Two cheers for Chris Christie's Social Security proposal

The New Jersey governor's proposal is...not bad?

Whatever you may think of New Jersey Gov. Chris Christie, let it never be said he was too afraid to dance out onto the subway tracks of U.S. politics and touch a toe to the third rail.

In brief, for retirees with income over $80,000 a year from other sources, Christie wants to reduce their Social Security benefits. For retirees making over $200,000, he wants to cut off the benefits entirely. And he wants to raise the program's retirement age from 67 to 69, and its early retirement age from 62 to 64. Marco Rubio has proposed a similar set of changes, and you could see his proposal and Christie's as the GOP answer to the growing desire among Democrats to raise Social Security benefits across the board.

Christie wants to phase in his changes gradually. But retirees in general, and wealthy retirees in particular, are still a formidable voting bloc. Which is why going after Social Security benefits is generally viewed as political suicide.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But just because a policy proposal is ballsy doesn't mean it's worthwhile on the merits. So let's go through the good and bad here.

In addition to getting a cheer for political bravery, Christie also gets one for his top line point: "Do we really believe that the wealthiest Americans need to take from younger, hard-working Americans to receive what, for most of them, is a modest monthly Social Security check?" It's hard to argue with that; wealthy retirees don't need the money, and it could be better spent elsewhere.

There's also a subtler issue: Bigger Social Security benefits go to richer beneficiaries who brought in more income over the course of their working lives. That's because our political discourse treats Social Security as a savings program; people who made more money while working "saved" more, ergo they should get a bigger payout.

But Social Security doesn't actually work like a bank account or an investment portfolio and it never has. Money comes into the government — whether via the payroll tax or the income tax — and then goes out as spending — whether through Social Security or any other program that gives people aid. The distinction introduced by the trust fund model is a pure abstraction, and American politics clings to it so tightly out of the morally juvenile impulse to tar recipients of other government programs as lazy or shiftless. But retirees are virtuous! So give them government aid, just don’t call it "welfare," even though that's what it is.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Flattening out Social Security benefits for everyone would start moving U.S. politics away from viewing Social Security as "separate" from the rest of the budget, and payroll taxes as a separate or special form of revenue. Indeed, the Congressional Budget Office (CBO) already assumes that when the trust fund runs out, the government will keep paying the same benefits it always has out of general revenue.

Ultimately, the goal should be to treat Social Security as just another government program that needs revenue like all the rest. And since the payroll tax is a horribly inefficient and regressive way to raise that revenue, we should roll it back and replace the revenue with something else. A combination of hiked income taxes and a value-added tax — a modified national sales tax — would probably be the best choice.

But this also brings us to the point where Christie's logic goes off the rails, because he thinks we need to rein in spending: "Every other national priority will be sacrificed, our economic growth will grind to a complete halt, and our national security will be put at even graver risk" if Social Security isn't reformed, Christie said.

