Finance indicates that China has been experiencing “unprecedented” capital flight since Russia invaded Ukraine, with average daily outflows touching nearly £500m at one point. To add insult to injury, “the study found no similar outflows from other emerging markets.” Any exodus of pension funds and insurers who “buy and hold” assets for the long run in China will be painful. “Although small in absolute terms, their presence helps anchor market valuations.” Chinese bourses are already the world’s worst performing outside Russia. “If the capital flight is sustained, it could aggravate the current sell-off at a politically sensitive time”: President Xi Jinping is set to be elected to a third term later this year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

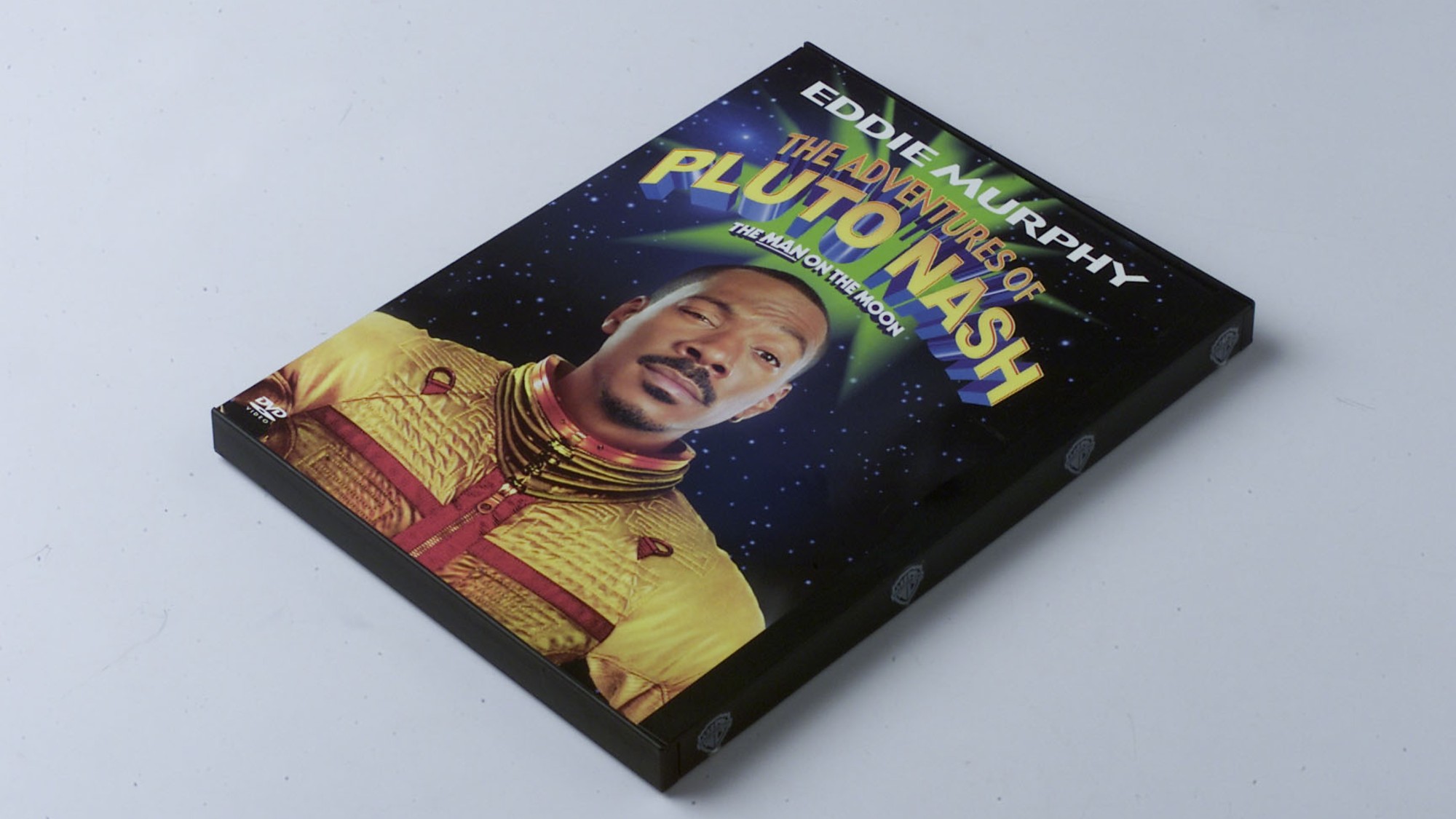

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere