The disappointing GDP report is a wake-up call for Democrats

Inflation has consequences

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The American economy was red-hot in the second quarter of 2021, growing at a 6.5 percent annualized rate, adjusted for inflation, and surpassing its pre-pandemic level. Good news, but there was a problem: Many on Wall Street expected a white-hot economy of 8 percent growth or higher. What's more, that expectation comes after it had been drifting lower of late. So real GDP growth failed to hit even that reduced target.

It's a disappointment Washington should take note of, especially the Biden White House and congressional Democrats as they attempt to push through two big spending bills. If the government injects money into an economy at a level that exceeds its capacity to productively meet that increased demand, the result will be higher inflation rather than more real growth. And it's growth after inflation that translates into higher take-home pay for workers.

But rising prices are eating into those gains. Not counting inflation, the economy grew at a 13 percent pace, the fastest non-pandemic quarter of growth since the third quarter of 1981. But inflation offset nearly half of that increase. It's one sign that too much money may be chasing too few goods. Or as consulting firm Capital Economics characterized the GDP report in a morning research note, "Overall, more evidence that stimulus provided surprisingly little bang-for-its-buck, with the economy quickly pushing up against unexpected supply constraints instead, which has driven inflation higher."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And while some of these supply constraints are temporary, the concern among economists is that if prices rise for a sustained period — whatever the nature of the initial causes — the surge will change our expectations about future inflation. And those altered expectations can become self-fulfilling if workers start demanding higher pay and businesses start charging higher prices as a result of those beliefs.

With the size of the economy now beyond where it was before the COVID-19 outbreak, policymakers need to think about how their actions will affect both growth and inflation going forward. From that perspective, then, the progress being made on the $1 trillion bipartisan infrastructure bill is encouraging. Of that amount, some $550 billion would be new spending, so far including $110 billion for roads, bridges, and major projects; $66 billion for passenger and freight rail; $39 billion for public transit; $65 billion for broadband; and $17 billion for ports and waterways.

It's a lot of money, even spread over a decade, but the goal is to boost the economy's long-term productivity by improving both physical and digital connectivity. Better infrastructure makes it easier for both atoms and bits to get from here to there. And by boosting the productive or "supply-side" of the economy, sustained inflation is less likely to become a chronic issue.

The other bill Congress is working on could prove more problematic. Anything close to the $3.5 trillion social spending plan (including education, child care, climate change, paid family and medical leave) risks intensifying today's inflationary pressures by pushing even more money into a supply-constrained economy. That's why if moderate Democrats are successful in reducing that amount, it might help make this recovery a longer one. The last thing we need is an inflation shock that forces the Federal Reserve to crank up interest rates and possibly terminate the expansion. Whatever good Democrats think their social spending will do, much could be undone by a recession and rising unemployment. While the pre-pandemic expansion was historically slow, it was lengthy. And by the end, wages were rising across the spectrum, even for the lower-skilled.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Yet if America is going to have a New Roaring '20s of sustained rapid growth, much of the heavy lifting is going to come from the private sector. And there's been lots of good news on that front, even in just the past two weeks. Hey, mock uber-billionaire Jeff Bezos and his provocatively-shaped rocket if you must, but the billionaire "space race" is helping advance technologies that will be critical to creating a multi-trillion-dollar economy in space. The recent announcement by Google-owned AI company DeepMind that its AlphaFold algorithm can confidently predict protein structures could result in new drugs or climate-resistant crops. Then there's the Wall Street report that startup Form Energy may have found the "holy grail" of the renewable energy sector: an inexpensive battery that provides long-lasting power storage for grids.

To get the most out of those and other innovations, America needs an efficient infrastructure system, but also a stable macroeconomic environment. Unfortunately, Washington is focusing too much right now on the former rather than the latter. Maybe this disappointing GDP report will help shift that perspective.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘The forces he united still shape the Democratic Party’

‘The forces he united still shape the Democratic Party’Instant Opinion Opinion, comment and editorials of the day

