The stay-at-home mommy wars: What both Obama and Republicans get wrong

It's about class, not culture

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Obama's tax proposal to help working families had barely left the presidential podium before critics pounced. And with that began the stay-at-home mommy wars. But don't be fooled into thinking this is a typical left vs. right argument about culture: it's about a bipartisan failure to help the lower class.

Obama’s proposal would bulk up the tax credit for child care expenses and provide a new tax credit for families with two earners. Because the tax credits would be of no use to families in which one parent stays home and doesn’t earn a taxable income, conservative journalists saw the plan as implicitly derogatory to traditional families and stay-at-home moms. The proposal is a declaration that "moms who stay at home with their children are less valuable than moms who work for pay," according to Tim Carney. Pascal-Emmanuel Gobry called it a progressive statement "about what the good society looks like" — and it’s families in which both parents work.

The first problem with this critique is that our tax code is already biased to help married families with one earner in numerous other ways, so Obama’s plan could be seen as a corrective rather than an affront. The president has also previously proposed expanding the child tax credit, which would help single- and dual-earner families with children alike.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

More importantly, however, Republican proposals have their own problems on this score. As Elizabeth Bruenig pointed out, the new form of child tax credit Sen. Mike Lee (R-Utah) proposed is not refundable, which means it likely will not help lower-income families, since they often have little to no income tax liability. (Lee's credit can be credited against the payroll tax, which is smart — but still of limited help, because state and local taxes are what really wallop the lower class.) Indeed, refundability is the key to making tax credits work for the less fortunate, and conservatives are depressingly uncomfortable with the feature.

That said, Obama cannot be allowed a pass here either. Neither his new tax credit for second earners or for child care expenses are refundable. Which is bizarre, frankly. The basic logic of the credits is understandable: families put both parents into the workforce to earn more income and get ahead economically. But that comes with costs, like commuting to work and finding care for the kids. Those costs are prohibitive for lower-income families, which means they can't have both parents working, which precludes them from upward mobility. But if they can't make use of Obama's credits either, what's the point?

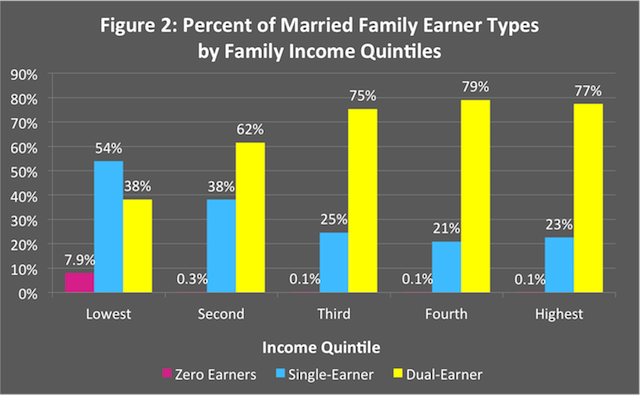

To see the full extent of the contradiction, we can look at new numbers Brad Wilcox put together over at the Family Studies Institute. According to data he pulled from the American Community Survey, families in which only one parent works are disproportionately to be found in the poorest two-fifths of married households.

In other words, the connective tissue underlying both parties' failure with regards to stay-at-home moms is not culture or values or lifestyle choices — it's class. The fight between proponents and opponents of Obama's new proposal is a fight over whether to give middle- and upper-class families with two earners more tax relief, or give it to middle- and upper-class families with one earner. Lower-class families of all stripes are being shoved to the periphery of the discussion.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As Robert VerBruggen has proposed, a better way to help families of all types up and down the income ladder would be to bulk up the child tax credit and make it fully refundable. (And definitely keep Sen. Lee's applicability to the payroll tax as well.) The cash could be used to cover child care costs or to boost household income while one parent stays home, as each individual family sees fit.

Or better yet, as Bruenig rightly concluded, is a child allowance: a simple check from the government per child, with no work requirements, that's the same for every family regardless of income level. It would acknowledge the fact that — as family-conscious conservatives and liberal feminists alike observe — the work of making a home is profoundly valuable to the economy and society even if it isn't rewarded by the markets. It would also avoid the strange, roundabout strategy of using the tax returns of the spouse who does labor in the market to compensate the spouse laboring outside the market. Lastly, it could also be folded into a public day care system to provide families maximum flexibility, as some Nordic countries already do.

The economic realities of stay-at-home moms mean both left and right need to rethink their policies. And conservatives need to stop taking umbrage over cultural identity spats that are of no use to any family — traditional or not — that isn't already well-to-do.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred