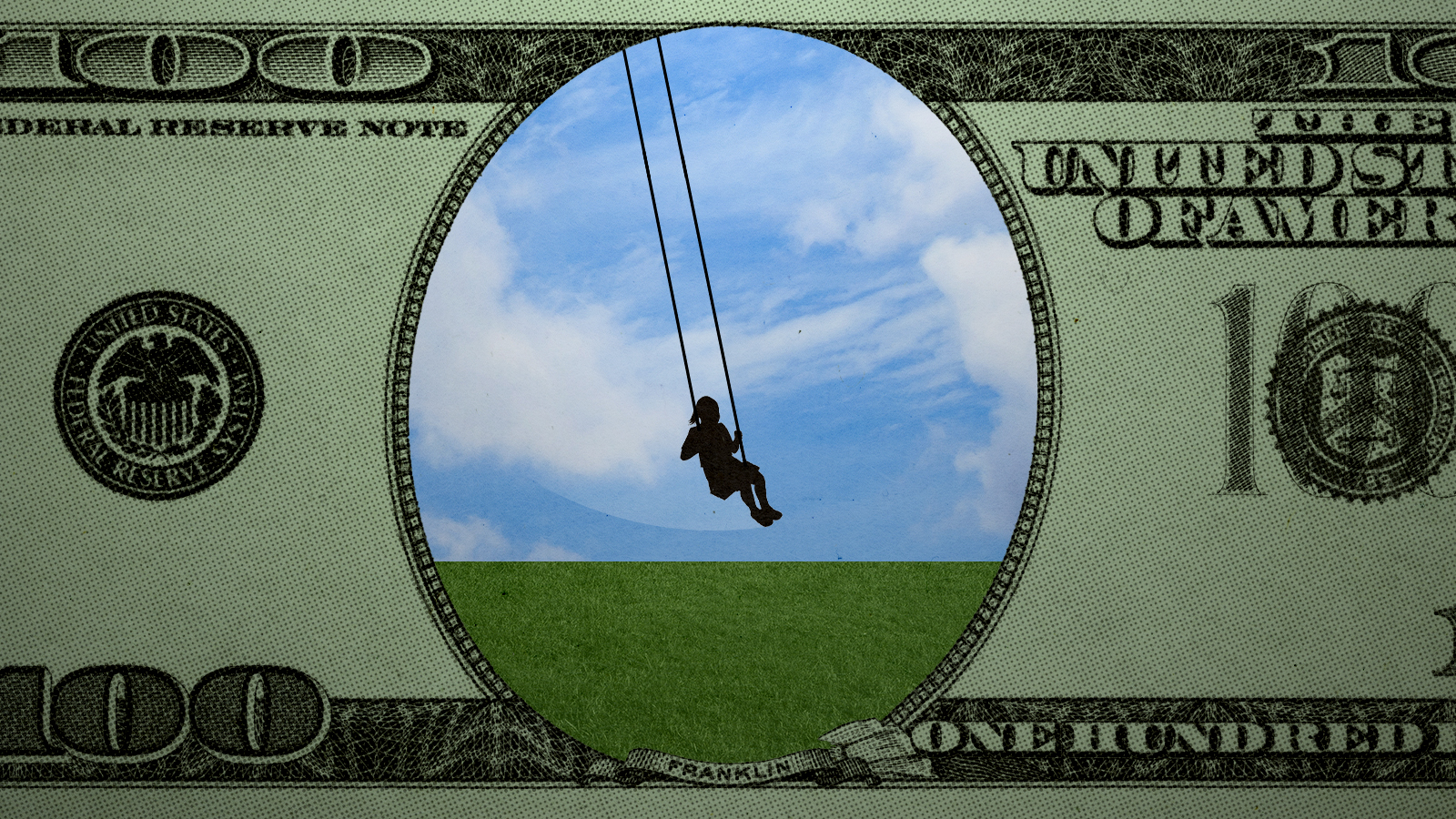

Understanding the debate around permanent CTC payments

Monthly payments could bring down poverty — or blow up the deficit

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Although the pandemic-era Child Tax Credit (CTC) payments to American families dried up earlier this year, passing a renewal of the program — and making it permanent — remains a top Democratic priority.

The program sent checks of $300 a month to most families for every child under the age of 6 and $250 a month for kids ages 6 through 17. Legislation to extend the program has stalled, CNBC reports, but there is "a growing list of of Democratic or affiliated legislators calling for reupping the credit." Until that happens, though, "families who are eager for more generous child tax credit checks will likely have to wait." Here are some ways those families could benefit — and why there's some skepticism about the proposal.

Pro: Last year's payments measurably reduced poverty

The checks were "vastly beneficial" to families, Jason Linkins writes at The New Republic. "In the six months of the expanded CTC, the overall rate of child poverty in the United States was slashed by 30 percent; food insufficiency was cut by 26 percent." Ending the program had the opposite effect: After the payments expired late in 2021, "the child poverty rate was up more than 40 percent, and any momentum behind reviving the measure was dead."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That makes a significant impact in the lives of people who were temporarily lifted from poverty, says Helaine Olen in The Washington Post. "Academic research demonstrates that income supports for families lead to everything from improved infant birth weights to better high school graduation rates, as well as an increased likelihood of attending college. That, in turn, will massively benefit each and every one of us."

Con: Cash payments might reduce parents' incentive to get a job

Prior to the pandemic-era payments, families could take advantage of the Child Tax Credit only when they filed their taxes. That was "a credit against taxes paid, which means work is required," Sen. Marco Rubio (R-Fla.) wrote last year in The Wall Street Journal. The government checks that families received "is wealth redistribution and the first step toward a universal basic income, because it includes no work requirement." In a separate statement he added: "We've seen the destructive consequences that follow when the government pays people not to work."

"There is a mountain of evidence that people's decisions whether or not to work respond to changes in tax policy, including to the generosity and structure of tax credits," Michael R. Strain writes in National Review. "When assessing whether a permanent expansion of the child tax credit is likely to affect people's decisions to work, that broader body of evidence should be considered."

Pro: But last year's payments didn't actually reduce employment

"The research indicates that providing parents with financial support for their children is not leading them to forgo employment income altogether," say researchers at Washington University in St. Louis. A look at employment rates among families receiving the checks found "no significant differences" in work participation among low-income, middle-income, and high-income recipients. "We also see no evidence that the CTC is increasing the proportion of parents who are staying home with their children rather than working."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A study from Columbia University had similar results, writes Ezra Klein in The New York Times. "Conservatives warned that the benefit would discourage work among parents, but the economists watched, and there's no evidence it did. Poor people, just like rich people, want to live on more than $3,000 per child per year."

Con: It's expensive

"Extending the expanded child credit would cost roughly $100 billion per year in new deficit spending" says The Heritage Foundation's Preston Brashers. "It would be irresponsible and counterproductive for Congress to add to our current deficit as the Federal Reserve is struggling to contain inflation." Besides, he says, "with $29.7 trillion of debt and counting … tax credits merely shift the burden of taxes to all those taxpayers who don't qualify for them."

That $100 billion price tag is "more than we spend on any existing nonmedical means-tested program, including food stamps," Bruce D. Meyer and Kevin Corinth write in The Washington Post.They conclude: "Expanding the child tax credit would not be a cost-effective way to address poverty."

Pro: Payments would help families struggling with inflation

"For families who were receiving up to $300 per child per month and now getting nothing, the price increases on groceries and gas can be scary," Katie Teague writes at CNET. Without a revival of government assistance, "those families might face food insufficiency and have difficulties paying their rent and utilities."

"Low- and middle-income families are getting hit the hardest," adds Ethen Kim Lieser at The National Interest. "Not only do they spend a larger share of their income meeting basic needs, they tend to have less savings to help cushion the blow of higher prices." That's why "reinstating last year's child tax credit enhancements couldn't come at a better time."

Con: It will be hard for Democrats to get the politics right

"Democrats, meanwhile, remained hamstrung as ever by their own right flank and, despite having narrow majorities in both houses of Congress and a sitting president, were unable to save the child tax credit, landing millions of American kids back in poverty," Elizabeth Bruenig writes in The Atlantic. "Politicians, whatever they say about their values and their beliefs, care mainly about power and money; believe it until you see them do or say something that could really cost them."

And there could be a cost. One poll found that "white, college-educated Democrats were the only demographic that expressed majority support for maintaining the expanded credit with no connection to work," Rachel M. Cohen reports at Vox. "Focus group research of working-class parents in southeastern Ohio, Atlanta, and San Antonio yielded similar results." That means there's a chance that "Democrats will just wait until after the midterms, when they can blame the passage of a work requirement on Republicans taking control of Congress."

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.