Obama's deficit-reduction plan: Just 'math'?

Look at the numbers, the president argues. Raising taxes on the rich isn't class warfare — it's a necessary step toward tackling the deficit

President Obama defended his deficit-reduction plan on Monday, saying that there's no way to shrink growing budget deficits without both spending cuts and new taxes. Republicans say the $1.5 trillion in new taxes Obama wants under his $3 trillion proposal amounts to an attack on the wealthy. But Obama argues that "this is not class warfare. It's math." Is Obama just being practical, or is he further politicizing the budget battles?

Do the math. You can't shrink the deficit without taxes: Billionaire hedge-fund executives really do pay a lower rate "than their chauffeurs and private chefs," says Eugene Robinson at The Washington Post, because investment earnings are taxed less heavily than wages. Republicans and "their upper-crust patrons" hate the idea of making tycoons pay their "fair share." But to anyone who's serious about reducing our debt, it's just "common sense."

"Obama's tax plan is common sense, not class warfare"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This isn't math. It's divisive politics: "Obama couldn't get Congress to raise taxes on higher earners to pre-Bush levels when the Democrats controlled both chambers of Congress," says John Hinderaker at Power Line. Obviously, he knows full well it won't happen with Republicans running the House. The president isn't really interested in reducing the deficit. He just wants to help Democrats sell themselves as the friends of the poor and middle class in 2012. That's not math, it's "demagoguery."

"$1.5 trillion in new taxes? Ho hum"

This is poker, not math: Obama's deficit-reduction plan — and his job-creation plan — "are best considered opening bids in an ongoing negotiation, a poker game being played at a time of maximum party polarization," says John Avlon at The Daily Beast. Instead of compromising at the outset, Obama is clearly articulating his position and daring Republicans to do the same. And make no mistake: For the GOP, "there is political risk in simply refusing all these proposals" — particularly a tax on millionaires — "just because they come from the president."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: which party are the billionaires backing?

Democrats vs. Republicans: which party are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

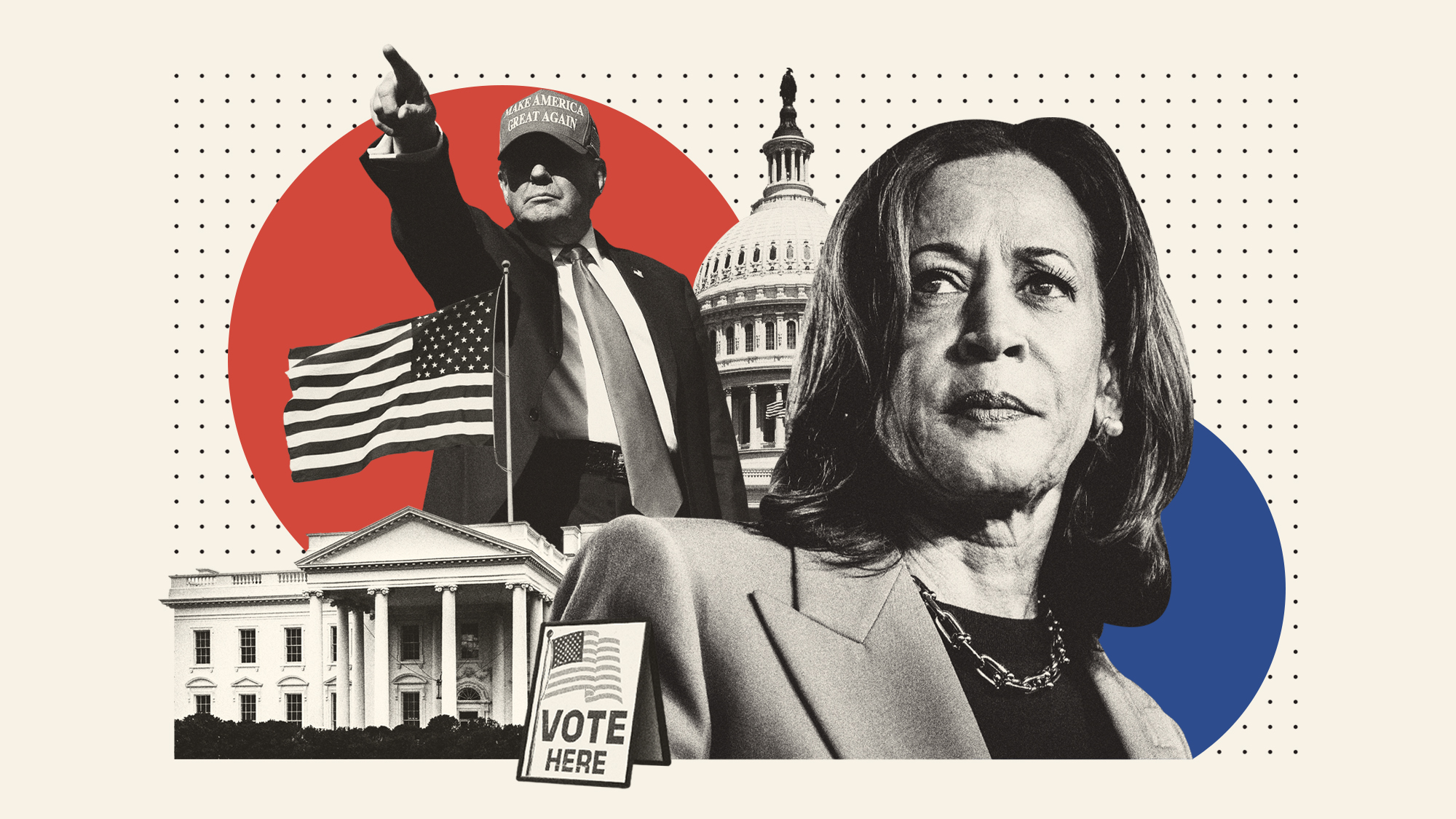

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event