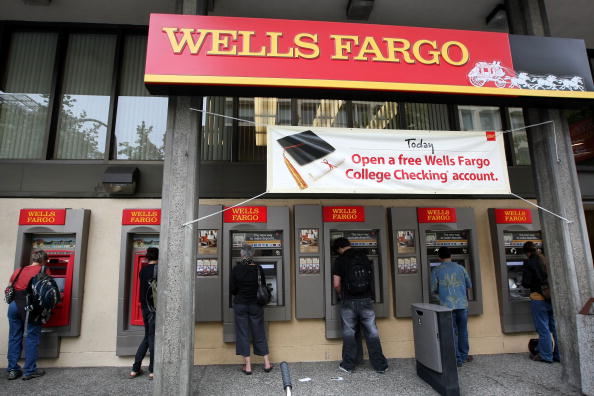

Credit scores likely impacted by Wells Fargo fake accounts

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Credit scores are checked by employers, landlords, utility companies, and lenders, and that's one reason why some consumer advocates are worried about Wells Fargo opening millions of phony accounts.

Wells Fargo has been fined $185 million for letting employees open checking and credit card accounts for customers without their knowledge, and while the company says it is contacting customers to find out if the accounts they have are authorized and promises to try to make restitution, it's highly likely credit scores have been majorly affected. When credit cards are issued, it's reflected on an individual's credit report. In some cases, NPR reports, Wells Fargo employees took money from a customer's existing account and moved it into a new account, which could have led to insufficient funds and late fees. There's also the possibility of customers not paying the annual fee for a credit card, since they couldn't make a payment for an account they didn't know was open.

These little dings to a credit report can add up, Ira Rheingold, executive director of the National Association of Consumer Advocates, told NPR. "You may not have qualified for a mortgage or you might have been dinged by getting charged a little higher interest rate because of what was reported wrongly on your credit report," he said. Rheingold wants to know how Wells Fargo is going to be able to figure out how the fake accounts affected customers — did a person miss out on getting a job because an employer saw late payments on their credit score? Will they be able to find out if a person received a higher interest rate on their mortgage because of inaccurate information? Even if all that can be determined, "once something affects a consumer's credit report and credit scores, it has the potential to have a lot of impact across the consumer's entire economic life," attorney Chi Chi Wu of the National Consumer Law Center told NPR.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.