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

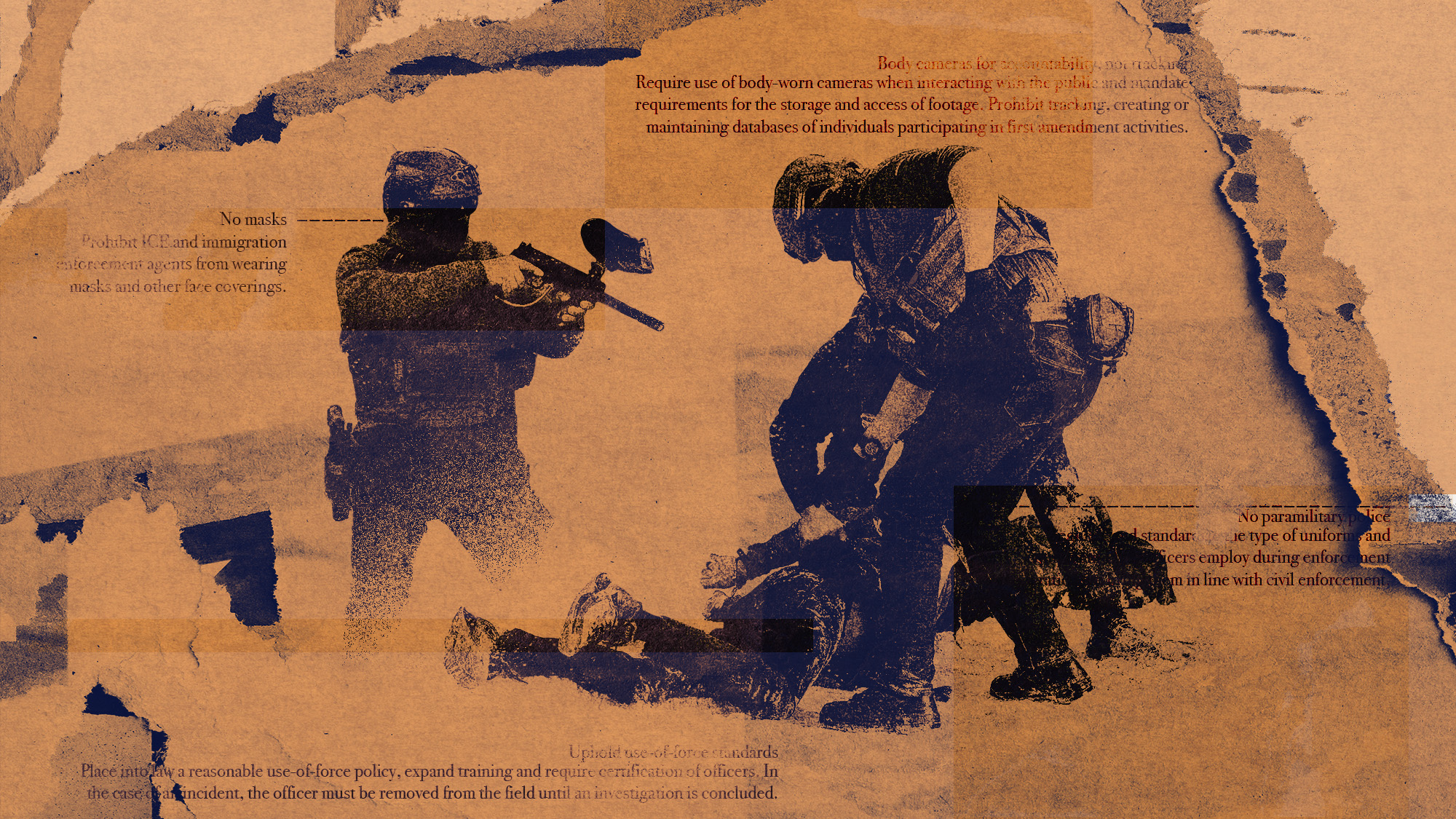

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

Democrats push for ICE accountability

Democrats push for ICE accountabilityFeature U.S. citizens shot and violently detained by immigration agents testify at Capitol Hill hearing

-

Democrats win House race, flip Texas Senate seat

Democrats win House race, flip Texas Senate seatSpeed Read Christian Menefee won the special election for an open House seat in the Houston area

-

The ‘mad king’: has Trump finally lost it?

The ‘mad king’: has Trump finally lost it?Talking Point Rambling speeches, wind turbine obsession, and an ‘unhinged’ letter to Norway’s prime minister have caused concern whether the rest of his term is ‘sustainable’

-

Is Alex Pretti shooting a turning point for Trump?

Is Alex Pretti shooting a turning point for Trump?Today’s Big Question Death of nurse at the hands of Ice officers could be ‘crucial’ moment for America