AT&T, DirecTV to merge in $49 billion deal

Facebook.com/ATT

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Sunday, AT&T announced it is acquiring DirecTV, gaining 20 million U.S. subscribers in a $49 billion deal.

AT&T will buy the company at $95 a share, The Washington Post reports, or $66.40 a share in AT&T stock and $28.50 a share in cash. Assuming the two giants join forces, they will be able to sell consumers bundles of phone, pay-TV, and high-speed internet. "This is very, very unique," AT&T Chairman and CEO Randall Stephenson said in a conference call. The deal "fulfills a vision that we've had for a couple of years... to take premium content and deliver it over multiple points for the consumer."

It is the latest large-scale merger in the telecommunications industry, a trend that worries some. "The industry needs more competition, not more mergers," says John Bergmayer of the consumer advocacy group Public Knowledge. "We'll have to analyze this one carefully for potential harms both to the video programming and the wireless markets."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘One Battle After Another’ wins Critics Choice honors

‘One Battle After Another’ wins Critics Choice honorsSpeed Read Paul Thomas Anderson’s latest film, which stars Leonardo DiCaprio, won best picture at the 31st Critics Choice Awards

-

Son arrested over killing of Rob and Michele Reiner

Son arrested over killing of Rob and Michele ReinerSpeed Read Nick, the 32-year-old son of Hollywood director Rob Reiner, has been booked for the murder of his parents

-

Rob Reiner, wife dead in ‘apparent homicide’

Rob Reiner, wife dead in ‘apparent homicide’speed read The Reiners, found in their Los Angeles home, ‘had injuries consistent with being stabbed’

-

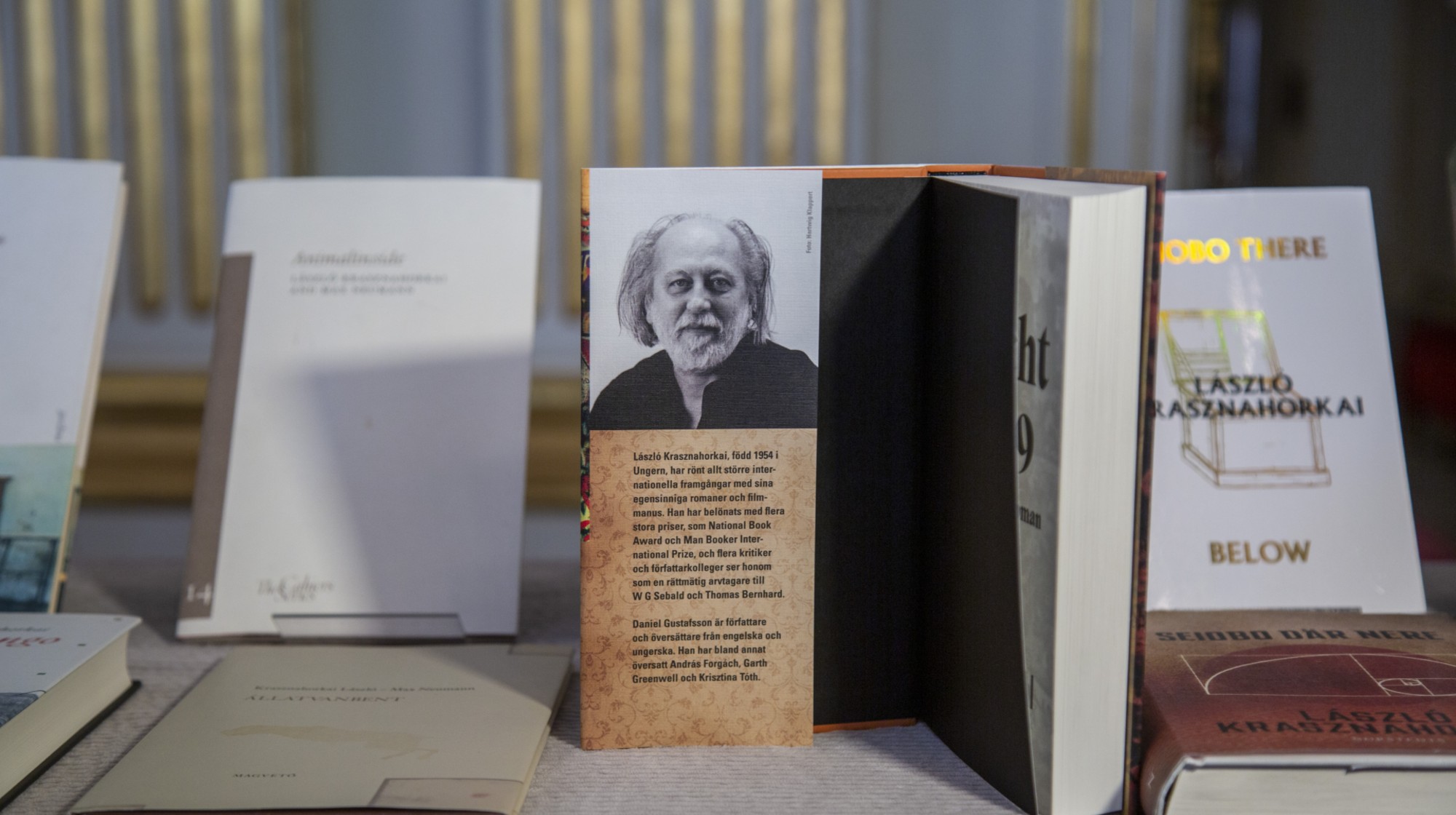

Hungary’s Krasznahorkai wins Nobel for literature

Hungary’s Krasznahorkai wins Nobel for literatureSpeed Read László Krasznahorkai is the author of acclaimed novels like ‘The Melancholy of Resistance’ and ‘Satantango’

-

Primatologist Jane Goodall dies at 91

Primatologist Jane Goodall dies at 91Speed Read She rose to fame following her groundbreaking field research with chimpanzees

-

Florida erases rainbow crosswalk at Pulse nightclub

Florida erases rainbow crosswalk at Pulse nightclubSpeed Read The colorful crosswalk was outside the former LGBTQ nightclub where 49 people were killed in a 2016 shooting

-

Trump says Smithsonian too focused on slavery's ills

Trump says Smithsonian too focused on slavery's illsSpeed Read The president would prefer the museum to highlight 'success,' 'brightness' and 'the future'

-

Trump to host Kennedy Honors for Kiss, Stallone

Trump to host Kennedy Honors for Kiss, StalloneSpeed Read Actor Sylvester Stallone and the glam-rock band Kiss were among those named as this year's inductees