Greece is still a sucking chest wound in Europe

Flickr CC by: Liako

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Via Kevin Drum, we find that Greece might have a successful debt auction:

Greece is undergoing an astonishing financial rebound. Two years ago, the country looked like it was set for a messy default and exit from the euro. Now it is on the verge of returning to the bond market with the issue of 2 billion euros of five-year paper.

There are still political risks, and the real economy is only now starting to turn. But the financial recovery is impressive. The 10-year bond yield, which hit 30 percent after the debt restructuring of two years ago, is now 6.2 percent....The changed mood in the markets is mainly down to external factors: the European Central Bank's promise to "do whatever it takes" to save the euro two years ago; and the more recent end of investors' love affair with emerging markets, meaning the liquidity sloshing around the global economy has been hunting for bargains in other places such as Greece.

That said, the center-right government of Antonis Samaras has surprised observers at home and abroad by its ability to continue with the fiscal and structural reforms started by his predecessors. The most important successes have been reform of the labor market, which has restored Greece's competitiveness, and the achievement last year of a "primary" budgetary surplus before interest payments. [Reuters]

But let's not get ahead of ourselves:

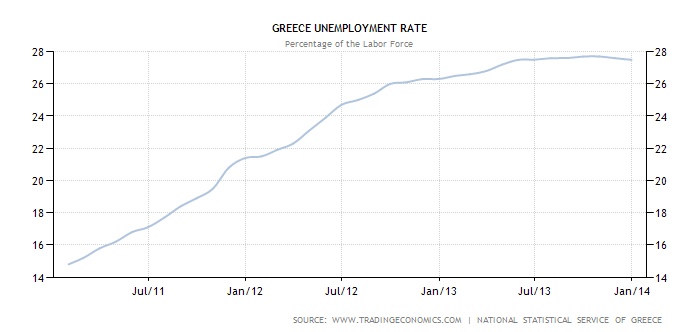

(Source: tradingeconomics.com)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Given the kind of people who have been in charge of the thing, I guess it's sort of impressive that the European Central Bank has finally figured out how to use their infinite Euro-creation power to keep member nations from defaulting on Euro-denominated debt. But with unemployment still over 27 percent, I'd say let's hold off on talk of a recovery.

Indeed, I rather fear this could be the worst of all worlds. Moving off the Euro would have been awful, but at least held the prospect of returning to growth and full employment within a couple years (from a much lower base). By contrast, the bank Natixis recently estimated that, given very generous assumptions, it will take Spain (which is in similarly dire straits) 25 years to return to 2007-era employment. A nation can do a great deal of catch-up growth in that time.

Realistically, I'd guess this means that Spain, Greece, Italy, Portugal, Ireland, etc., will never recover fully, and instead we're witnessing the birth of a crummy, tattered Franco-German empire with a permanently depressed periphery.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read