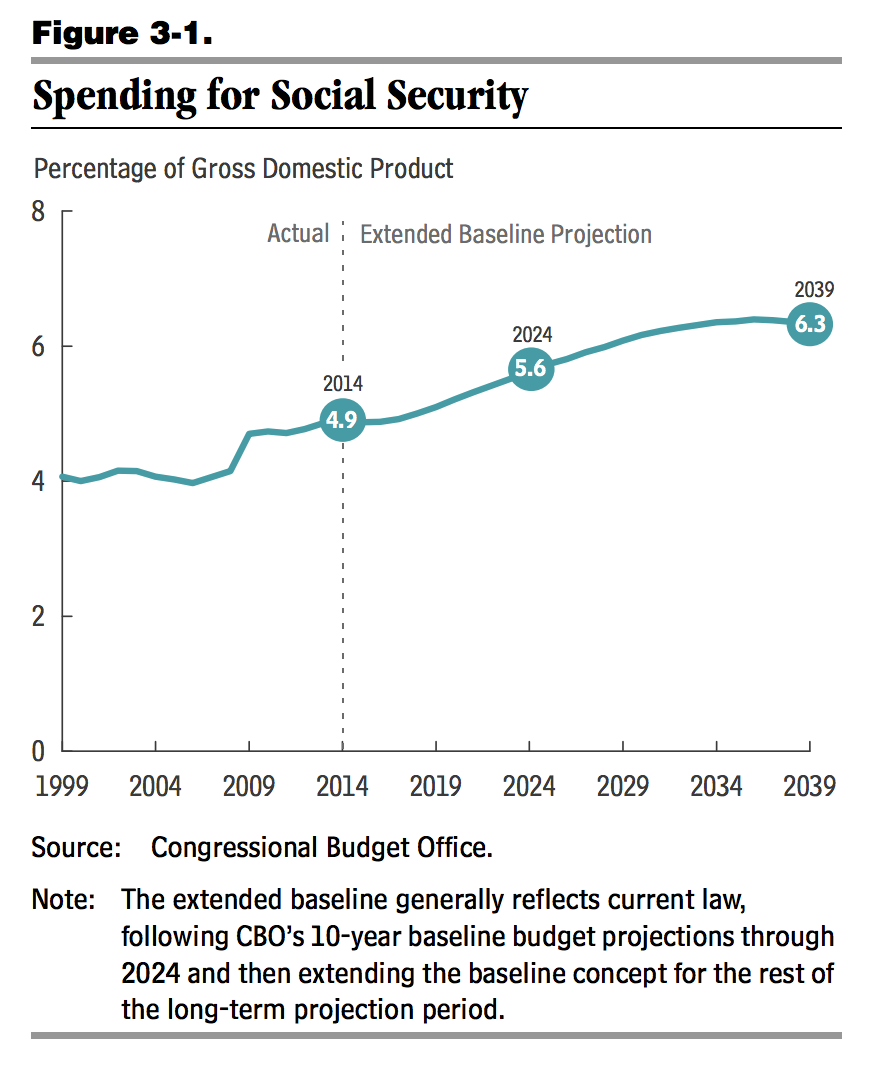

But if you look at those CBO projections again, they show current annual Social Security spending is 4.9 percent of GDP. If the benefit structure remains unchanged, they will rise to 6.3 percent per year by 2039 and plateau. And that paltry 1.4 percent of GDP is the entirety of the so-called Social Security "crisis" — the retirement of the Boomers, everything.

Getting an extra 1.4 percent of GDP in revenue is not hard. Oh, it's hard politically, because the Republicans are dementedly opposed to all tax hikes. But it's not hard economically. The idea that it would crowd out other spending or significantly slow down the economy has effectively zero evidence behind it.

Christie's idea of eliminating Social Security benefits entirely for the above-$200,000 crowd may not be so hot, either. The old saw in U.S. politics is that programs for the poor tend to be poor programs, because their beneficiaries don't have the political clout to protect them. Conversely, programs that include the middle and upper classes in their benefits even if they don't need them — like Social Security and Medicare — tend to be much harder for politicians to mess with or cut.

Economist Lane Kenworthy has done a cross-country comparison among advanced Western nations that poked a fair number of holes in that thesis. He arrived at a more nuanced idea: government aid can be targeted and politically survive, as long as big social insurance programs for health care and retirement and the like remain universal. That conveys a broad social agreement that "everyone is in this together."

And frankly it doesn't matter much spending-wise, anyway. Seniors making over $80,000 annually account for a little over 3 percent of Social Security's benefit payouts.

Finally, raising the retirement age is also a very bad call. The justification for it tends to be that life expectancy has risen, so people are spending way more years in retirement. But that's only true for the upper class. For the lower class, life expectancy has been nearly flat for the last few decades. People who have good health and incomes and forgiving desk jobs are free to continue working. Let them. But cut people who aren't so lucky a break.

If anything, we should increase total spending on Social Security, as Elizabeth Warren and the Democrats want — just with the flatter benefit structure Christie and Rubio want. Here's a very rough back-of the-envelope calculation: Social Security currently spends $851 billion a year. If we upped that by just another $180 billion annually (or a whopping 1 percent of GDP), we could give everyone on the program — retirees, the disabled, children, widows, everyone — a big enough check to keep a household of two above the federal poverty line. All for a grand total addition of 2.4 percent of GDP annually by 2039.

Right now, 9 percent of American seniors remain in poverty despite the presence of Social Security. (Though the poverty rate for seniors would be 44.4 percent without the program.) So clearly we can do better.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Zimbabwe’s driving crisis

Zimbabwe’s driving crisisUnder the Radar Southern African nation is experiencing a ‘public health disaster’ with one of the highest road fatality rates in the world

-

The Mint’s 250th anniversary coins face a whitewashing controversy

The Mint’s 250th anniversary coins face a whitewashing controversyThe Explainer The designs omitted several notable moments for civil rights and women’s rights

-

‘If regulators nix the rail merger, supply chain inefficiency will persist’

‘If regulators nix the rail merger, supply chain inefficiency will persist’Instant Opinion Opinion, comment and editorials of the day

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook