The benefits of filing your self-assessment during the festive season

The tax return deadline is at the end of January but acting sooner may be helpful

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Millions of people are due to file a self-assessment tax return by the end of January.

The deadline to file your return and pay any tax due is 31 January, or you could face a fine starting from £100. But taxpayers are being warned to start early as it may be harder than usual to get help.

HMRC has said it will focus on "priority calls" in the run-up to the deadline, highlighting that two-thirds of calls to its self-assessment helpline can be resolved online.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, that is a "bizarre choice", said Holly Mead in The Times, as it leaves a "significant number of people" without support, including those who can’t access online services or don’t feel confident trying.

Data from HMRC showed that 22,060 people submitted their most recent tax return between Christmas Eve and Boxing Day last year. Of these people, 141 people filed between 11pm and midnight on Christmas Eve, while the peak time over the three days was between midday and 1pm on Boxing Day, with 953 returns, and 319 were filed at the same time on Christmas Day.

Here is why it may be worth filing your return over the festive period.

Who has to file a self-assessment tax return?

A self-assessment return reports any untaxed income to HMRC.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If you are self-employed, freelance or receive "multiple sources of income" such as from rent or dividends, then you will "most likely" have to submit an annual self-assessment tax return, said Unbiased.

Some people may not realise this includes income they have earned, said MoneyWeek, as "frozen thresholds and lower allowances push more people into paying tax".

This may include high earners receiving child benefit, people earning more than £1,000 from a "side hustle" or if you earn more than £1,000 from savings, added Mead. So, in short, "a lot of people".

The deadline for paper returns was 31 October so that has already passed. If you haven't already filed, you need to complete an online tax return and pay any tax due by 31 January.

The benefits of starting early

Tax returns "aren't fun", said Simply Business, but there are benefits to filing as soon as possible. For example, knowing the "actual cost" of your bill can ensure you have money ready to pay by January.

That means you can set a budget over Christmas, added MoneyWeek, plus you would have time to set up a Time to Pay arrangement with HMRC "if you can't afford the bill".

Completing a self-assessment tax return "isn't always straightforward", said Which?, so you may need time to call the HMRC helpline or check its website. You could be "left hanging in a long queue of stressed customers" if you wait until January to make a start.

You may also receive rebates "more quickly", added the consumer watchdog, for overpaid tax from previous years.

How to reduce your tax bill

The last thing self-employed people or business owners want is to "pay more tax" than they need to, said TaxAssist Accountants, so it is "crucial" to know what expenses you can claim to keep your bill down.

Self-employed business owners can deduct "certain business expenses" to reduce the trading profit and therefore the tax owed, the website added. This includes the cost of running the business such as an office, stationery, finance and repair costs.

Higher and additional rate taxpayers can claim tax relief on charitable donations, making giving to a good cause "good for charity as well as your tax bill", said The Times Money Mentor. There may be other expenses you can claim for such as work uniform costs or business travel as well as energy bills if you work from home.

You can also "take action to reduce your liability going forward", said Rob Morgan, chief analyst and broker Charles Stanley. This includes putting more money into an ISA or pension, dividing assets with a spouse and "harvesting" assets to make use of falling allowances and selling up before you could be charged more.

For example, the amount of capital gains you can earn tax-free from selling assets such as shares is dropping from £6,000 to £3,000 from April 2024, while the dividend allowance is halving to £500.

An accountant can help claim expenses and deal with complicated issues, added Unbiased. You may not need an accountant if your finances are "relatively simple" and you know what you are dong, but an accountant could help avoid mistakes that result in a fine plus the cost of using a professional is “tax-deductible”.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

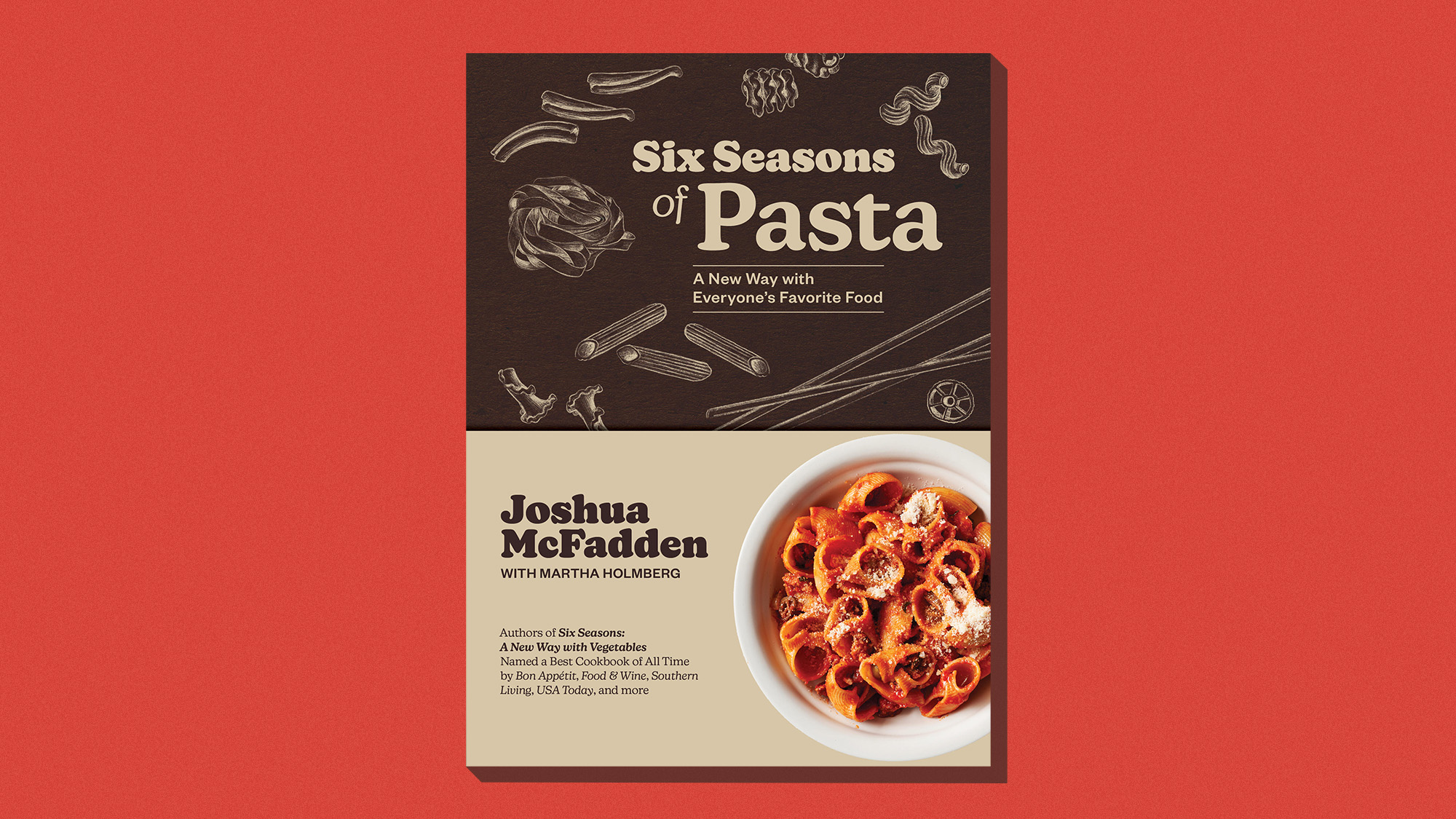

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

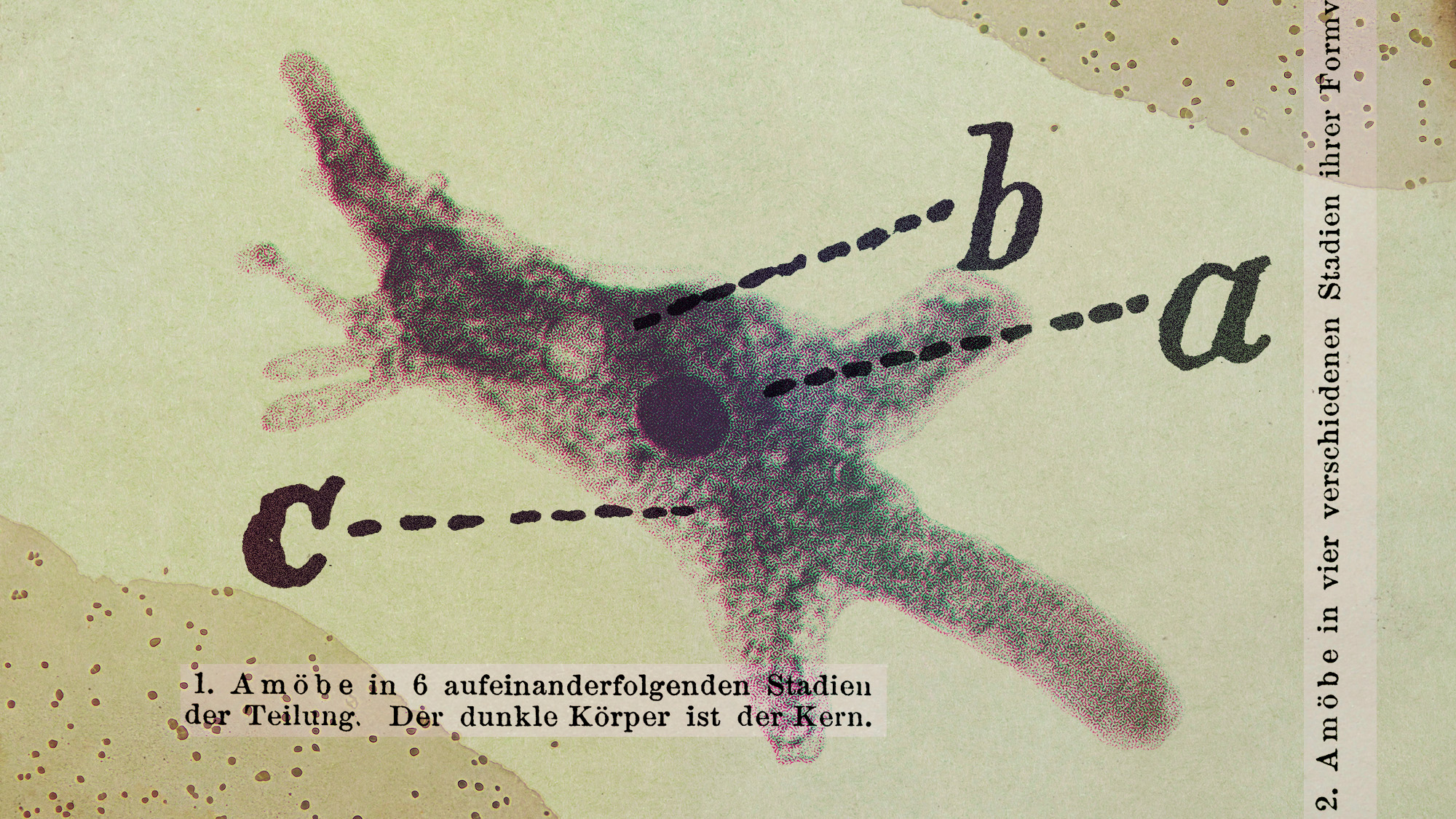

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

Filing statuses: What they are and how to choose one for your taxes

Filing statuses: What they are and how to choose one for your taxesThe Explainer Your status will determine how much you pay, plus the tax credits and deductions you can claim

-

3 tips to help protect older family members from financial scams

3 tips to help protect older family members from financial scamsthe explainer Prevent your aging relatives from losing their hard-earned money

-

What would a credit card rate cap mean for you?

What would a credit card rate cap mean for you?the explainer President Donald Trump has floated the possibility of a one-year rate cap

-

What to look for in a reliable budgeting app

What to look for in a reliable budgeting appThe Explainer Choose an app that will earn its place in your financial toolkit

-

Planning a move? Here are the steps to take next.

Planning a move? Here are the steps to take next.the explainer Stay organized and on budget

-

3 smart financial habits to incorporate in 2026

3 smart financial habits to incorporate in 2026the explainer Make your money work for you, instead of the other way around

-

What to know about the rampant Medicare scams

What to know about the rampant Medicare scamsthe explainer Older Americans are being targeted

-

4 ways to streamline your financial life in 2026

4 ways to streamline your financial life in 2026the explainer Time- and money-saving steps