Everything you need to know about the $1.9 trillion American Rescue Plan but were too uninterested to ask

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

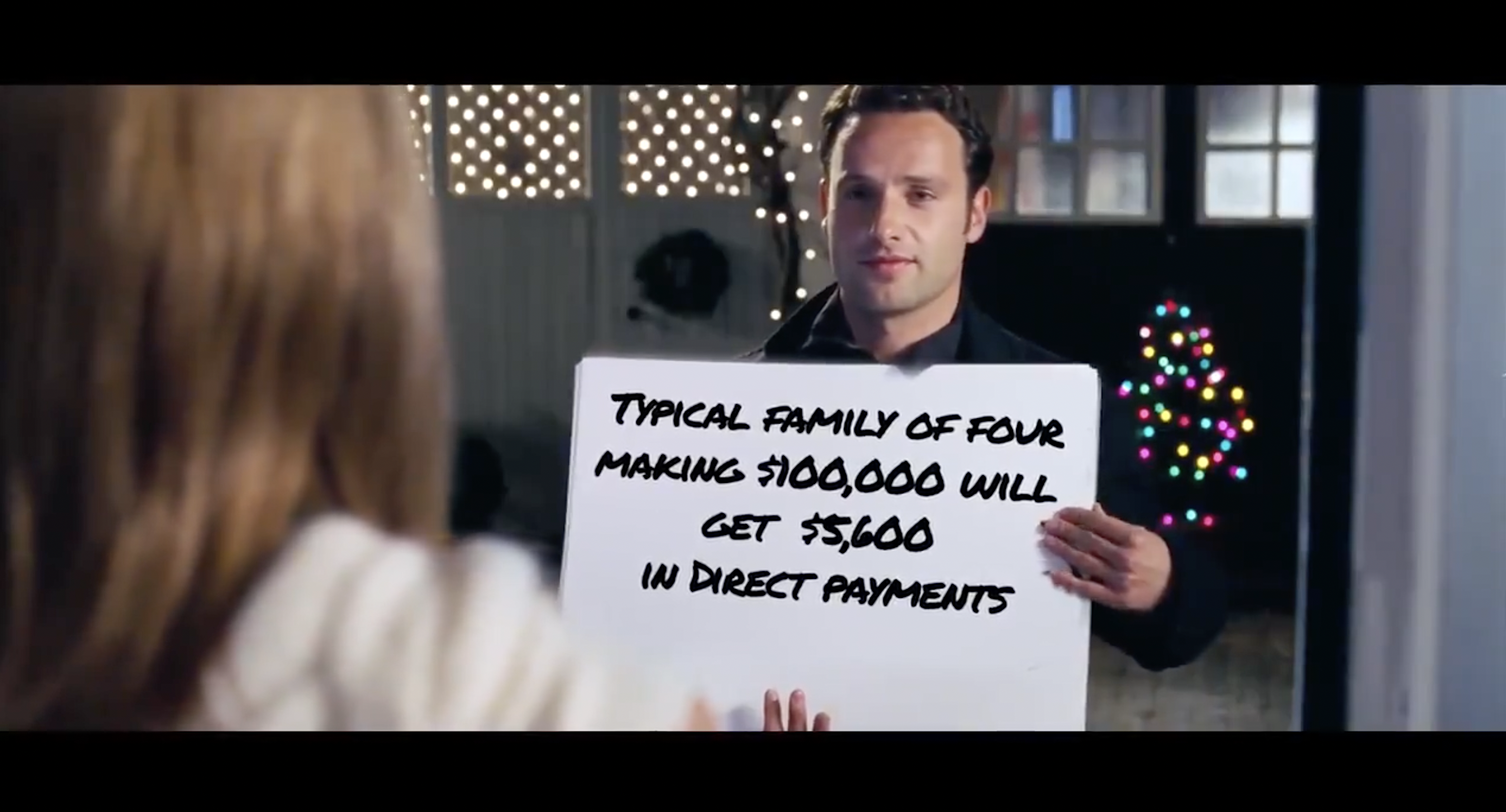

President Biden will sign the American Rescue Plan on Friday, after all nearly all Democrats and zero Republicans passed the $1.88 trillion COVID-19 relief and stimulus bill. Unlike the previous rounds of COVID-19 support, most of this bill — 54 percent — goes to households, most notably via $1,400 checks for most Americans.

Those direct payments will cost about $400 billion. Where will the other $1.5 trillion go? The Democrats are trying to find creative, even cinematic, ways of showing off the highlights.

Here's a more sober look at what's inside the ARP:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

- State and local governments: $350 billion. "These funds, initially proposed to plug COVID-19-created holes in public budgets," can also be spent "on improving services such as water, sewage, and broadband," The Atlantic reports.

- Child Tax Credit expansion: $3,000 to $3,600 per child. The IRS will send these payments out "periodically" over one year to parents earning up to $75,000, $150,000 filing jointly, and $112,000 for single heads of household.

- Rental and housing assistance: $21.5 billion.

- Public transportation: $30.5 billion. "COVID has really decimated transit ridership, and that has eaten a huge hole in agencies' budgets," TransitCenter's Ben Fried tells The Atlantic.

- K-12 schools: $125 billion for reopening, plus $1.25 billion for summer enrichment, $1.25 billion billion for after-school programs, and $3 billion for education technology.

- Colleges and universities: $39.6 billion, split roughly between emergency financial aid for students and financial support for the institutions.

- Tax increases: $60 billion. While most of the legislation is focused on cutting taxes ($590 billion), Democrats included three arcane tax hikes on the rich and large corporations to keep the bill within the $1.9 trillion price range, Politico reports.

- Non-chain restaurants: $28.6 billion. Debt-free grants to independent restaurants with 20 or fewer locations.

- Farmers and food supply: $10.4 billion, including $5 billion to Black and other disadvantaged farmers.

- Affordable Care Act expansion: $62 billion. More than half will go toward subsidizing ACA premiums, with the rest going to Medicaid enticements — including to expand maternal care — and COBRA subsidies.

- Live music venues: $1.25 billion, added to the $15 billion already approved.

- Rural health care: $500 million.

- Public libraries: $200 million, distributed through the Institute of Museum and Library Services.

- Arts and cultural institutions: $270 million.

You can dig deeper into the ARP at The Washington Post, USA Today, and the Senate Democrats' summary.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.