Hear that, Janet Yellen? The economy is screaming for help.

Time for a paradigm shift at the Federal Reserve

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

For the first quarter of 2014, the economy was said to be shrinking by an annualized 1 percent, a pretty bad result. Now the revisions to that estimate are in, and they are much, much worse. According to the Bureau of Economic Analysis, real GDP shrank by 2.9 percent on an annual basis in the first quarter of this year, the worst such number since the first quarter of 2009, during the depths of the Great Recession.

My colleague John Aziz argues that this alone shouldn't convince the Federal Reserve to halt its tapering of unconventional monetary stimulus, but I disagree. This is a great opportunity to shock the Federal Reserve Board out of its cautious stance, and take some bold action to extricate itself and the economy from a sandpit of pitiful growth and zero interest rates.

Let's review: since late 2008, when it pushed short-term interest rates all the way to zero, the Fed has been completely out of normal monetary policy firepower. Thus, they've tried three rounds of unconventional monetary stimulus, or quantitative easing (QE). The first two rounds of QE were discrete amounts of asset purchases, while the third was open-ended, with a fresh amount of stimulus following every month.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But since late last year, the Fed has been "tapering," i.e. slowly ending, its open-ended program. In the context of six years of mass unemployment, an economy that is well below capacity, and an output gap that might be trillions deep, a sharply negative quarter of GDP is strong evidence that the taper was way too premature. This report might just be bad enough to shock them into reversing course. As I argued a few months ago:

For reasons that remain somewhat obscure, the Fed as an institution is clearly just incredibly uncomfortable with unconventional stimulus, and they've been itching and fidgeting and sweating to cut back on quantitative easing as soon as they can. Ironically, this probably backfires, as their obvious eagerness to cut the program erodes its effectiveness by convincing markets that the Fed intends to tighten policy prematurely, which weakens the economy and forces the Fed to keep up their halfhearted stimulus longer to avoid deflation or another recession. I'd bet that this happens again in the next few months. [The Washington Post]

By my count this is the third time that the Fed has been eagerly trying to extract itself from its unconventional posture, only to have the economy stumble and (probably) force them back into it.

Why this is happening is a matter of some dispute. Some argue quite convincingly that it's because economic elites simply believe keeping inflation at or below 2 percent is by far the most important thing in the world, and neither the Fed nor anybody else with power cares that much about unemployment or trillions in lost wealth.

That argument has to be at least partially correct, in my view. But I suspect the Fed's current quagmire is also partly the outcome of the current balance of ideology and political pressure there, which means that it's also possible that Fed board members are making errors of reasoning and might be convinced to change their views. (Hey, it happened to the once-hawkish head of the Minneapolis Fed, Naryana Kocherlakota.)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

For example, some at the Fed have argued that these unconventional stimulus programs are risking financial instability (like Jeremy Stein, though he has since resigned), concluding that the programs should be stopped. But if we accept the increasingly plausible view that without this stimulus, the economy would immediately crash, this suggests that even for hawks who are deeply uncomfortable with unconventional stimulus, the quickest way to get the Fed to stop doing it is to stimulate so aggressively that interest rates can be gotten off the zero lower bound. As Ryan Avent argued two years ago:

One wants to scream, try overshooting for once. Try overshooting for once! Try it! Try pushing inflation up above 2 percent for a while and see if you can't generate enough growth to soak up some slack in the economy, thereby greatly reducing the risk that any little headwind that comes along knocks the economy back below stall speed. Try it! There is no way that a year of 3 percent inflation is bad enough to justify this pitiful hiccuping recovery. Try overshooting! [The Economist]

If the actual explanation for the Fed's behavior is a monomaniacal concern for inflation above all things, then we're basically screwed. But if hawkish Fed elites are actually prolonging their own agony, they might be convinced to change their mind. The worst quarter of GDP in five years is an opportune time to do it.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

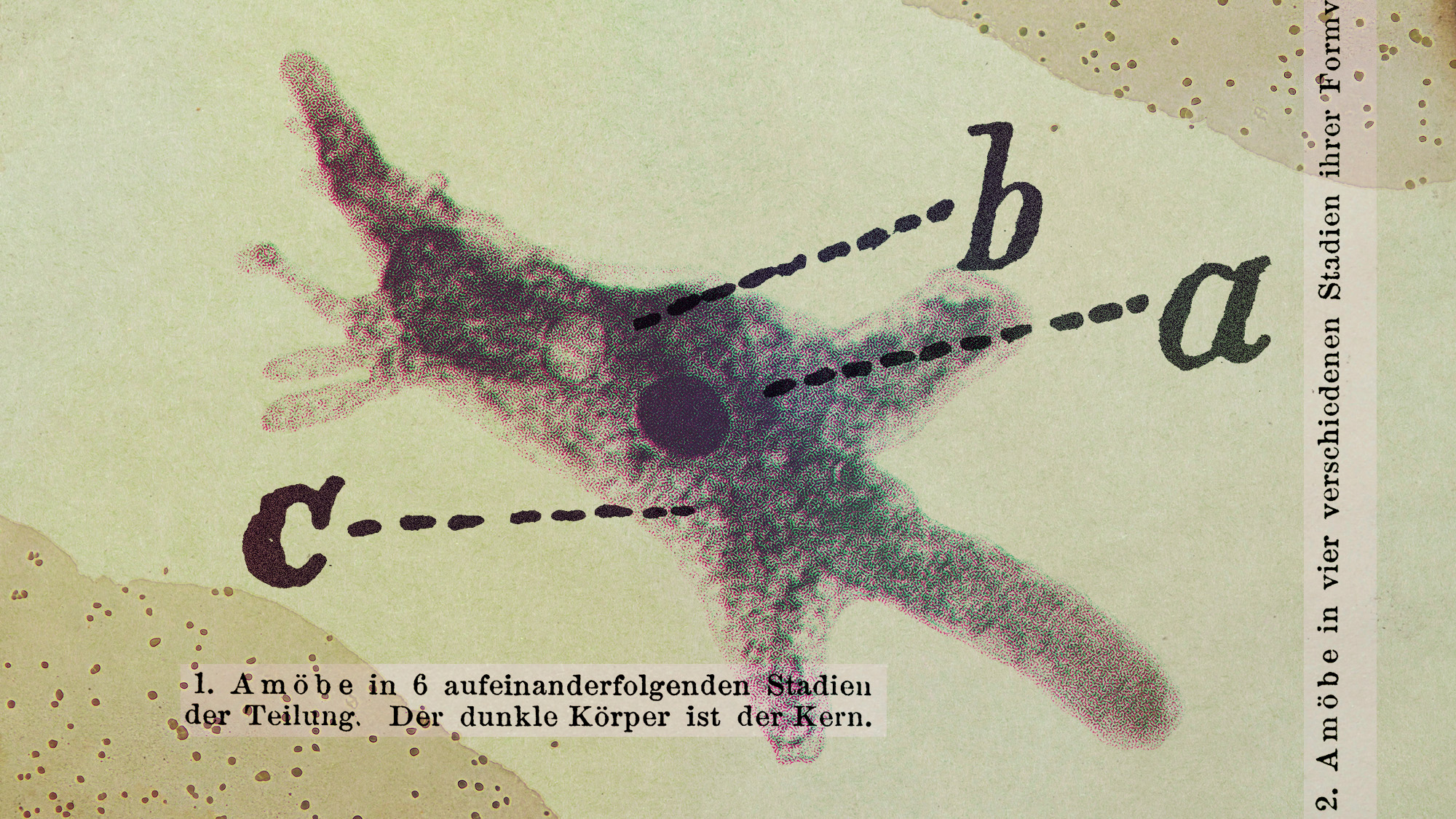

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred