A bipartisan proposal to make a universal basic income a reality in America

The elements of a bipartisan deal are there

A universal basic income (UBI) — in which the government would deposit a check in your bank account every month — has become something of a cause du jour among many on the left.

Its merits are many and varied. It would reduce poverty, but would be less politically vulnerable to cuts than other safety net programs because it isn't means-tested. Like food stamps and such, it isn't tied to work, so it would raise workers' bargaining power and thus their wages. Finally, by giving families some economic breathing room, it would roll back some of the market's encroachments into family and community life — for instance, a UBI would probably lead to a lot more meals cooked and eaten at home.

Still, a UBI remains a pretty outlandish idea in the context of American politics. And the folks on the right who kinda-sorta support it mainly see it as a way to do away with other aspects of the welfare state.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If a UBI is going to become a reality, its supporters will have to get a little creative in their political strategy.

Over at Vox, Dylan Matthews recently laid out the start of such a strategy: Among portions of the GOP and the conservative movement there's been growing enthusiasm for the "FairTax" — a 30 percent national sales tax to replace all other taxes. But sales taxes are regressive — the poor spend more of their income on consumption and basic necessities, so the tax hits them comparatively harder. So the FairTax plan includes a check from the government that compensates every household for whatever sales tax they'd pay on consumption below the poverty threshold.

For example, based on federal poverty guidelines, the FairTax scheme calculates that a two-parent family of four at the poverty level would spend $31,020. Due to some complicated math, a 30 percent sales tax rate is equivalent to a 23 percent income tax rate, so the FairTax would send the family back 23 percent of that $31,020 — $7,135.

The FairTax's fans insist on calling this a tax rebate (or "prebate") for rhetorical purposes. But as Matthews points out, it's literally a UBI as well. If you're compensating people for consumption spending, you might as well be compensating them for breathing. Everyone gets it, no one has to be employed to get it, and it comes in 12 monthly installments. It's a UBI by the backdoor.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But we're not out of the woods yet. Replacing all taxes with a national sales tax is itself a radically outlandish idea. And not a good one; while most European countries have more regressive tax systems than the U.S., they rely on a mix of income taxes, payroll taxes, and consumption taxes. So the FairTax would outdo them all in terms of burdening the poor, and all to fund a social safety net that is far skimpier than the European models.

But we could replace a part of the U.S. tax system. Namely, the payroll tax.

It's basically the worst possible species of tax. The payroll tax is actually just another income tax, but applied at a flat rate without the progressive brackets, making it regressive in the same way a national sales tax would be. Moreover America's payroll tax is capped, so the income you earn above a certain level isn't taxed. With a national sales tax, by contrast, no matter how much money you make or how big your expenditures are, you'll still pay the tax on them.

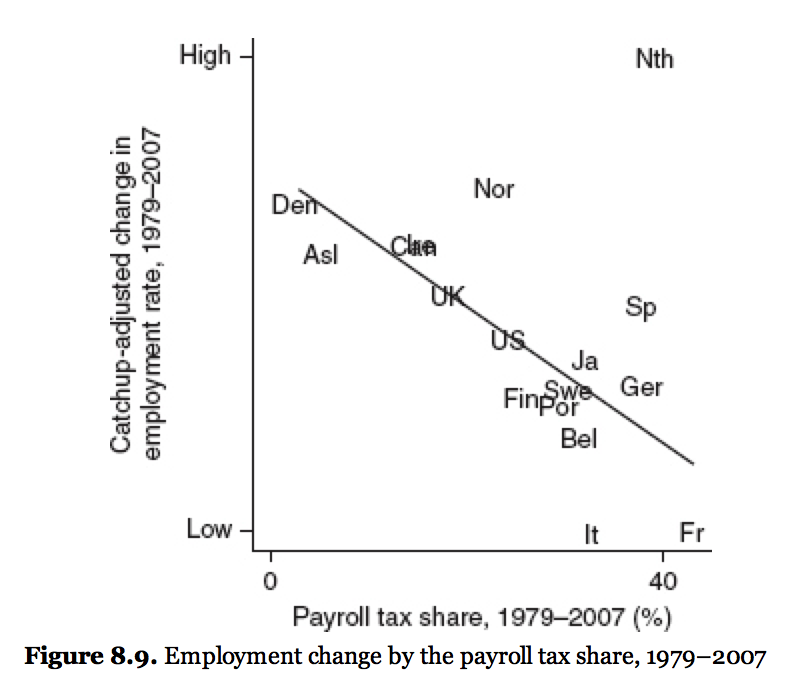

Moreover, sales taxes hit consumption, but payroll taxes hit employment — they tax job creation. In a comparison of different Western countries' tax mixes, economist Lane Kenworthy found that different combinations of payroll taxes, consumption taxes, and income taxes had about the same effect on economic growth rates. But a heavier reliance on payroll taxes was associated with a pretty significant drop in employment rates.

Access to work is, obviously, one of the key avenues by which economic growth actually makes its way to everyday people. And a decline in how much work the lower class can access over the last few decades has been a major contributor to America's stagnant incomes.

There are caveats: The effect Kenworthy found is diluted if you control for other surrounding policies and economic institutions. And the Netherlands is a major outlier. But all else being equal, payroll taxes are the least desirable of the payroll-consumption-income tax menu.

And yet, these days two-thirds of Americans pay more in payroll taxes than they do in income taxes. The situation is, to put it mildly, less than ideal.

To their credit, some conservatives recognize this, so there's arguably political ground here to build a compromise package. The tax plan proposed by Sens. Mike Lee and Marco Rubio would offer a new tax credit that is refundable against payroll tax liability. The Washington Examiner's Tim Carney and The New York Times' Ross Douthat have called for rolling the payroll tax back — or fiddled with the idea of replacing it with a value-added tax (VAT).

A VAT is just a sophisticated version of a sales tax. FairTax advocates don't like it for various reasons — they prefer a straight retail sales tax — but a VAT is the version used by most European countries, and the end effect on consumers is the same. Denmark, the Netherlands, Sweden, France, and Britain all have VAT rates of 20 percent or more, but we'd just need a VAT rate of 12.3 percent to replace all of the revenue currently raised by the payroll tax.

The rebate-but-really-UBI that would go with a 12.3 percent VAT would admittedly be considerably smaller than the $3,000 per person per year that would be needed to halve poverty. But it would get the ball rolling.

Obviously, the best way to pass a UBI would be to just pass a UBI, and let the finances sort themselves out. But barring a Democratic takeover of the presidency and the legislature that would dwarf the 2008 landslide, that isn't going to happen anytime soon. So a compromise package of this sort is probably the most realistic way to get the policy started.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred