The end of OPEC

Welcome to the shale era

Did you notice that gas prices are really low? I thought you might have. And if you need a reminder, just look at how far they've plummeted over the last year:

And did you notice how this is having a huge impact on the economy? Not only by speeding up the U.S. recovery, but also by aiding China, Japan, and Europe. Energy prices are one of the biggest limiting factors on the global economy. Most people don't remember that the economy began slowing down in 2007 because of high gas prices fueled by increased emerging markets' demand.

So, what's going on now?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The answer, in a nutshell, is the shale revolution. The new technology for extracting oil and gas from shale reserves — which, let's remember, was opposed every step of the way by progressives, and is characteristic of a special American inventiveness — has proved a boon to the economy, and to employment, and even to the environment, since the revolution is driving a lot of oil and coal to be replaced by less-carbon-intensive natural gas.

But what about OPEC, the cartel of oil-producing countries that has kept gas prices up — and therefore its foot on the throat of the global economy — for 40 years?

At first, people thought that OPEC was purposefully keeping prices low (by not reducing supply) in order to smother the emerging shale industry in the crib. With low oil prices, less investment would flow to alternatives to conventional oil, which can be expensive.

But, as Bloomberg reports, that might not be the answer. The answer increasingly seems to be that OPEC isn't raising prices because it can't raise prices.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The cartel isn't holding. The smaller OPEC members don't want to shrink output — which would have to happen to raise prices — because their economies are too unstable and they can't afford it. Even Saudi Arabia, the most important OPEC member, is in favor of staying the course.

But more importantly, everyone in OPEC knows what would happen if they tried this: U.S. oil producers would put back online all those rigs that they have idled since prices plummeted.

OPEC is stuck in a Catch-22: Low prices mean they don't control the market anymore; but if they raise prices, they lose control of the market.

Investment in shale is only going to continue. And that means we may be witnessing one of the most significant geopolitical and economic events of the past 50 years: the death of OPEC.

Pascal-Emmanuel Gobry is a writer and fellow at the Ethics and Public Policy Center. His writing has appeared at Forbes, The Atlantic, First Things, Commentary Magazine, The Daily Beast, The Federalist, Quartz, and other places. He lives in Paris with his beloved wife and daughter.

-

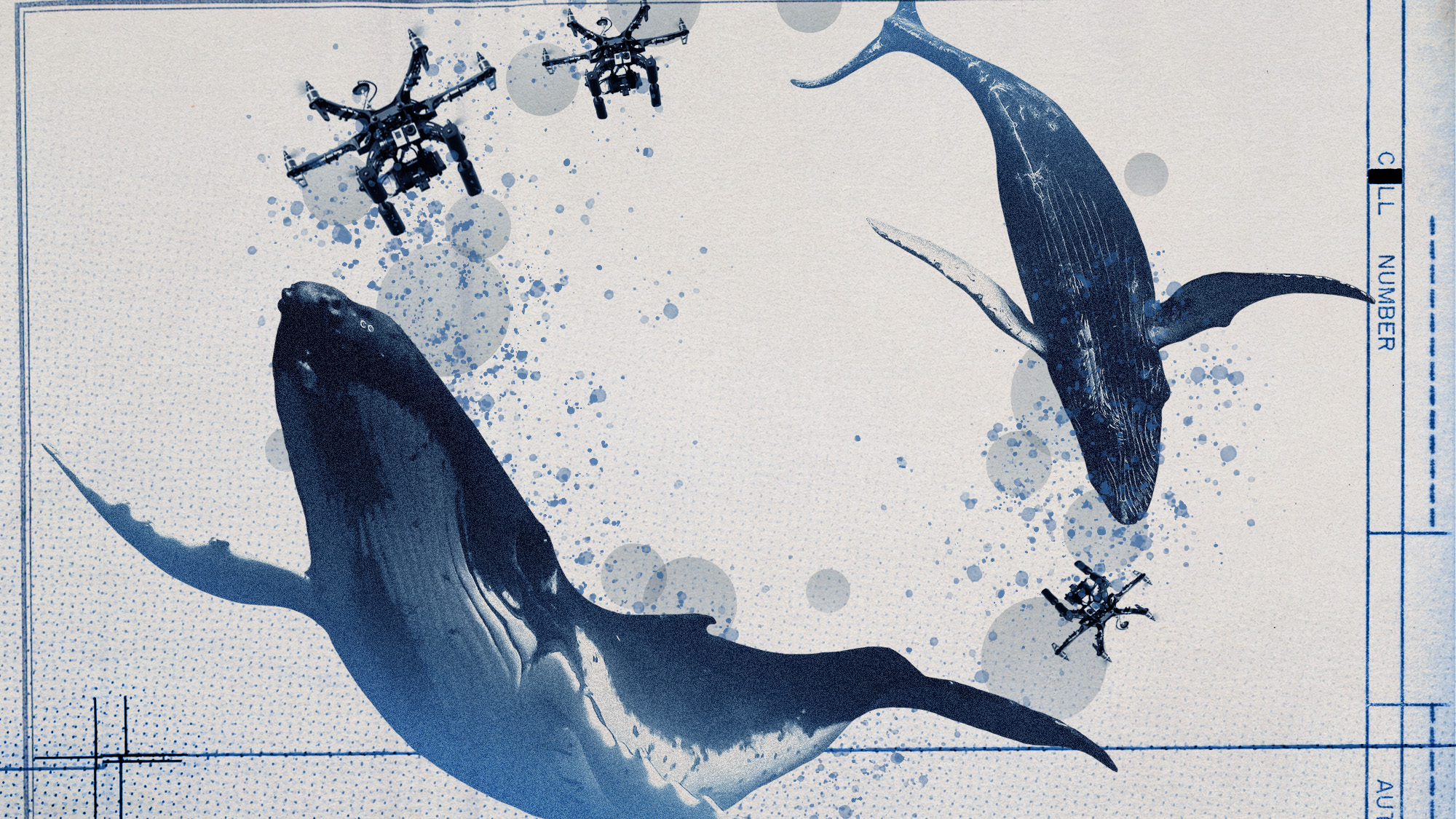

How drones have detected a deadly threat to Arctic whales

How drones have detected a deadly threat to Arctic whalesUnder the radar Monitoring the sea in the air

-

A running list of the US government figures Donald Trump has pardoned

A running list of the US government figures Donald Trump has pardonedin depth Clearing the slate for his favorite elected officials

-

Ski town strikers fight rising cost of living

Ski town strikers fight rising cost of livingThe Explainer Telluride is the latest ski resort experiencing an instructor strike

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy