Due to website issues, the IRS is giving taxpayers an extra day to file

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a lucky break for procrastinators, the Internal Revenue Service announced Tuesday it will let people have an additional day to file and pay their taxes because its website had issues throughout the day.

Now, individuals and businesses with a filing or payment due on April 17 have until midnight April 18 to take care of things. The IRS said despite system outages, taxpayers were still able to file through their software providers and Free File. "This is the busiest tax day of the year, and the IRS apologizes for the inconvenience this system issue caused for taxpayers," Acting IRS Commissioner David Kautter said in a statement. "The IRS appreciates everyone's patience during this period. The extra time will help taxpayers affected by this situation."

Although you could take full advantage of the extended deadline, the IRS says its processing systems are back up and running, and recommends filing your taxes tonight, since who knows what tomorrow may bring.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Catherine Garcia has worked as a senior writer at The Week since 2014. Her writing and reporting have appeared in Entertainment Weekly, The New York Times, Wirecutter, NBC News and "The Book of Jezebel," among others. She's a graduate of the University of Redlands and the Columbia University Graduate School of Journalism.

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

ABC News to pay $15M in Trump defamation suit

ABC News to pay $15M in Trump defamation suitSpeed Read The lawsuit stemmed from George Stephanopoulos' on-air assertion that Trump was found liable for raping writer E. Jean Carroll

-

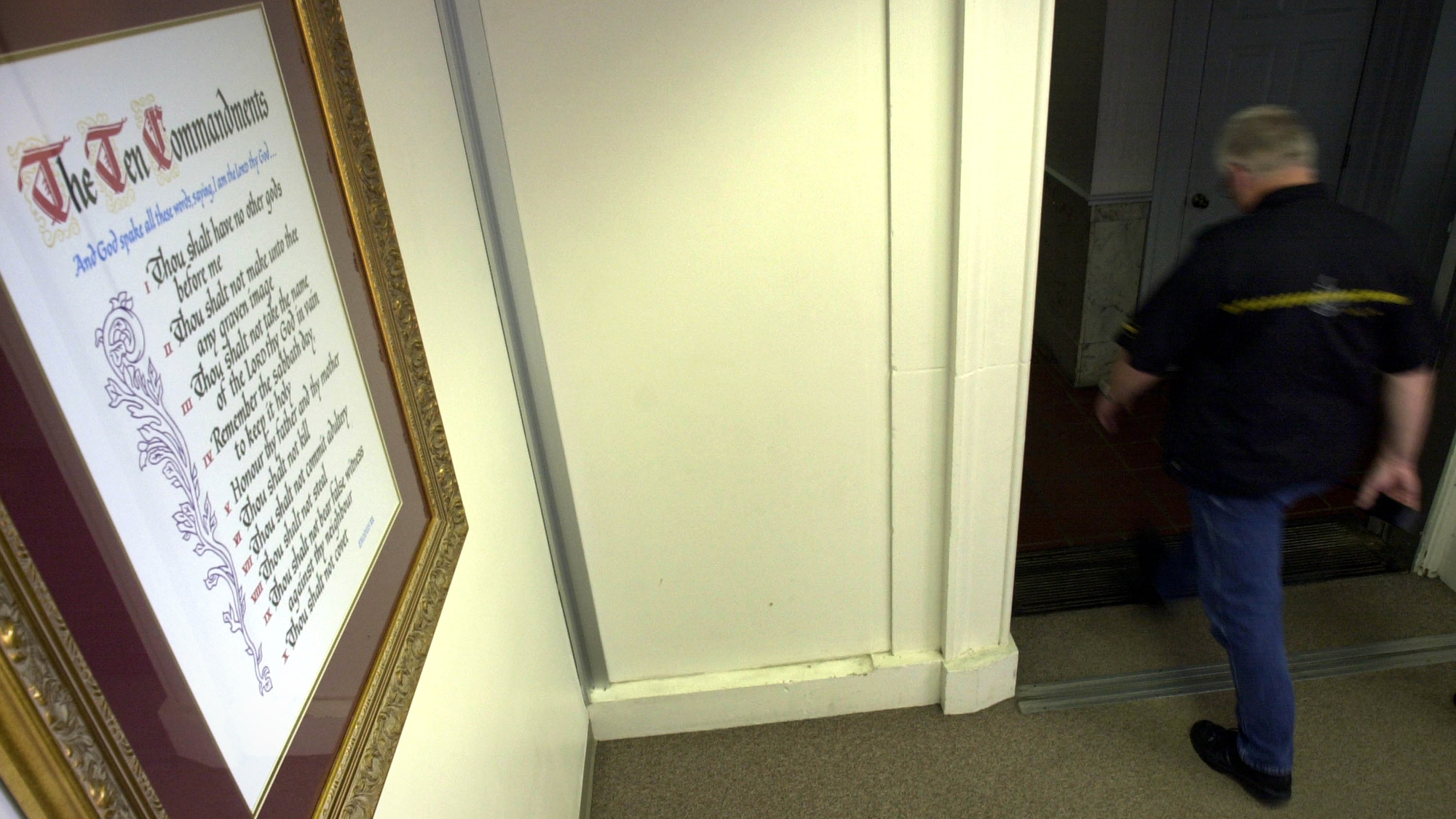

Judge blocks Louisiana 10 Commandments law

Judge blocks Louisiana 10 Commandments lawSpeed Read U.S. District Judge John deGravelles ruled that a law ordering schools to display the Ten Commandments in classrooms was unconstitutional

-

ATF finalizes rule to close 'gun show loophole'

ATF finalizes rule to close 'gun show loophole'Speed Read Biden moves to expand background checks for gun buyers

-

Hong Kong passes tough new security law

Hong Kong passes tough new security lawSpeed Read It will allow the government to further suppress all forms of dissent

-

France enshrines abortion rights in constitution

France enshrines abortion rights in constitutionspeed read It became the first country to make abortion a constitutional right

-

Texas executes man despite contested evidence

Texas executes man despite contested evidenceSpeed Read Texas rejected calls for a rehearing of Ivan Cantu's case amid recanted testimony and allegations of suppressed exculpatory evidence

-

Supreme Court wary of state social media regulations

Supreme Court wary of state social media regulationsSpeed Read A majority of justices appeared skeptical that Texas and Florida were lawfully protecting the free speech rights of users

-

Greece legalizes same-sex marriage

Greece legalizes same-sex marriageSpeed Read Greece becomes the first Orthodox Christian country to enshrine marriage equality in law