The U.S. is a global manufacturing 'rising star,' for pretty depressing reasons

Thinkstock

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For everyone who wants the United States to become a (bigger) manufacturing powerhouse again — so, most people in the U.S., and every member of Congress — a recent report from the Boston Consulting Group is a mixed blessing. On Friday, BCG released its rankings of cost competitiveness in manufacturing around the world, and the U.S. came in second place, after China. It is now more cost effective to produce goods in the U.S. than Brazil, the report found.

The U.S., along with Mexico, is one of the BCG's "rising stars" of global manufacturing, for having "significantly improved relative to nearly all other leading exporters across the globe." At least 300 companies have brought their manufacturing back to the U.S. from overseas, because "it just makes economic sense," BCG senior partner Hal Sirkin, a co-author of the report, tells Yahoo News. "The gap is closing and, when you add the transportation costs, it makes a lot more sense for a lot of products to be made in the U.S. than in China."

That sounds great, right? But remember what made China so alluring to manufacturers in the first place — low labor costs, lax environmental standards, and overworked factory workers? Here's BCG's explanation for why the U.S. is back in the manufacturing game:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The key reasons were stable wage growth, sustained productivity gains, steady exchange rates, and a big energy-cost advantage that is largely driven by the 50 percent fall in natural-gas prices since large-scale production of U.S. shale gas began in 2005. [BCG]

Another way of saying that: Fracking, foreign exchange rates, and that "stable wage growth," which Reuters calls "a euphemism for the fact that, in inflation-adjusted terms, industrial wages here are lower today than they were in the 1960s even though worker productivity has doubled over the same period of time." The only one of those factors that isn't controversial is the stronger yuan.

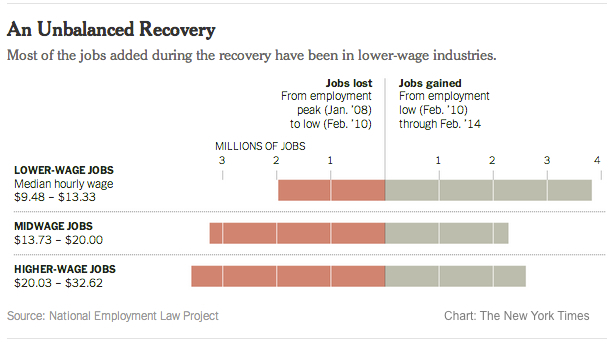

As this chart from The New York Times shows, the jobs that have been created in the post–Great Recession recovery have skewed toward the low end of the pay scale:

Most manufacturing jobs pay pretty decently, especially compared with fast food service. But as we celebrate the return of the American manufacturing sector, it's worth remembering that it's only partly because "Made in China" is becoming more expensive — "Made in the USA" is also becoming cheaper, for better and for worse.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read