First quarter GDP plunged 2.9 percent

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

We already knew that GDP fell in the first quarter. The Department of Commerce had estimated that output fell by 1 percent as manufacturers sold off inventories produced last year rather than producing new goods, and with unusually harsh weather keeping consumers at home, and shutting down construction and forestry sites.

But new data suggests it was worse than we thought. GDP actually fell in the first quarter at a seasonally adjusted annual rate of 2.9 percent. That's the worst decline since the first quarter of 2009, when output fell 5.9 percent.

The big question is whether this is just a temporary bump in the road, or whether it reflects a more serious problem. Some will argue that this slump is a product of the Federal Reserve tapering its quantitative easing programs too early, and that this slump indicates that it is inevitable that the Fed will have to go back to a stronger stimulus program to get the economy growing again. This is a premature view. A single quarter's data can be quirky, and influenced by transient factor like weather and inventories.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Still others argue that the problem is ObamaCare, but although healthcare spending slightly fell, the impacts of that program will become clear in the long term, not over a single quarter.

Those taking a more optimistic view of the data will argue that the improving employment picture, rising service sector activity, and rising stock markets suggest a broader economic strength and continued recovery. That is the view that I am taking until the second quarter's data shows otherwise.

But certainly, this urges caution. The Federal Reserve must begin to consider the possibility that the taper came too early, and be prepared to reverse course at a moment's notice.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

‘One Battle After Another’ wins Critics Choice honors

‘One Battle After Another’ wins Critics Choice honorsSpeed Read Paul Thomas Anderson’s latest film, which stars Leonardo DiCaprio, won best picture at the 31st Critics Choice Awards

-

Son arrested over killing of Rob and Michele Reiner

Son arrested over killing of Rob and Michele ReinerSpeed Read Nick, the 32-year-old son of Hollywood director Rob Reiner, has been booked for the murder of his parents

-

Rob Reiner, wife dead in ‘apparent homicide’

Rob Reiner, wife dead in ‘apparent homicide’speed read The Reiners, found in their Los Angeles home, ‘had injuries consistent with being stabbed’

-

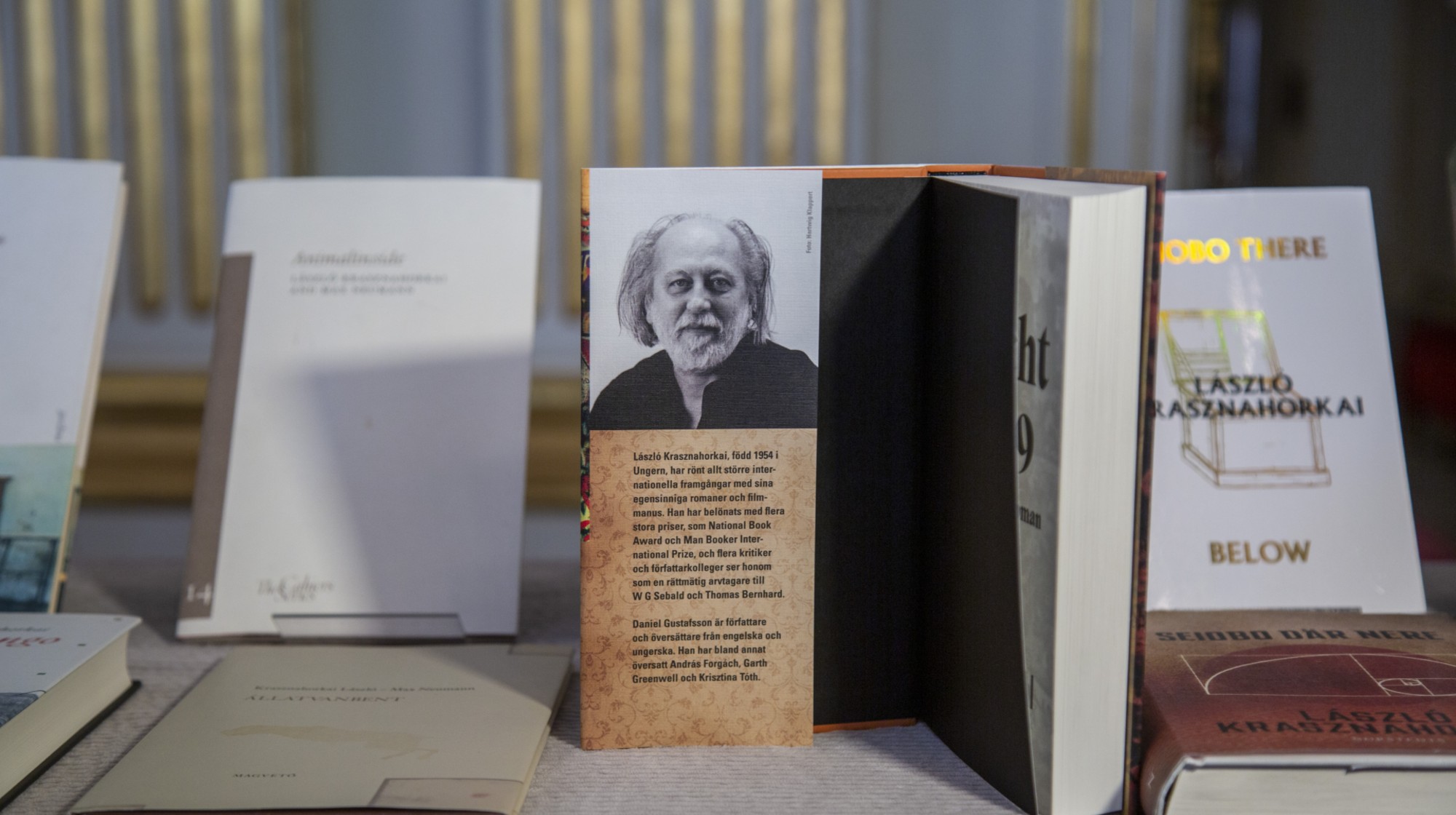

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees